Table of Contents

Table of Contents

Key Takeaways

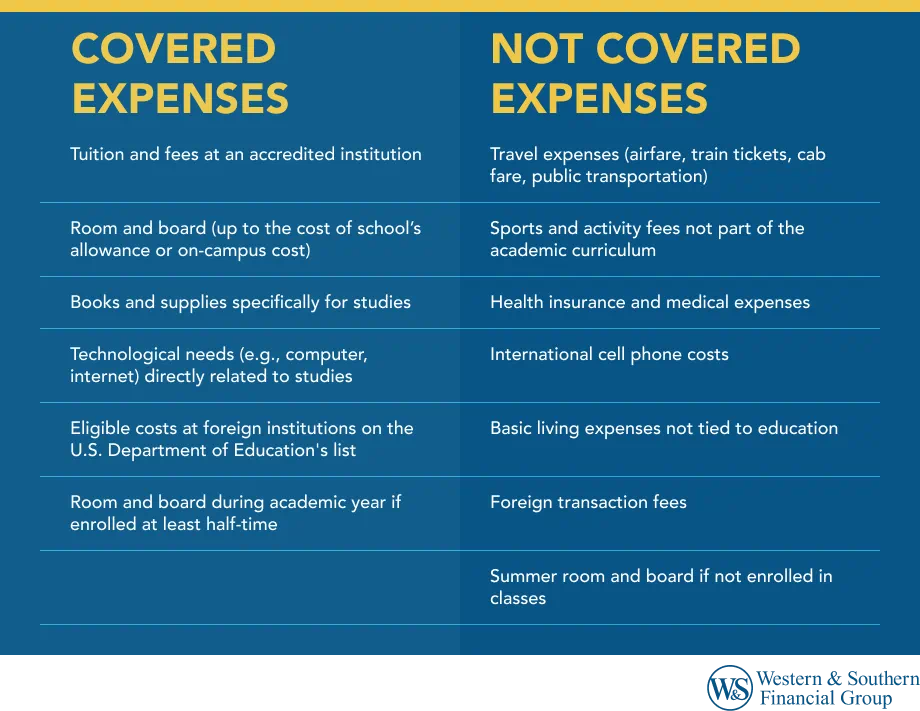

- 529 plans can be used to pay for qualified education expenses when studying abroad if the school is eligible for federal financial aid.

- Qualified expenses include tuition, fees, room and board, books, supplies, and computer equipment.

- Unqualified expenses include travel costs, extracurricular fees, health insurance, cell phone bills, living expenses, and foreign transaction fees.

- To withdraw funds without penalty, you must be enrolled in at least half of the normal full-time course load, and periods like summer break may not count toward this requirement.

- 529 plans allow tax-advantaged savings and growth for education, and consulting a Registered Representative can help maximize their benefits.

A 529 college savings plan can offer a number of advantages for both students and their families. These plans allow you to set aside money for educational expenses while also offering potential tax advantages as long as the money is used for qualified expenses. But what if you are interested in studying in another country? Can you use a 529 to pay for study abroad programs? Here's some information to consider.

529 College Savings Plan Basics

529 plans are sponsored by individual states and help families and students save for future education expenses. The money in the plan has the potential to grow tax-deferred and you may not have to pay federal or state taxes when you withdraw money from the plan as long as it's used for qualified expenses. The following costs are considered qualified education expenses:1

- Tuition and fees

- Room and board

- Books and supplies

- Technological needs, such as a computer or internet access

There are a few important caveats to note on qualified expenses.

- The school must be accredited for these expenses to be considered qualified.

- Room and board expenses are limited to either the cost of the school's allowance for room and board or the cost of living in on-campus housing, whichever is greater.

- The books, supplies and technology you purchase must be specifically for your studies.

You will have to pay income taxes on any gains, and you might be required by the state sponsoring your 529 college savings plan to pay back any state income tax deductions or credits that you have previously received. While you can technically withdraw funds from your 529 for non-qualified expenses, there is an extra 10% tax penalty (on top of the income tax you pay on gains) for doing so.

Can You Use a 529 to Pay for Study Abroad?

Where does studying abroad fit into this? The good news is that you can use your 529 money to pay for some of the expenses associated with studying in a foreign country.

As long as the academic institution you plan to attend outside of the U.S. is eligible to participate in federal student aid programs, you can use your 529 money to pay for qualified education expenses. You may be able to determine if your chosen school qualifies by checking the U.S. Department of Education's list of international schools that participate in federal student aid programs.2

What Study Abroad Costs Are Not Qualified?

Though the bulk of your educational expenses are considered qualified, there are an additional number of unqualified costs associated with studying abroad. The following costs are not considered qualified, and they can be quite expensive for students studying abroad:

- Travel to and from your educational institution, including air travel, train tickets, cab fare and public transportation

- Sports and activity fees that are not part of the basic curriculum

- Health insurance and medical costs

- International cell phone costs

- Basic living expenses

- Foreign transaction fees

You must be at least a half-time student in order to be able to use your 529 money penalty-free for qualified expenses. If you decide to stay in your host country over summer break without taking any classes, you likely cannot use your 529 funds to pay for room and board, even if those were qualified expenses during the academic year.

Getting Started With a 529 College Savings Plan

Setting money aside is one way to help prepare for your or your child's future education. With 529 plans, you can also enjoy tax-advantaged growth and withdrawals for qualified education expenses, even if the student in question hopes to study outside the U.S. To learn more about opening a 529 college savings plan, consider speaking with a registered financial representative.

Maximize your college savings by utilizing a 529 plan for study abroad programs. Invest Today

Sources

- Tax Benefits for Education - 2023 Tax Returns. https://www.irs.gov/pub/irs-pdf/p970.pdf.

- Aid for International Study. https://studentaid.gov/understand-aid/types/international#participating-schools.