Key Takeaways

- Learn how to talk to loved ones about exploring life insurance for the first time.

- Frame it as a positive conversation about planning for the future and taking care of each other.

- Explain that you're exploring options to ensure they're financially secure if something happens to you.

- Reassure them it's not about thinking negatively — it's about being proactive and responsible.

- Let them know you'll be researching different plans and talking to professionals to find the best fit.

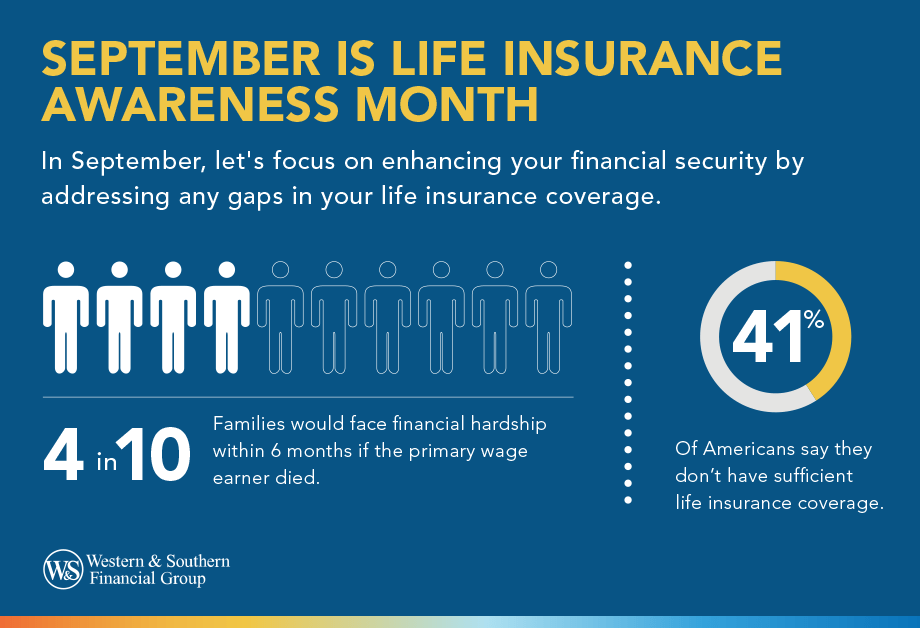

September is Life Insurance Awareness Month. It's an annual reminder to learn and spread the word about the importance of life insurance. Many people struggle with how to discuss the importance of life insurance with their loved ones. It can be an uncomfortable conversation. But it doesn't have to be that way.

Read on to learn more about the importance of making life insurance decisions early and how you can broach the subject with your loved ones.

The Importance of Purchasing Life Insurance Earlier

Making life insurance decisions earlier in life offers several benefits. For example, because younger persons are likely to live longest, purchasing life insurance at younger ages typically results in lower premiums. By locking in lower rates early on, individuals can save significant amounts of money over the life of the policy. Plus, obtaining life insurance early provides financial protection sooner for loved ones in the event of unexpected death. Doing so helps ensure that dependents are provided for and financial obligations, such as mortgage payments, education expenses or other debts, can be met.

In addition, discussing life insurance with loved ones is essential. It's important that everyone concerned understands thar protection is in place, beneficiaries are properly designated and financial plans are aligned with shared needs and goals. Open communication with loved ones about life insurance helps avoid misunderstandings and ensure wishes are respected for all involved parties.

How to Talk to Loved Ones About Exploring Life Insurance for the First Time

Here are a few basic need-to-know items and concepts about exploring life insurance with loved ones for the first time. Consider them a starting point for easier explanation and improved understanding:

- Financial protection: Life insurance helps ensure your loved ones are financially supported if you're no longer there. Think of it as helping provide a safety net.

- Coverage options: Different types of life insurance that can be tailored to individual needs, such as term life (covers you for a specific period) and whole life (covers you your entire life and builds cash value).

- Coverage needs: The amount of coverage you need depends on many factors, including your outstanding debts, such as mortgages and student loans, as well as future needs, such as a child's college education. Factor in your current income and how long your dependents might need financial support. Then multiply your income by a certain period (e.g., 5 or 10 years) to estimate the amount of coverage you might need.

- Affordability: Premiums (often made as monthly payments) are important to consider. You'll want to choose a plan that fits your budget comfortably.

- Your health: Your health and habits impact the cost of life insurance. Being honest about your health is essential to obtaining the most accurate quote, as well as to ultimately securing coverage. Note: You don't need to go into medical details with loved ones, but emphasize that honesty is key to getting the best rate.

- Beneficiaries: These are the people who receive the payout from the life insurance policy. You should decide who you want to benefit from this financial support in the event of your death.

- Reviewing needs: Your needs might change over time, so make it a point to periodically review your policy to ensure it continues to fit your situation.

- Getting help: Consulting a financial professional is helpful in tailoring a life insurance plan for your unique needs and financial goals. They can guide you through all of the above and help you determine the appropriate amount of coverage.

Framing the Conversation Around the Importance of Life Insurance

For life insurance awareness month, follow these ideas for framing a life insurance conversation with your loved ones:

- Frame it as a positive conversation about planning for the future and providing for each other.

- Explain that you're exploring options to ensure they're more financially secure if something happens to you.

- Reassure them it's not about thinking negatively but simply being proactive and responsible instead.

- Let them know you'll be researching different plans and talking to professionals to identify the best approach.

By openly discussing these need-to-know points, you involve your loved ones in this important financial decision. And when you need the guidance of a financial professional, Western & Southern is here to help.

Celebrate Life Insurance Awareness Month by securing your future. Get a Life Insurance Quote

Sources

- Life Insurance Awareness Month. https://www.limra.com/liam/.