Table of Contents

Table of Contents

Key Takeaways

- Debt is generally categorized as secured or unsecured, depending on whether it’s backed by collateral like a house or car.

- Revolving debt, like secured credit cards, enables repeated borrowing up to a limit, whereas installment debt, such as mortgages or auto loans, features fixed payments and a set end date.

- Common types of consumer debt include credit cards, mortgages, auto loans, student loans, medical bills, and personal loans, each with different terms and risks.

- Grasping debt structures, rates, and terms helps you borrow wisely and avoid strain.

- Managing debt requires planning. Strategies like consolidation can reduce interest and improve stability.

What Is Debt?

Debt is money you've borrowed and need to repay over time, usually with some interest. People often take on debt from places like banks to cover significant expenses such as buying a house, paying for college, or dealing with unexpected costs. Student loans help make pursuing education more affordable, while credit cards and personal loans can be convenient for managing day-to-day expenses.

Recognizing why debt occurs and the different types will help you make better financial choices.

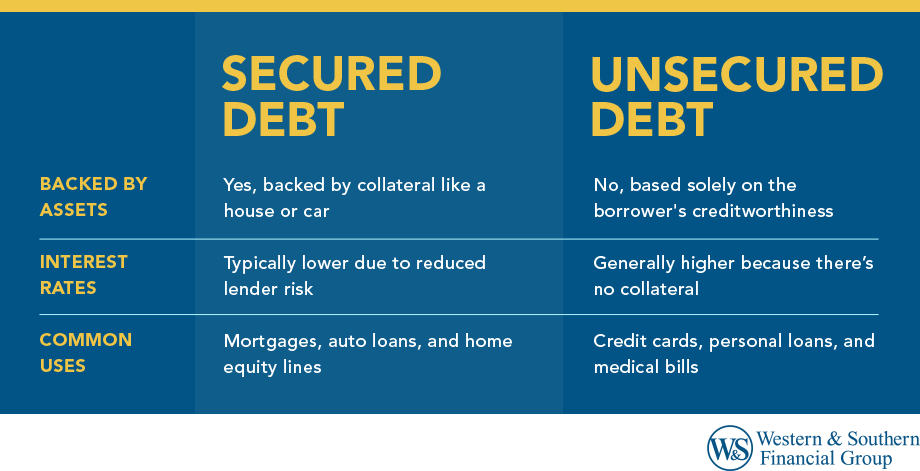

Secured Debt vs. Unsecured Debt

Debt typically falls into one of two categories: secured or unsecured. Knowing the difference can help you better understand the types of debt you might have. Here's a quick breakdown:

- Secured debt is backed by collateral like a car or home. If you don’t pay, the lender can take the asset. Interest rates are usually lower.

- Unsecured debt has no collateral backing it up, like a house or car, so you pay higher interest rates. If you fall behind on payments, you could face pesky collection calls or even legal troubles.

Key Differences

| Comparison Point | Secured Debt | Unsecured Debt |

| Backed by Assets | Yes, backed by collateral like a house or car | No, based solely on the borrower's creditworthiness |

| Interest Rates | Typically lower due to reduced lender risk | Generally higher because there’s no collateral |

| Common Uses | Mortgages, auto loans, and home equity lines | Credit cards, personal loans, and medical bills |

Understanding the difference between secured and unsecured debt can help you choose borrowing options appropriate for your financial situation and risk tolerance.

Revolving Debt vs. Installment Debt

Revolving and installment debt are two primary repayment methods, each working differently. Knowing their differences can help you choose the best fit for your financial goals.

- Revolving debt lets you borrow up to a limit, with payments varying by amount owed. Interest is not fully paid monthly. It aids cash flow but requires careful spending.

- Installment debt is like taking out a loan for a certain amount and then paying it back monthly, usually with some interest, until it’s all cleared by a set deadline.

Key Differences

| Feature | Revolving Debt | Installment Debt |

| Repayment Structure | Flexible payments, no end date | Fixed payments, set term |

| Access to Funds | Reusable credit limit | One-time lump sum |

| Common Examples | Credit cards, credit lines | Mortgages, auto loans, personal loans |

Knowing how each repayment structure works can help you manage your cash flow more effectively and make smarter borrowing decisions.

