Key Takeaways

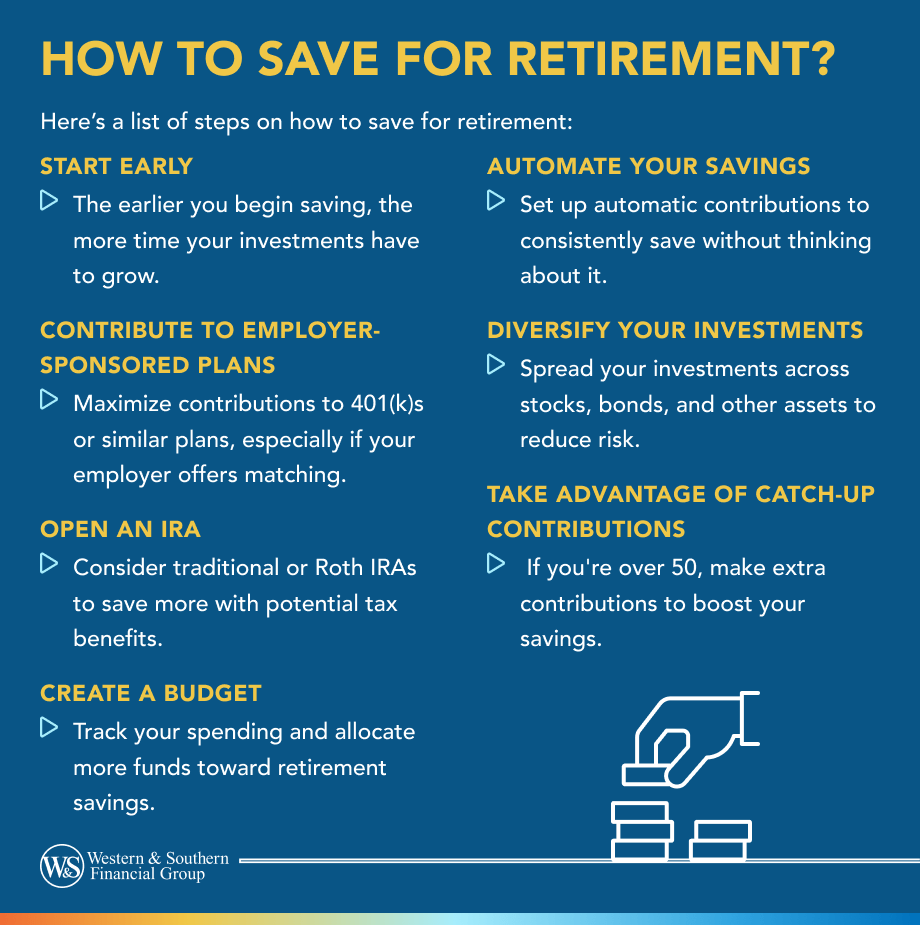

- Estimate how much income you'll need in retirement by calculating your fixed, flexible, and discretionary expenses to set a savings goal.

- Allocate 10-15% of your income towards retirement savings to stay on track.

- Explore options like a 401(k), traditional or Roth IRA, SEP IRA, or SIMPLE IRA, each with its own benefits and contribution limits.

- If you're 50 or older and behind on savings, utilize catch-up contributions to increase your IRA or 401(k) contributions in 2023.

- Save monthly, increase contributions with raises, control nonessential spending, and avoid lifestyle inflation as your income grows.

It pays early to start early with retirement planning.

You need up to 80% of your annual income today to retire comfortably1.

Here are five ways to help get your retirement plan off the ground.

Step 1: Determine How Much You Might Need to Retire Happily

It's time to crunch some numbers and review your expenses.

- Fixed expenses: Mortgage or rent, life and health insurance, utilities and other necessary expenses

- Flexible expenses: Groceries, clothing, transportation and more

- Discretionary expenses: Travel, gym memberships and other nonessentials

Let's say the total equals $3,000/month. You'll likely need a minimum of this amount in retirement income to cover these expenses.

Multiply your total retirement income for the year by the anticipated length of your retirement to come up with a savings goal.

Step 2: Make Saving a Priority

After you have a savings goal, determine how much you should put aside each month. A good rule of thumb is to set aside about 10-15% of your income for retirement.2

Step 3: Decide How You'll Prepare for Retirement

Here are some options:

- 401(k): Contribute a percentage of your income. Some employers even match a portion of your contributions.

- Traditional or Roth IRA: Put pre-tax or after-tax dollars into a retirement account.

- SEP IRA: Self-employed? Make tax-deductible contributions of up to 25% of your salary, which cannot exceed $69,000 for 2024.

- SIMPLE IRA: Make tax-deductible contributions of up to $16,000 for 2024.

Step 4: If You're 50 or Older, Consider Making Catch-Up Contributions

Behind on retirement savings? If you're 50 or older, making catch-up contributions can help you get closer to your goal.

For 2024, you can contribute an additional $1,000 to an IRA or an additional $7,500 to a 401(k).4

Step 5: Put in the Work

Continue to save every month.

- Landed a raise? Consider increasing your retirement contributions

- Spend less on nonessentials

- Avoid lifestyle inflation — earning more doesn't mean you should spend more

Start developing the road map to your retirement destination today.

Having a retirement plan in place helps support a fulfilling lifestyle when you stop working. Start Your Free Plan

Sources

- Retirement Topics - Benefits of Saving Now. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-benefits-of-saving-now.

- How much should I save?. https://money.cnn.com/retirement/guide/basics_basics.moneymag/index7.htm.

- 401(k) limit increases to $23,000 for 2024, IRA limit rises to $7,000. https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000.

- Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits.