Highlights

- The U.S. stock market posted the best back-to-back returns in a quarter century this past year, and the dollar’s appreciation was the largest in nearly a decade. They reflect better-than-expected U.S. economic performance throughout the year and continued enthusiasm toward stocks tied to artificial intelligence.

- Equity investors are optimistic that Donald Trump’s policies of tax cuts and deregulation will boost the economy’s long-term growth prospects. Bondholders, however, are unsure whether inflation will decline to the Federal Reserve’s (Fed) 2% target, and they are concerned about the prospect for outsized federal budget deficits.

- The principal risk for investors is that a wider U.S. current account deficit could give Trump added incentive to increase tariffs significantly. If a trade war breaks out, it would heighten uncertainty about the global economy and likely increase market volatility.

- Amid this, we are positioning investment portfolios with a modest overweight to risk. Valuations generally reflect continued growth and a limited margin of safety at current levels; however, there are still macroeconomic risks to the U.S. economic expansion.

A Strong Economy Generated Stellar Investment Returns in 2024

Several favorable economic developments this past year gave investors reason to celebrate. Most notably, the growth rate for the U.S. economy surpassed expectations at the start of the year, while inflation declined more than anticipated. 2024 also ended on an upbeat note for investors, who are optimistic about the economy’s prospects in the wake of Donald Trump’s decisive election victory.

The U.S. stock market set record highs for the S&P 500 Index and the Nasdaq 100 Index during 2024, with both indexes posting returns of 25% or more (see Figure 1). This marked the second consecutive year of outsized returns in which a select group of tech stocks led the way amid optimism about the prospects for artificial intelligence. Valuations for the S&P 500, as measured by Robert Shiller’s cyclically adjusted price earnings ratio, are now the highest since the internet boom in the second half of the 1990s.

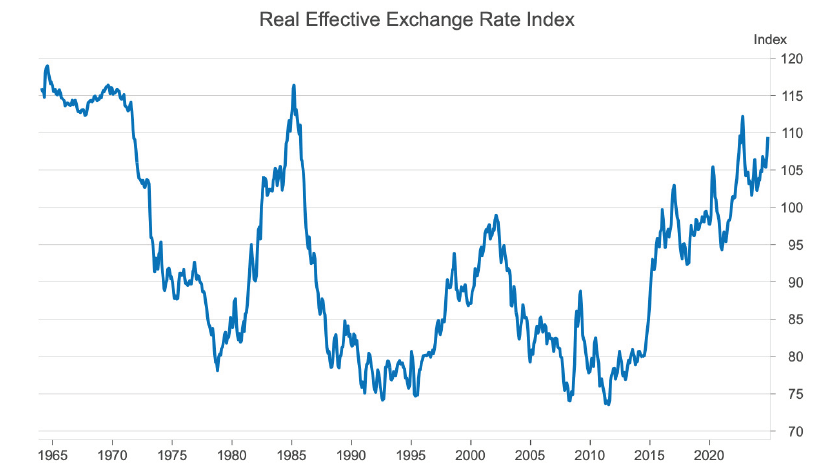

At the same time, the U.S. dollar posted its strongest gain in nearly a decade, rising by 7% on a trade-weighted basis. The real effective exchange rate for the dollar, which takes inflation-rate differentials into account, is now at the highest level since the mid-1980s (see Figure 2).

Figure 1. Investment Performance by Asset Class for 2024

Source: Bloomberg.

Source: Bloomberg.

Figure 2.The Real Trade-Weighted Dollar Is the Highest Since the Mid-1980s

Source: BIS.

Returns for bondholders, by comparison, were disappointing considering that the Fed lowered the Fed Funds rate by a full percentage point to 4.25%-4.50% in the last four months of the year. During that stretch, ten-year Treasury yields rose by nearly a full percentage point to close around its high for the year just below 4.6%. This mainly reflected expectations that the Fed would slow the pace of rate cuts this year and concerns that the federal budget deficit is too large.

The U.S. Economy Is Near Its Productive Potential

As Donald Trump assumes office, he inherits an economy that is firing on most cylinders. Real GDP expanded at an estimated 2.8% pace in 2024, surpassing expectations for a second consecutive year, and the unemployment rate ended the year at 4.2%. The pace of economic activity is likely to moderate in 2025 because the economy is operating close to its productive potential, but the risk of recession has diminished.

Manufacturing is the weakest sector, with the ISM purchasing manager diffusion index below the 50 threshold for the past two years. This indicates the majority of respondents expect activity to stay weak. While manufacturing now accounts for only 10% of the U.S. economy, it is important politically, and Trump’s stated goal is to revive it.