Major Consumer Debt Types

Knowing the features, pros, and cons of different types of debt can help you make smarter financial choices. Here are some of the most common types to be aware of:

Credit Card Debt

Credit cards are like having a flexible spending friend. You can borrow up to a limit for shopping or snagging some quick cash. Remember that you'll see interest charges sneaking in if you don't pay it in full.

Features:

- High interest rates. Carrying a balance can lead to rapid accumulation of interest.

- Minimum monthly payments. These allow flexibility but often extend repayment timelines.

- Revolving credit line. You can borrow again up to your limit as you repay.

- Often used to manage monthly expenses or supplement tight budgets.

| Pros | Cons |

| Repay flexibly, exceeding the minimum if desired. | Unpaid balances incur high interest costs that accumulate rapidly. |

| In emergencies, credit cards provide quick access to needed funds. | Easy access to credit cards often leads to overspending. |

| Using credit cards responsibly boosts credit history and aids future loans. | Late payments or high credit use can damage your credit score. |

Mortgage Debt

Mortgage debt is a loan to buy a house or some real estate. You typically pay back over a long stretch, like 15 to 30 years.

Features:

- Secured by property. Your home or real estate acts as collateral.

- Fixed or variable interest rates. Rates can remain stable or change over time.

- Long repayment terms. Monthly payments are spread over decades, making them a classic example of installment debts.

| Pros | Cons |

| Builds home equity as you gain ownership while paying down the mortgage. | Delinquent mortgage payments may result in foreclosure and the loss of your home. |

| Interest payments may be deductible, offering potential tax benefits. | Mortgages are long-term commitments, utilizing income for years. |

| Mortgages usually have lower rates and better terms than unsecured debt. | Owning a home includes taxes, maintenance, and insurance costs. |

Auto Loans

Auto loans help you finance the purchase of a new or used car by breaking the cost into manageable time payments. As an installment loan, they let you repay the borrowed amount over the loan over time —usually with interest.

Features:

- Secured by the vehicle. The car serves as collateral.

- Fixed monthly payments. Payments are predictable and set for the loan term.

- Terms usually range from 3 to 7 years. These are typical installment loans, with a set end date.

| Pros | Cons |

| Makes car ownership accessible by spreading the cost over time. | Cars depreciate fast, possibly leaving you owing more than their worth. |

| Borrowers with high credit scores enjoy competitive interest rates. | Missed payments can result in the repossession of your vehicle. |

| Interest may make the car cost more than its value. |

Student Loans

Student loans cover higher education costs, including tuition, books, and living expenses. They fall into two main categories: federal and private.

Federal Student Loans

- Issued by the U.S. Department of Education

- Typically offer fixed, lower interest rates

- Come with flexible repayment options, including income-driven plans

- Do not require a credit check for most loans

- May offer deferment, forbearance, and some forgiveness options

Private Student Loans

- Issued by banks, credit unions, or other private lenders

- May have variable or fixed interest rates, often higher than federal loans

- Fewer repayment options and limited flexibility

- Usually require a credit check or a co-signer

- Less likely to offer deferment or forgiveness programs

| Pros | Cons |

| Allows access to higher education without upfront costs | Interest accrues over time, even during deferment (in some cases) |

| Federal loans offer deferment and income-based repayment options | Can lead to long-term debt, especially with large balances |

| May improve earning potential by supporting career advancement | Limited forgiveness options and strict eligibility requirements |

Other Types of Debt

- Personal loans are unsecured debts you borrow without putting up any collateral. They're great for debt consolidation loans, handling surprise expenses, fixing up your home, or making big purchases. Many folks use them to combine their debts, making it easier to manage payments and potentially lowering the interest they’re paying.

- Medical debt arises when people can't immediately pay for medical treatments or healthcare services received.

- Consumer debt encompasses personal debt incurred from purchasing goods and services, including credit card balances, auto, student, and personal loans, as well as unpaid utility bills.

