Finances for the Future

Many Americans we surveyed are investing to build wealth during these uncertain economic times. They’re also seeking financial advice on social media platforms more often than one might expect. Our recent study examines a sample of 1,031 Americans’ varying perceptions, strategies and motives for wealth-building. Study participants include baby boomers (born 1955-1964), Gen Xers (born 1965-1980), millennials (born 1981-1996) and adult Gen Zers (born 1997-2004).

With inflation on the rise, read on to discover how well they understand financial planning and what they are (or aren’t) doing to secure their financial futures today.

Key Takeaways

- High earners who responded to the survey indicated their ideal wealth breakdown would contain 3% more stock assets than the average American surveyed.

- Budgeting focused on savings (48%), investing in the stock market (48%) and working multiple jobs (44%) were the most popular wealth-building strategies among those surveyed.

- Nearly 62% of Americans surveyed became more committed to their wealth-building strategies due to inflation.

Ways to Build Wealth

Our report begins with some insight into the average amount of money the Americans we surveyed have saved. We also determined what they think is the ideal wealth breakdown.

Understandably, income greatly affects one’s ability to put money away while still affording the costs of daily life. High earners (respondents with annual earnings of $100,000 or more) were much more likely than lower-paid respondents to have over $50,000 in savings. The average American only has about $1,000 to $5,000 saved.

Surprisingly, 60% of Americans surveyed felt they would be comfortable living paycheck to paycheck, especially those from Gen Z. This young generation (whose oldest members were born in 1997) was 35% more likely than all other age groups to feel this way.

According to survey respondents, an ideal wealth breakdown would include a mix of cash savings, stocks, real estate holdings and other diverse investments.

According to our survey results, the most popular wealth-building strategies among respondents were saving cash through budgeting and investing in the stock market. Increasing income by working a multiple jobs was another top strategy employed by 44% of surveyees.

Learning About Wealth Building

From those surveyed, where have they searched for knowledge about wealth-building strategies? Their answers may surprise you.

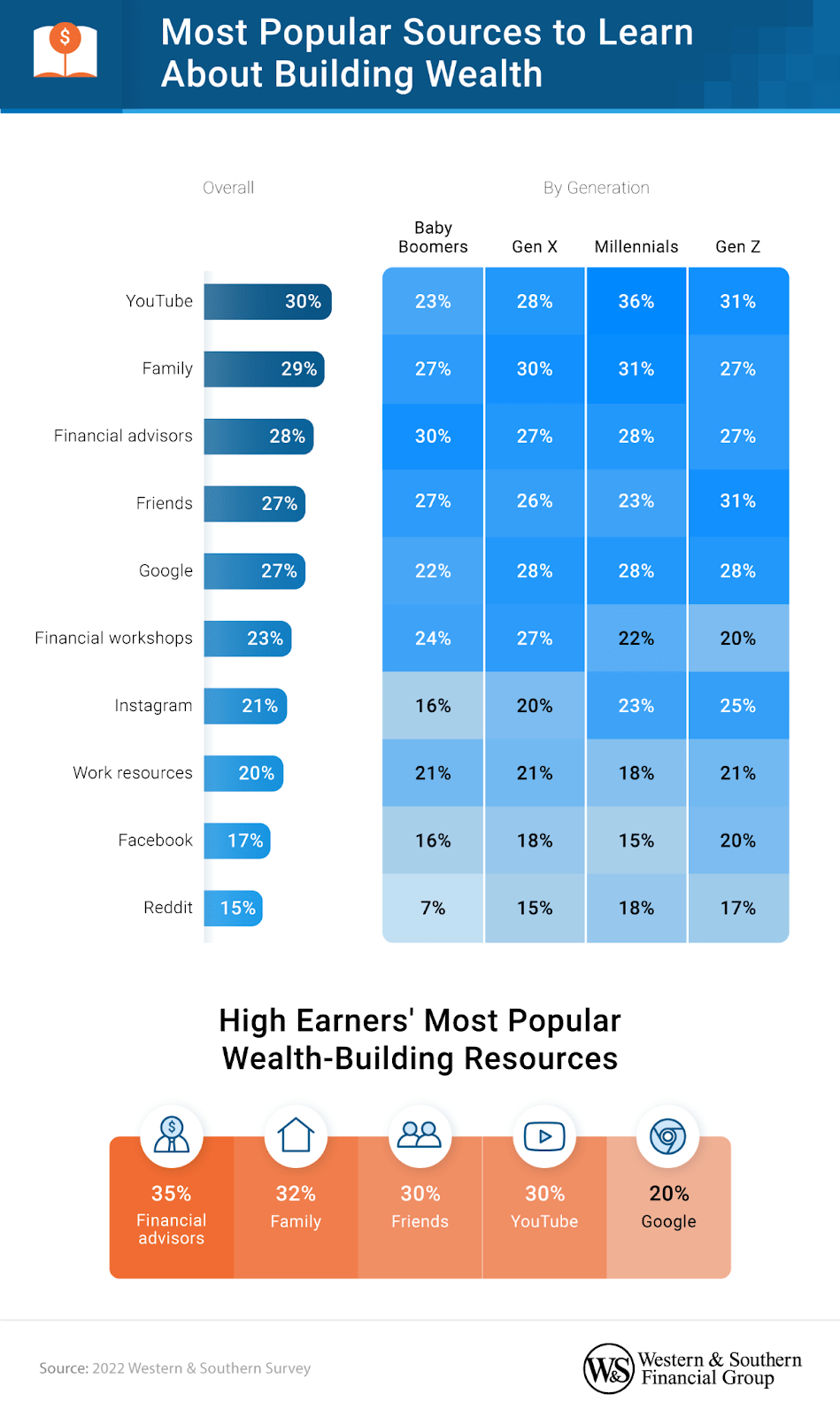

Overall, YouTube was the top source for learning about wealth-building strategies among those surveyed. While this platform doesn’t necessarily have a financial advisory reputation on its own, many reputable banks and other financial institutions have pages with high subscriber numbers. Baby boomer (born between 1955-1964) and high earner respondents were less keen to rely on trust social media for advice, as both groups notably favored traditional financial advisors over YouTube, Instagram and Facebook.

