Key Takeaways

- Mutual funds let investors access a diversified portfolio of stocks, bonds, and securities managed by professionals.

- Mutual fund fees cover management but can reduce returns compared to directly owning securities.

- Actively managed funds rely on a manager, but they may underperform passive index funds.

- Mutual funds support dollar-cost averaging and reinvestment, though taxes can reduce efficiency.

- Despite offering diversification, mutual funds still carry market risk and potential principal loss.

If you've heard of mutual funds but aren't exactly sure what they are or how they work, rest assured that you're not alone. These investment options can help diversify portfolios, but they come with their own set of advantages and potential drawbacks.

Gaining a basic understanding of mutual funds can help you identify whether they may help serve your financial goals. Here's an introduction to some of what you need to know about these investments as well as an overview of the common pros and cons of mutual funds.

What Are Mutual Funds?

Mutual funds are pooled investments that may invest in dozens or hundreds of securities, such as stocks or bonds, that are packaged together into one security. Mutual funds may be actively managed, where a fund manager or management team selects the securities in the fund portfolio. Alternatively, they may be passively managed, which means they merely track the performance of a benchmark index, such as the S&P 500.

Many different types of mutual funds exist. They are typically categorized by their individual objectives (such as growth or income), by market capitalization (such as large-cap, mid-cap or small-cap stocks) or by sector (such as technology and health). Mutual funds may also invest in bonds, which are typically categorized by maturity (such as short-term, intermediate-term and long-term) and by the issuer (such as a corporation, municipality or government).

You can buy into mutual funds similar to the way you can buy shares of a singular stock. The main difference is that mutual funds comprise many different stocks and bonds.

What Are the Pros & Cons of Mutual Funds?

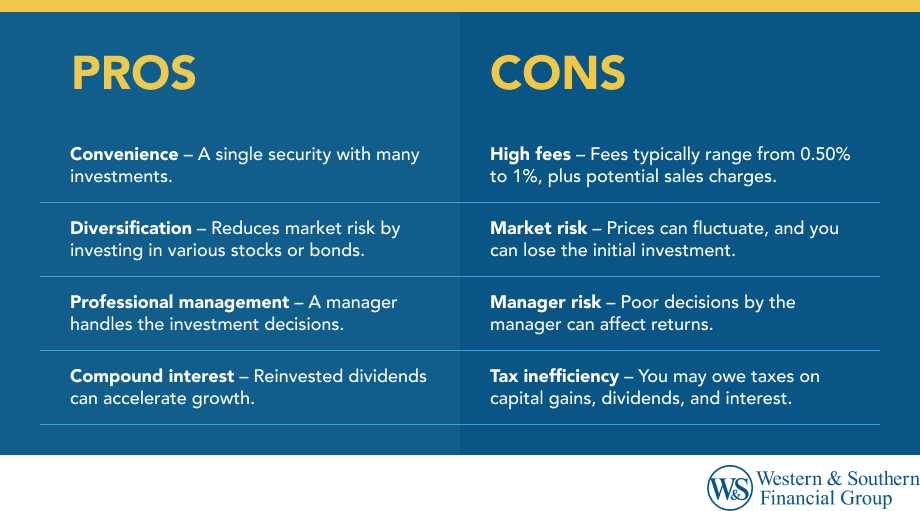

There are several mutual fund advantages and potential drawbacks that investors should be aware of before deciding to invest. While mutual funds offer benefits such as convenience, diversification, professional management and compound interest, they also can have high fees, market risk, manager risk and tax inefficiency. Before you get involved, weigh these points against your personal financial goals:

Possible Pros

- Convenience. Investors can conveniently select a mutual fund that may include dozens or hundreds of investments within one packaged security.

- Diversification. Mutual funds typically invest in a wide range of stocks or bonds, which provides instant diversification. This can help reduce market risk in a portfolio. Of course, diversification cannot guarantee profit or protection against loss in a declining market.1

- Professional management. Rather than taking the time and resources to research and analyze stocks or bonds, investors can buy into a mutual fund and allow a professional to select and manage the investments in the portfolio.

- Compound interest. Investors can choose to have dividends and interest reinvested, which will then go to buy more shares of the mutual fund, enabling faster growth by earning interest on top of interest.

Potential Cons

- High fees. Mutual funds have expenses, typically ranging between 0.50% to 1%, which pay for management and other costs to operate the fund. Some mutual funds have sales charges, or "loads," that investors pay when either buying or selling a mutual fund.

- Market risk. Just as with stocks and bonds, mutual funds generally have market risk, meaning that prices can fluctuate up and down. They also have principal risk, which means you can lose the original amount invested. Remember that investments cannot guarantee growth or sustainment of principal value; they may lose value over time. Past performance is not an indication of future results.

- Manager risk. In the case of actively managed funds, a portfolio manager can be susceptible to bad judgment, such as emotion-led decisions or poor timing in the buying or selling of securities.

- Tax inefficiency. Mutual funds pass along capital gain distributions to investors, which arise from the selling of securities at a profit, even if the investor did not sell any shares. Investors also pay taxes on dividends and interest earned in the fund.

The Bottom Line

There are several mutual fund advantages to consider, including convenience, diversification and professional management. However, they might not be an ideal choice for every investor. Knowing the pros and cons of mutual funds before deciding to buy shares will help you decide if it's right for you. As with all important financial decisions, consider getting help from a financial professional to discuss whether mutual funds will fit your goals.

Consider mutual funds to balance growth and reduce risk in your portfolio. Start Investing

Footnotes

- Diversification does not ensure a profit or protect against a loss in declining markets.