- Payday loans are short-term loans with very high interest rates, usually due by your next payday. They're often criticized for their steep fees, which can make it easy for borrowers to fall into a cycle of debt.

- Home Equity Loans / HELOCs allow borrowing against home equity and can be used as a secured loan for significant expenses.

- Buy Now, Pay Later (BNPL) Loans let you divide online purchases into installments with little or no interest. They are commonly used for short-term financing.

Each type of debt has its purpose, and knowing how they work can help you make smarter borrowing choices and manage your finances.

How Debt Affects Your Financial Health

When used carefully, debt can support your financial goals—but if it’s mismanaged, it can lead to serious setbacks. That’s why it’s important to understand how debt fits into your overall financial picture. Here are a few ways it can impact your financial health:

- Impact on Credit Score: How well you manage debt influences your credit score. Depending on your score, you may not be able to buy a house or apply for a loan.

- Having Multiple Debts: Managing all kinds of debt with different due dates, interest rates, and amounts can be challenging. This can lead to payments that negatively impact your credit score and may result in late fees, worsening your financial situation.

- Financial Stress: Excessive debt can increase stress and anxiety, harming mental health and decision-making. Overwhelming debt may lead to more borrowing, worsening the situation.

- Limited Financial Flexibility: High debt limits your cash flow, reducing savings and investment options. This hinders building an emergency fund, planning for retirement, or making major life decisions like changing careers or relocating.

Understanding the effect of debt on your credit, income, and financial stability is critical. It can be the difference between qualifying for opportunities or facing financial setbacks.

Managing Debt: Strategies That Can Help

There’s no single right way to manage debt, but a few tried-and-true strategies can help you stay on track and make consistent progress toward paying it down.

- Try the Debt Snowball Method: First, pay off your smallest debt to build momentum, while making minimum payments on more significant debts.

- Use the Debt Avalanche Method: If your credit has improved, refinancing high-interest loans can secure better terms, especially for mortgages, auto, or student loans.

- Consider Consolidating Your Debts: Combining debts through a debt consolidation loan may lower your rate and simplify your payments with a single due date.

- Look Into Refinancing: Refinancing may help you replace high-interest debt with a better-secured loan, especially for mortgages, car loans, or student debt.

- Automate Payments and Adjust Regularly: Automate payments to avoid late fees and boost credit scores. Review expenses regularly to find savings and speed up debt repayment.

When & How to Seek Help

If managing debt feels overwhelming, it’s okay to ask for support. Here are a few options to consider:

- Talk with an Advisor: Consulting a financial professional or certified credit counselor can clarify your options and impact, and aid in a tailored repayment plan.

- Debt Management Plans (DMPs): DMPs from nonprofit debt relief programs can help lower interest rates and consolidate payments without needing a new loan.

- Credit Counseling Services: These services provide financial education, budgeting advice, and personalized guidance to help you develop a plan to manage your finances more effectively. Look for certified credit counselors from reputable nonprofit organizations.

- Debt Settlement Companies: These companies negotiate with creditors on your behalf to reduce the total and debt owed. However, exercise caution and thoroughly research any company; some may be scams or charge high fees without delivering results.

- Bankruptcy Consultation: If your debt is insurmountable, consulting with a bankruptcy attorney can help explore options like Chapter 7 or Chapter 13 bankruptcy. This is a serious step that can affect credit scores and future borrowing and; some provide a fresh financial start.

- Financial Therapists: If debt is causing significant emotional stress, seeking therapy can offer support and coping strategies to manage anxiety related to money. These professionals can help address the psychological impacts of debt.

The sooner you take action—whether on your own or with help—the more control you’ll have over your financial future.

Final Thoughts

Not all debt is harmful— when managed wisely, it can support your financial goals. The key is making informed decisions, having a clear plan, and using debt as a tool rather than a burden. Staying on top of your accounts, managing installment payments, and sticking to a budget can all help build a stronger financial foundation.

Start learning about the different types of debt today. Get My Free Financial Review