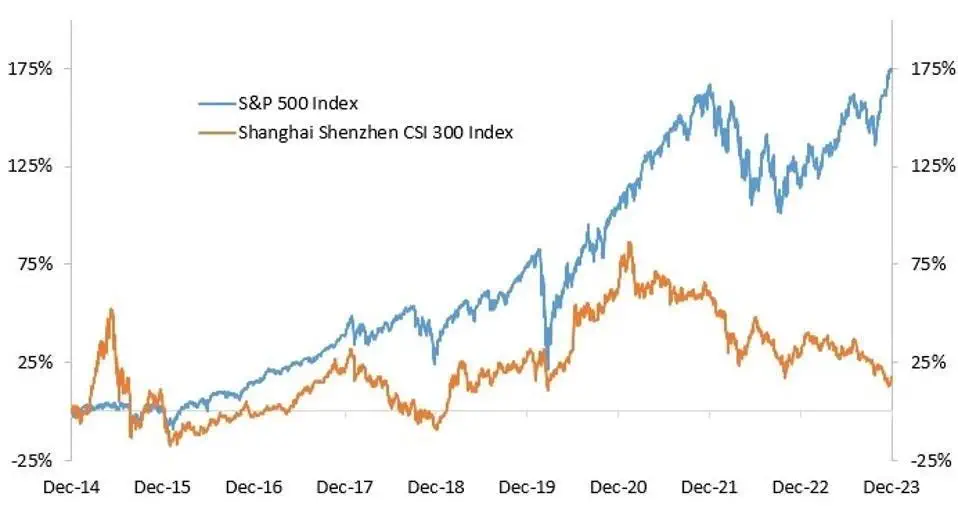

China had the worst return among the markets in the index, and it has now trailed the S&P 500 index since 2017, with the gap increasing steadily (see Figure 1).

Figure 1: Return on China CSI 300 Index vs. S&P 500 Index

Source: CSI 300 Index vs. S&P 500 Index Bloomberg.

China's Equity Markets

China's equity markets are also off to a poor start this year, with the benchmark CSI 300 index falling to a five-year low in late January. In response, China’s government is considering emergency measures totaling 2 trillion yuan ($278 billion) to prop them up, according to Bloomberg. The measures reportedly would mobilize proceeds from offshore accounts of Chinese state-owned enterprises that would purchase shares through the Hong Kong exchange link.

China’s cabinet has urged such action, and state firms have started purchases to stem capital flight from foreign investors that also pushed retail Chinese investors into safer assets. The State Council, which is the country’s top governing body, is also calling for better regulations and greater transparency to stabilize markets and boost confidence, according to The Wall Street Journal.

Meanwhile, China’s central bank announced Wednesday that it would lower the reserve requirement ratio by half a percentage point to 7% next month and also ensure that added funding and liquidity were available to property developers.

Stock & Property Markets

The big question is whether these actions will help turn the tide in the stock and property markets.

Several leading Wall Street firms are upbeat about prospects for China’s stock market this year on the grounds the economy has recovered from the COVID-19 pandemic restrictions. For example, Goldman Sachs projects equity returns of 18% to 19% in its recent China Musings commentary, assuming China’s economy grows by about 5% this year.

On the surface, this appears reasonable, considering official statistics show China’s economy grew by 5.2% last year. However, upon closer inspection of the underlying data, there are reasons to be skeptical about the economy’s performance.

The Rhodium Group, an independent research organization, observes that by mid-2023, the evidence of an economic slowdown was abundant, as indicated by a steady shrinking of the property sector and a growing list of defaults among private real estate developers. At the same time, China’s overall trade surplus shrank throughout the pandemic, and China’s consumers were not spending sufficiently to achieve the government’s growth target. All told, it estimates that growth was closer to 1.5% last year, and it foresees only a modest cyclical recovery this year.

While the truth may lie somewhere between these estimates, some steps the Chinese government has taken to alter statistics have raised questions about their accuracy. For example, China suspended the release of monthly data on joblessness among young people ages 16-24 after the figures hit consecutive record highs of 21% in mid-2023, The New York Timesreported. Following criticism of this action, it recently reported an “adjusted” figure that excludes students, which showed a jobless rate of 14.9%.

China's Growth Rate Slowdown

In a previous post, I cited reasons why a 5% per annum growth target is unsustainable: China’s population growth has slowed significantly as a legacy of the one-child policy, and returns on invested capital have fallen as total factor productivity has been cut roughly in half in the past decade. Therefore, economic efficiency would have to improve significantly to achieve the stated target. Yet many economists question how this will be possible, considering that economic policy under President Xi Jinping has favored inefficient state-owned enterprises over the private sector.

Faced with these structural challenges, it will be difficult for policymakers to restore investor confidence, considering that it has limited tools at its disposal. First, the government is constrained from boosting spending by China’s high debt ratio, which was approaching 300% of GDP at the end of 2022, Nikkei reported. Second, while there is room for the central bank to ease monetary policy further amid some signs of deflation, it is also trying to stabilize China’s currency after it depreciated against the U.S. dollar by 9% last year.

What Should Foreign Investors Do in These Circumstances?

My take is they should be wary of investing in China’s stock markets even though they appear relatively cheap.

Chinese stocks are cheap for two key reasons: First, in light of all that is happening internationally, investors are beginning to question whether China’s economic miracle is over; Second, some observers believe the weakness in the property market over the past two years is only the tip of the iceberg.

China's Property Market

In a recent speech, Professor Emeritus Robert Z. Aliber of the University of Chicago’s Business School points out several stylized facts about China’s property market, including the following: 50 million vacant apartments, apartment prices had declined by 6% from the peak, and expenditures on new apartments likely to decline by 2 million units per year. He questions why anyone would buy a newly constructed unit when prices of the large pool of vacant apartments are falling. In his view, China could experience a recession when the property bubble bursts.

Some commentators liken China’s problems to Japan’s in the early 1990s when bubbles in both the stock and property markets burst simultaneously. However, there are two key differences: the extent of over-valuation of China’s stock market is not as great, and the Chinese government is prepared to bolster financial institutions to deter a run on them.

That said, there is also one similarity to consider. Namely, the longer China’s stock market underperforms international benchmarks, the greater the incentives are for global fund managers to underweight Chinese equities as they did for decades after Japan’s bubble burst. At the retail level, moreover, there are an increasing number of international equity mutual funds that exclude China from their benchmarks, The Economist noted.

Finally, The Economist observes that nostalgia for China’s boom years in the 1990s is evident from a hit television show titled Blossoms Shanghai, where the heroes are swashbuckling capitalists in Shanghai in the early 1990s. If so, it suggests foreign investors are not the only ones questioning the country’s direction.

A version of the article was posted on Forbes.com on January 25, 2024.

This publication contains the current opinions of the author but not necessarily those of Fort Washington Investment Advisors, Inc. Such opinions are subject to change without notice. This publication has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy, or investment product. Information and statistics contained herein have been obtained from sources believed to be reliable and are accurate to the best of our knowledge. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of Fort Washington Investment Advisors, Inc. Past performance is not indicative of future results.