Table of Contents

Table of Contents

Key Takeaways

- Falling stock prices, negative investor sentiment, and economic slowdown mark a bear market.

- A bull market happens when stock prices rise, and investors feel confident about the economy.

- Bull markets typically last three years, with an average gain of 100%, while bear market downturns slightly exceed this duration, causing an average loss of 20%.

- Investors usually buy more stocks in bull markets but shift to safer assets, such as bonds or cash, during bear markets.

- Sticking to a long-term plan, avoiding emotional decisions, and keeping a diversified portfolio helps in both market types.

What Is a Bear Market?

A bear market occurs when stock prices fall by 20% or more from their recent highs and remain in decline in the stock market trends for an extended period.

Key characteristics of a bear market include:

- Declining stock and asset prices

- Negative investor sentiment and decreased confidence

- Slowing growth

- Rising unemployment or stagnant job creation

- Decrease in corporate earnings

- Potential tightening of monetary policy

- Higher interest rates are further straining the economic environment

Bear markets often reflect broader economic downturns and can lead to a downward spiral as panic selling causes more declines.

Historical Examples of Bear Markets

Bear markets are not uncommon and have occurred throughout history:

1. The Great Depression (1929–1932): One of the worst in history, the Dow lost nearly 90% of its value.

2. The Dot-com Bust (2000–2002): Triggered by the collapse of tech stocks, this famous bear market wiped out trillions in market value.

3. The Global Financial Crisis (2007–2009): This bear market was triggered by the housing market bubble and credit crisis, with major indexes declining by over 50%.

4. COVID-19 Crash (February–March 2020): Although brief, the market fell sharply due to uncertainty and a weak economy brought on by a global health crisis.

Common Investor Reactions in Bear Markets

Bear markets often trigger fear. Investors may sell assets to avoid further losses, shift to cash or bonds, and retreat from the market altogether.

Emotions can lead to poor investment decisions in bear markets. Education, patience, and long-term planning help investors avoid costly errors. Bear markets are challenging but temporary—just one phase in a larger market cycle.

What Is a Bull Market?

A bull market is a financial market in which asset prices, particularly in the equity markets, are rising or expected to rise. This trend typically continues for a prolonged period, often months or even years.

Key characteristics of a bull market include:

- Steadily increasing share prices over an extended period.

- Elevated levels of investor confidence

- Robust growth of the Gross Domestic Product (GDP)

- Declining rates of unemployment

- Enhanced corporate profitability

- Interest rates that are low or remain stable

This type of market can occur in any financial market, but it's most often associated with the stock market.

Historical Examples of Bull Markets

Several notable bull markets have shaped the U.S. stock market:

1. Post-WWII Boom (1949-1968): A two-decade-long surge fueled by economic expansion and industrial growth.

2. The 1982–2000 Bull Market: This 18-year bull market was driven by lower interest rates, technological innovation, and increasing global trade.

3. Post-Financial Crisis Bull Market (2009–2020): One of the longest in history, this bull market followed the 2008 global financial crisis and was supported by monetary easing and low inflation.

How Investors Tend to Respond During Bull Markets

In bull markets, optimism and risk appetite rise. Investors typically buy and hold more equities and fixed-income exposure, expect higher returns, and focus on growth stocks and sectors.

Even in bull markets, long-term investors must avoid assuming constant price rises. Diversified portfolios help reduce risk. Growth occurs in bull markets, but strategic planning and diversification are crucial.

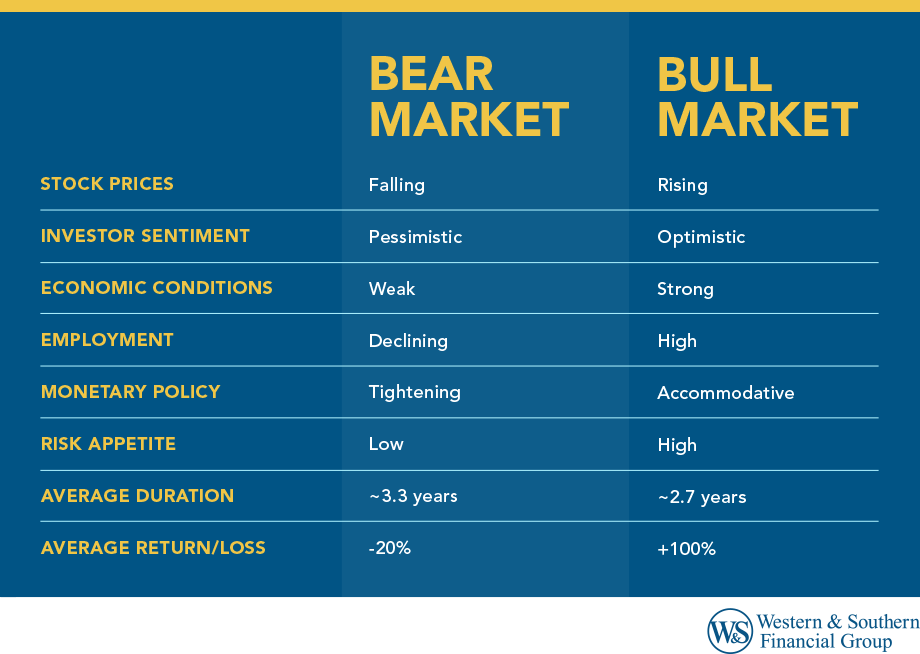

Bear Market vs Bull Market: Key Differences

Understanding the key differences between bull vs. bear markets can help investors make more informed decisions. Here is a detailed breakdown of how each market type behaves across several important features:

