Table of Contents

Table of Contents

Key Takeaways

- Make a plan to become financially independent by finding income sources and reducing reliance on others.

- Learn how to budget by tracking your income and expenses to stay within your means.

- Create an emergency fund by saving 3-6 months of living expenses as a safety net.

- Develop a retirement roadmap by exploring options like 401(k)s or IRAs and contributing early.

- Consider life insurance protection with term life insurance for affordable coverage for loved ones.

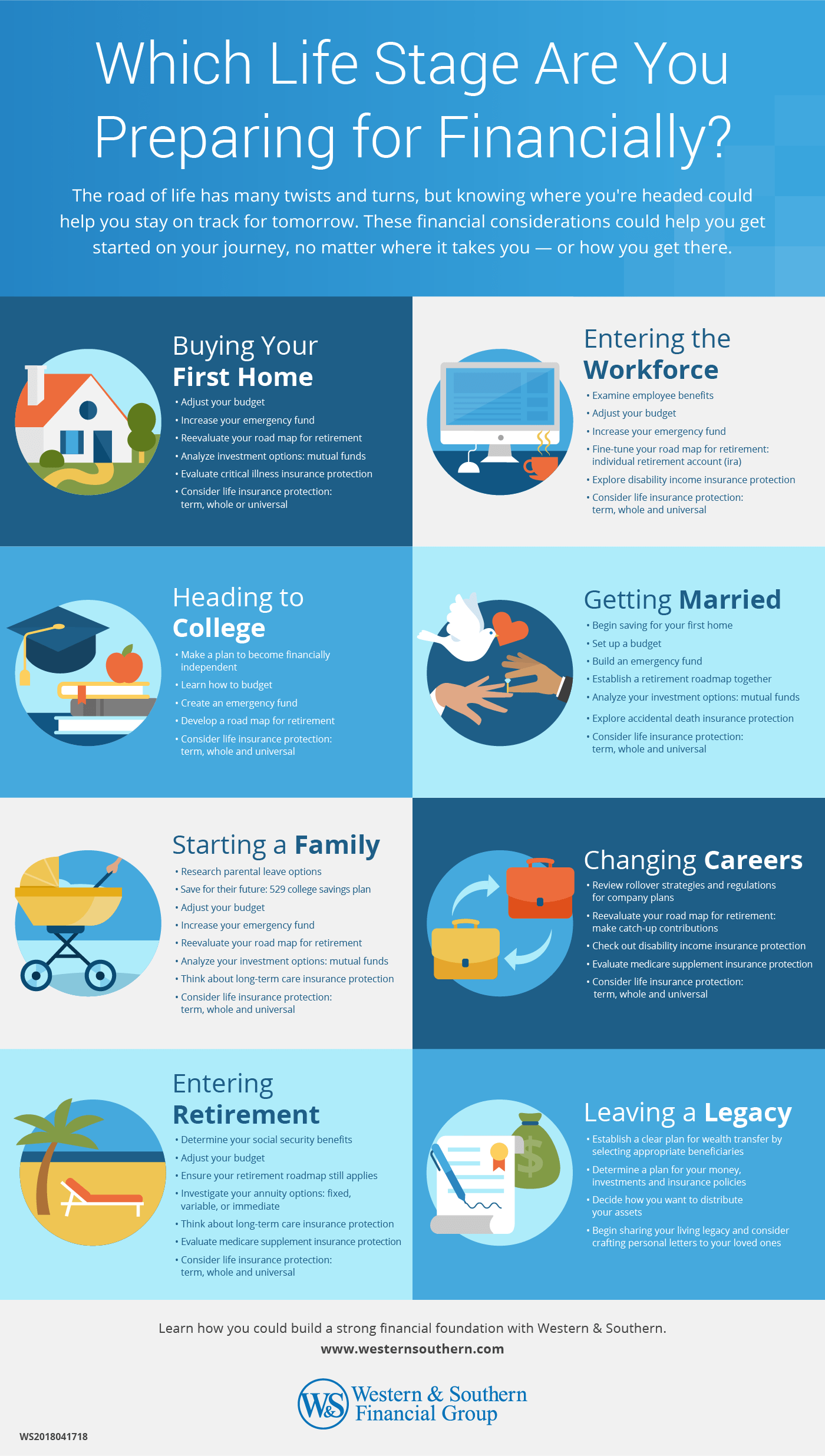

For each of us, there are many life stages to consider. Whether it be preparing for a new baby or a loved one's death, it's important to know how to help ensure you remain financially secure. While there are many things to consider in each of these stages, properly preparing yourself can reduce stress. The road of life has many twists and turns, but knowing where you're headed could help you stay on track for tomorrow. These financial considerations could help you get started on your journey, no matter where it takes you or how you get there.

Heading to College

- Make a Plan to Become Financially Independent

- Learn How to Budget

- Create an Emergency Fund

- Develop a Road Map for Retirement

- Consider Life Insurance Protection: Term, Whole and Universal

Entering the Workforce

- Examine Employee Benefits

- Adjust Your Budget

- Increase Your Emergency Fund

- Fine-tune Your Road Map for Retirement: Individual Retirement Account (IRA)

- Check Out Disability Income Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Getting Married

- Begin Saving for Your First Home

- Set Up a Budget Together

- Build an Emergency Fund Together

- Add Your Spouse to Your Road Map for Retirement

- Analyze Your Investment Options: Mutual Funds

- Explore Accidental Death Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Stay prepared with strategies tailored to each stage of your life. Get My Free Financial Review

Buying Your First Home

- Adjust Your Budget

- Increase Your Emergency Fund

- Reevaluate Your Road Map for Retirement

- Analyze Your Investment Options: Mutual Funds

- Look Over Critical Illness Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Starting a Family

- Research Parental Leave Options

- Save for Your Baby's Future: 529 College Savings Plan

- Adjust Your Budget

- Increase Your Emergency Fund

- Reevaluate Your Road Map for Retirement

- Analyze Your Investment Options: Mutual Funds

- Think About Long-Term Care Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Changing Careers

- Review Rollover Strategies for Company Plans

- Reevaluate Your Road Map for Retirement: Make Catch-Up Contributions

- Check Out Disability Income Insurance Protection

- Evaluate Medicare Supplement Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Entering Retirement

- Determine Your Social Security Benefits

- Adjust Your Budget

- Fine-tune Your Road Map for Retirement

- Investigate Your Annuity Options: Fixed, Variable, Immediate

- Think About Long-term Care Insurance Protection

- Evaluate Medicare Supplement Insurance Protection

- Consider Life Insurance Protection: Term, Whole and Universal

Leaving a Legacy

- Establish a Plan for Wealth Transfer

- Choose a Beneficiary for Select Annuity Payouts

- Choose a Beneficiary for Your Life Insurance Death Benefit

- Choose a Beneficiary for Your Accidental Death Insurance Benefit

Learn how you could build a strong financial foundation with Western & Southern.

Plan for each life stage with confidence through financial planning. Get My Free Financial Review