Why Build Wealth?

Whether saving for a medical emergency or a rainy day fund, Americans surveyed have different motivations for wanting to increase their wealth. Many people have also felt the squeeze of recent inflation on their ability to save or invest money.

The need or desire to increase their wealth has driven those Americans surveyed to seek information on savings and investment strategies. Saving for an emergency, living without financial worry and having a comfortable retirement were their top three priorities. Almost half of all Americans (47%) surveyed also saved to be financially stable during times of inflation.

Recent rises in inflation have threatened the savings of many Americans. It’s also given many a reason to hunker down financially for economic uncertainties in the future. Sixty-two percent of Americans surveyed reported increased commitment to savings due to inflation. However, higher earners differed from the pack as they were 21% more likely than all other respondents to not change strategies because of inflation. They may have responded differently to these challenging times because inflation can have a harsher effect on lower-income households.

Passing wealth to future generations was also important to 40% of Americans surveyed. Most people surveyed plan to leave cash to their children, followed by stocks and real estate holdings.

What Is Missing From Your Wealth-Building Vocabulary?

The information and terminology needed to approach saving and investing are less commonly known than one might think. We found that younger Americans surveyed, specifically Gen Zers (born 1997-2004), were less likely than other groups to know the meaning of many financial terms we asked about in the survey.

Even though we’ve highlighted Gen Z above, they weren’t necessarily alone in their financial literacy deficiency. Over three-quarters of Americans surveyed couldn’t define volatility, hedge fund or index. More than two-thirds also didn’t know about 401(k)s, which many companies offer as a retirement savings strategy.

Some Americans surveyed brushed up on their knowledge as inflation rose, indicating they were looking for advantages in a tougher economy. Trust funds (18%) were the most learned term since the onset of inflation, but 16% of Americans surveyed also learned about short selling stocks. Perhaps they were motivated by the potential opportunity to make money during a potential drop in the market.

Resources are available to Americans looking to increase their financial literacy and better navigate the current economy.

Start Planning for the Future Today

The majority of Americans we surveyed are trying to build wealth so they can rely on savings in an emergency. Some also reported wanting a life free of financial worry and a comfortable retirement. With multiple investment and savings opportunities, and the right tools and knowledge, Americans can help create their ideal diversification strategy. There are now more options than ever for investment advice across multiple platforms designed to help Americans increase their financial literacy and develop a smart wealth-building strategy.

Methodology

Western & Southern Financial Group surveyed 1,031 Americans, asking them about their wealth-building strategies, sources of knowledge and overall knowledge gaps. Generationally, 21% of respondents were baby boomers (born 1955-1964), 25% were Generation X (born 1965-1980), 27% were millennials (born 1981-1996) and 27% were Generation Z (born 1997-2004) aged 18 or older. Additionally, 17% of respondents were high earners, meaning they reported earning over $100,000 annually.

The margin of error for this study is ±3% with a 95% confidence interval. These findings rely on self-reported data. Potential issues with self-reported data include but are not limited to selective memory, hindsight bias and telescoping.

About Western & Southern

Founded in Cincinnati in 1888 as The Western and Southern Life Insurance Company, Western & Southern Financial Group, Inc., a Fortune 500 company, is the parent company of a group of diversified financial services businesses. Its assets owned ($66 billion) and managed ($35 billion) totaled $101 billion as of June 30, 2022. Western & Southern is one of the strongest life insurance groups in the world. Its seven life insurance subsidiaries (The Western and Southern Life Insurance Company, Western-Southern Life Assurance Company, Columbus Life Insurance Company, Gerber Life Insurance Company, Integrity Life Insurance Company, The Lafayette Life Insurance Company, and National Integrity Life Insurance Company) maintain very strong financial ratings. Other member companies include Eagle Realty Group, LLC; Fort Washington Investment Advisors, Inc.;1 IFS Financial Services, Inc.; Touchstone Advisors, Inc.;1 Touchstone Securities, Inc.;2 W&S Brokerage Services, Inc.;1,2 and W&S Financial Group Distributors, Inc.

1 A registered investment adviser.

2 A registered broker-dealer and member FINRA/SIPC.

Review our current financial ratings.

Fair Use Statement

Find something useful in our study? This website may contain copyrighted material, the use of which may not have been specifically authorized by the copyright owner. This material is available in an effort to explain issues relevant to financial education, financial literacy and understanding. The material contained in this website is distributed without profit for educational purposes. Feel free to share it for any noncommercial purpose, but please link back to this page when doing so. This should constitute a “fair use” of any such copyrighted material (referenced and provided for in section 107 of the U.S. Copyright Law). If you wish to use any copyrighted material from this site for purposes of your own that go beyond “fair use,” you must obtain expressed permission from the copyright owner.