Table of Contents

Testamentary TrustTestamentary TrustTable of Contents

Key Takeaways

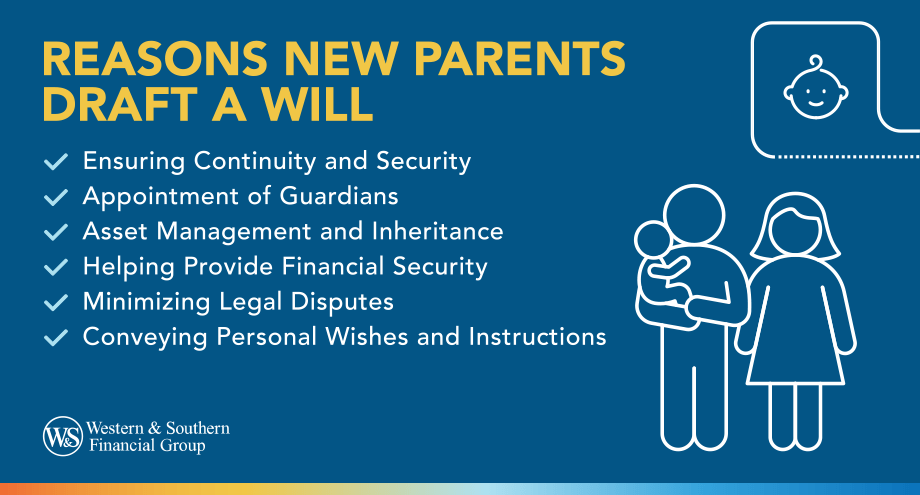

- Appointing a guardian for minors secures your child's upbringing and welfare.

- Specifying asset distribution can help minimize disputes and ensure your wishes are honored.

- Creating trusts helps protect minors' inheritances until they are of age.

- Addressing debts and taxes in a will avoids burdening beneficiaries.

- A will is an act of love and responsibility.

Understanding the Basics of Wills

A will is an estate planning tool and legal document that outlines your final wishes for your assets and dependents, safeguarding your child's future and ensuring assets are distributed per your desires. A will can include provisions for a trust, which can manage and protect assets for minor children until they reach a suitable age.

The document appoints someone to manage your estate, lists your assets and liabilities, and designates beneficiaries. Assets in a will can include a wide range of property such as real estate, financial accounts, vehicles, personal belongings, family business interests and intellectual property.

If you don't have a will, you may want to seek the expertise of an estate attorney who understands your circumstances and the laws in your state. Click here to learn more about the steps to create a will.

Appointing a Legal Guardian for Minors

A will allows parents to name a guardian for their minor children, helping to ensure they are cared for by a trusted individual if both of you were to pass away.

This appointment helps ensure that your child's guardian shares your values and preferences for upbringing so they will be cared for according to your wishes.

Legal guardians must provide for the minor's physical well-being, including housing, food, clothing, medical care, insurance and education. Additionally, they are responsible for managing the minor's finances (if applicable) and making decisions in the minor's best interests, including medical decisions and financial decisions, while being accountable to the court.

Managing Estate Asset Distribution

Having addressed appointing a guardian for minors, it is equally important to focus on asset distribution to ensure your estate is allocated according to your wishes. A will plays a crucial role in managing asset distribution for several key reasons:

Creating Trusts for Minors or Special Needs

A will can create a testamentary trust, but it must go through the probate process to become effective. Trusted individuals or entities will manage assets for minors or special needs children, ensuring their financial care according to your wishes until beneficiaries reach a specified age.

Specifying Beneficiaries

A will allows you to identify who should receive your assets after your death, including family members, friends, charities or any other entities you choose.

You can also designate specific beneficiaries for certain types of financial accounts, like bank accounts, retirement plans, and life insurance policies, which take precedence over the will. Naming beneficiaries allows you to determine who will benefit from your estate, which is not guaranteed if your estate is distributed according to intestate succession laws (the default legal process when there is no will).

Detailing Asset Allocation

Beyond naming beneficiaries, a will lets you precisely describe how your assets should be divided. You can allocate specific accounts or set your estate percentages to different people. This level of detail can help prevent misunderstandings and disputes among your heirs.

Minimizing Family Disputes

A will can help minimize potential disputes among family members by clearly outlining how you want your assets distributed. When your wishes are documented, there is less room for misunderstanding or contention over who gets what.