| Characteristic | Bear Market | Bull Market |

| Stock Prices | Falling stock prices indicate declining investor confidence and economic slowdown. | Rising stock prices suggest optimism and economic expansion. |

| Investor Sentiment | Pessimism dominates, with many expecting further declines. | Optimism prevails, encouraging more investment activity. |

| Economic Conditions | The economy is often weak, with shrinking GDP and other negative indicators. | Strong economic growth supports business activity and investment returns. |

| Employment | Employment levels decline as businesses reduce costs and hiring slows. | High employment levels typically accompany economic growth. |

| Monetary Policy | Central banks often tighten policy (e.g., raising interest rates) to combat inflation or stabilize financial markets. | Policies are generally accommodative, with low interest rates to stimulate growth. |

| Risk Appetite | Investors tend to be risk-averse, favoring cash or fixed-income assets. | Investors are more willing to take risks in pursuit of higher returns. |

| Average Duration | Lasts approximately 3.3 years on average. | Typically endures for about 2.7 years. |

| Average Return/Loss | Experiences an average market decline of around 20%. | Sees average gains of approximately 100%. |

Causes of Bear and Bull Markets and Market Shifts

A bull or bear market doesn't occur in isolation. Numerous elements can instigate or influence a shift in market trends and directions.

Common causes of bear markets include:

- Economic recessions: When economic activity slows significantly, companies struggle to grow, leading to declining stock prices.

- High inflation or deflation: Disruptions in purchasing power and increased costs can reduce consumer spending and corporate profits.

- Rising interest rates: Higher borrowing costs can limit business expansion and reduce consumer activity, putting downward pressure on markets.

- Geopolitical instability: Conflicts, wars, or trade tensions can create uncertainty that discourages investment and disrupts global markets.

- Market corrections turning into prolonged declines: Sometimes, a short-term dip evolves into a bear market if underlying economic weaknesses are exposed.

Common causes of bull markets include:

- Strong GDP growth: When the economy expands at a healthy pace, businesses grow, jobs are created, and consumer spending increases—all of which fuel market optimism.

- Low unemployment: A strong labor market typically increases disposable income and consumer spending, boosting corporate earnings and stock prices.

- High corporate earnings: When companies are profitable, they often reinvest in their growth or return value to shareholders through dividends and buybacks.

- Stable or low interest rates: Lower borrowing costs encourage businesses to expand and consumers to spend, which supports equity markets.

- Investor confidence: Positive sentiment and belief in continued growth lead more investors to buy stocks, pushing prices higher.

Other influential factors:

- Global pandemics or health crises can shock economies, restrict mobility, and severely impact industries, leading to broad market declines.

- Natural disasters: Widespread disasters can disrupt production, supply chains, and infrastructure, affecting economic output.

- Changes in fiscal or monetary policy: Shifts in government spending, taxation, or central bank actions can change investor expectations and market dynamics.

Understanding economic and policy conditions helps predict market changes. Investor actions and external events often drive transitions between bull and bear markets.

How to Adjust Your Investment Strategy

Whether you're facing a bull or bear market, the right investment strategy should be based on your goals, risk tolerance, and time horizon.

| Market Type | Investment Strategy |

| Bear Market |

|

| Bull Market |

|

| All Market Types |

|

These are general investing principles for informational purposes. Speak with a certified financial advisor or investment advisor for personalized guidance and investment advice.

Bear and Bull Markets vs Other Market Conditions

Not all market movements fall neatly into bull or bear territory. Other phases or transitions may occur.

- Market Corrections: A correction is a short-term decline in stock prices of 10% or more, often part of a healthy market cycle.

- Recessions and Recoveries: While bear markets often align with recessions, not all recessions lead to bear markets, and vice versa.

- Volatile or Sideways Markets: Market stagnation or periods of volatility can be disorienting. In these times, asset prices fluctuate without a clear upward or downward trend, often referred to as a flat market trend.

Recognizing these other market trends is key to understanding where we are in the broader market cycle. Markets can move in many directions, and knowing the type of environment you're in helps you manage expectations and strategy.

Final Thoughts

Bull and bear markets are both standard parts of the market cycle. The key is to stay informed, think long-term, and avoid emotional decisions. By aligning your portfolio with your goals and staying consistent, you're more likely to ride out the lows and benefit from the highs.

Ready to better understand market trends? Invest In My Future

Frequently Asked Questions

Is a bear or a bull market better?

Should I wait for a bear market to invest?

What does black bull mean?

Sources

- Is another bear market coming out of hibernation? Here’s what to know. https://www.pbs.org/newshour/economy/is-another-bear-market-coming-out-of-hibernation-heres-what-to-know.

- Here's Exactly How Long the Average S&P 500 Bull Market Has Lasted -- and What History Says About the Future. https://www.fool.com/investing/2025/01/11/heres-exactly-how-long-the-average-sp-500-bull-mar.

- What is a bull market? https://www.fidelity.com/learning-center/smart-money/bull-market.