The decline in U.S. manufacturing dates back to the 1980s, when it represented about 23% of the economy. U.S. manufacturers faced stiff competition from their Japanese and European counterparts as the U.S. dollar soared to record highs, and the U.S. current account deficit reached a then-record 3% of GDP. U.S. multinationals began to outsource production abroad to stay competitive, and the pace of outsourcing intensified after China joined the WTO in 2001.

Over the last 15 years, however, the U.S. economy has become more productive than other industrial economies, and U.S. multinationals dominate the rankings of the world’s largest corporations. Corporate profits after tax have soared since the 2008 Global Financial Crisis (GFC), and profit margins are at all-time highs (see Figure 3).

The main factor that accounts for this outperformance is superior U.S. productivity growth linked to advances in technology. In the three months ended September 2024, U.S. output per hour work was up by nearly 9% from its pre-pandemic level, according to the Bureau of Labor Statistics. There has also been a substantial widening in the productivity gap between the U.S. and Europe since the 2008-2009 GFC.

Figure 3. Profit Margins Are at All-Time Highs

Source: BEA.

Two Policy Issues for Bondholders

This does not mean there is clear sailing ahead for the U.S. economy. The main policy issues for bondholders are whether inflation will reach the Fed’s 2% target and whether there will be progress in narrowing the federal budget deficit.

Of these, the encouraging news is on the inflation front, where both headline and core inflation that excludes volatile food and energy components have fallen substantially. The improvement is mainly due to a lessening of supply chain disruptions during the COVID-19 pandemic and Fed policy tightening in 2022-2023.

The reduction in inflation enabled the Fed to lower the funds rate by 100 basis points in the last three FOMC meetings. However, the Fed indicated at the December FOMC meeting that it would pause to gauge how the economy is performing. The bond market is now pricing in just one 25 basis point decline in the funds rate to about 4.0%-4.25% this year, which is one fewer cut than the expectations of Fed officials.

By comparison, there is less reason to be optimistic that the U.S. government will make substantial headway in lowering the federal budget deficit that stands at 6% of GDP. The goal of Scott Bessent, Trump’s designated Treasury Secretary, is to cut the deficit in half to 3% of GDP.

One obstacle is that Trump campaigned on extending key provisions of the Tax Cut and Jobs Act that are set to expire at the end of 2025, which the Congressional Budget Office estimates will increase deficits by $4.5 trillion over a ten-year period. Trump also campaigned on eliminating taxes on Social Security benefits and income from tips and increasing the refundable child care, although Congress may not approve them.

On the spending side, Trump has asked Elon Musk and Vivek Ramaswamy to run a government task force that would help cut spending by $2 trillion. To get there, however, would require cutting entitlement programs such as Social Security, Medicare, and Medicaid that account for 45% of total spending. Mandatory outlays and net interest payments account for nearly three quarters of total spending, while the discretionary component is just over one quarter of the total.

The Treasury yield curve could continue to steepen if inflation does not fall further and the budget deficit proves intractable.

Figure 4. The U.S. Current Account Deficit Could Widen Further

Source: BEA.

Positioning Investment Portfolios

Interest rates moved higher during the fourth quarter driving fixed income returns lower, although ending the year in positive territory. While this move in rates also gave equities a pause in the final months of 2024, returns for the year were exceptional at 25% for the S&P 500. As a result, expensive valuations are likely to limit upside while the market looks for new policy proposals to maintain growth forecasts.

In balanced portfolios, we favor a modest overweight to equities relative to fixed income. Despite our improved economic outlook, elevated asset prices result in a modest overweight risk posture within the strategy. Valuations generally reflect continued growth and a limited margin of safety at current levels; however, there are still macroeconomic risks to the U.S. economic expansion.

In fixed income, we are positioning portfolios with a modest overweight to credit risk. Credit spreads tightened over the quarter and currently represent historically tight levels, representing limited upside. However, the improved economic outlook should support tight spreads. Portfolios are increasing weighted toward liquid, higher quality issues while remaining focused on compelling bottom-up opportunities. Interest rates increased materially over the quarter and are toward the higher end of our expected range, representing attractive value.

Within equities, we are maintaining a cautious stance but are selectively finding bottom-up opportunities. Valuations appear stretched for the aggregate market following a 58% return for the S&P 500 since the beginning of 2023 while earnings growth has been more modest. Market breadth improved during the second half of 2024, but fundamentals will need to improve for smaller companies in order to sustain that momentum. We are prioritizing high barrier to entry businesses with high returns on capital and maintaining a moderately defensive posture within portfolios.

Download 4Q 2024 Commentary: Investing in the Trump 2.0 Era

Download 4Q 2024 Commentary: Investing in the Trump 2.0 Era