Facilitating a Smoother Probate Process

Having a will typically makes the probate process (the legal process of administering your estate) smoother and more straightforward. The court will have clear instructions on distributing your assets, which can expedite the process and reduce legal costs. Keep in mind that estate laws differ by state.

Flexibility in Asset Distribution

Wills can be updated as your circumstances change, which means you can alter the distribution of your assets if your financial situation, relationships, or preferences change over time.

Managing Business Interests

Having a will as a business owner can be crucial as it can designate a specific heir to take over the business.

Addressing Debts & Taxes

A will can provide vital instructions for how debts, including taxes, should be settled to ensure that your estate is distributed to your beneficiaries as intended after all obligations are resolved.

A will helps manage asset distribution and care for your loved ones. Start My Free Will1

Minimizing Legal Complications

Drafting a will is a critical step in estate planning that can significantly minimize legal complications for several reasons:

- Clear Distribution of Assets: A will provides specific instructions on how assets should be distributed after your death. This clarity can prevent disputes among heirs and beneficiaries, as the will outlines your exact wishes.

- Appointment of Executors and Guardians: In a will, you can appoint an executor who will manage and distribute your assets according to your wishes. For parents, designating a guardian for minor children is crucial. This pre-emptive decision avoids potential legal battles over guardianship should the parents pass away unexpectedly.

- Avoiding Intestacy Laws: Without a will, your estate is distributed according to state intestacy laws, which might not align with your personal wishes. A will ensures that the estate is handled as you desire, not as the state decides.

- Reducing Probate Challenges: While a will still goes through probate (the legal process of validating a will), having one typically makes the process smoother. A clear, legally valid will can expedite the probate process and reduce the likelihood of legal challenges.

- Minimizing Estate Taxes: A well-planned will can also help reduce the burden of estate taxes on the beneficiaries. Strategic asset distribution and the use of trusts can also be effective ways to minimize tax liabilities.

- Preventing Family Disputes: A will that clearly states your wishes can help prevent potential family disputes over asset distribution, especially in families with complex dynamics or significant assets.

You might consider naming alternate guardians in case your initial selections are unable to fulfill the role or are no longer alive when needed.

It is always advisable to consult with an experienced estate planning lawyer and estate tax professional to ensure your will is legally sound, enforceable and tailored to your specific circumstances and wishes.

Leaving a Lasting Legacy to Help Secure Your Child's Future

A will is not just a legal document but an expression of love and commitment to your children's well-being, ensuring that your legacy benefits them long after you're gone. It is an instrumental tool for several compelling reasons:

Asset Protection for Children

By specifying in your will how your assets should be distributed, you ensure that your children receive the inheritance you intend for them, including money, property, family heirlooms, and other valuable assets that contribute to their financial stability and future prosperity.

Appointment of Guardians

A will is crucial for appointing a guardian for parents with minor children. This decision helps ensure that, in the event of your untimely death, your children will be cared for by someone you trust, aligning with your values and parenting style. Thus, they will have stability and continuity in their upbringing.

Creating Trusts for Children

A will allows you to form trusts to manage children's inheritance until they are capable, ensuring assets are used for specific purposes and protected from potential misuse.

Educational & Life Opportunities

By allocating funds into a testamentary trust specifically for education or other life-enhancing opportunities, you can ensure that your children can access resources that contribute to their personal and professional development, even in your absence.

Ensuring Continuity & Security

Ultimately, a will provides continuity and security for your children. It assures them that their needs and future have been thoughtfully considered and cared for, which can deliver comfort and stability during a challenging time.

Conclusion

Creating a will is crucial for parents to protect their children's well-being and ensure their assets are distributed as intended. It provides legal clarity for the appointment of guardians for minors, mitigates potential legal disputes, and facilitates a smooth estate transition.

Creating a will is a powerful step towards a secure future for your loved ones. Don't leave their well-being to chance—take control by documenting your wishes.

A will lets new parents designate guardianship and plan their child's future. Start My Free Will1

Frequently Asked Questions

Why do parents write a will?

Why is it important to have a clearly drafted will?

Why do new parents need a will?

What happens to children if parents die without a will?

How do you choose a guardian for your child in a will?

When should new parents create their first will?

What should be included in a will for new parents?

How often should parents update their will?

Sources

- Free Will from Fabric by Gerber Life, a member of the Western & Southern Financial Group Family of Companies. https://www.westernsouthern.com/about/family-of-companies.