Highlights

- The Election: Polls were showing an extremely close Presidential race until mid-October. During the past month, investors began pricing in higher odds of Republican victories with implications for inflation, growth, and the deficit.

- Consumer Strength: Personal consumption continues to drive economic growth as consumer spending contributed 2.5% to Q3 GDP.

- Breadth: Market breadth has improved within equities, with value and small caps outperforming in Q3.

- Heightened Volatility: Fluctuations in interest rates have been particularly high this year as economic data has been noisy, which has impacted forecasts for monetary policy.

Table of Contents

Macro Insights

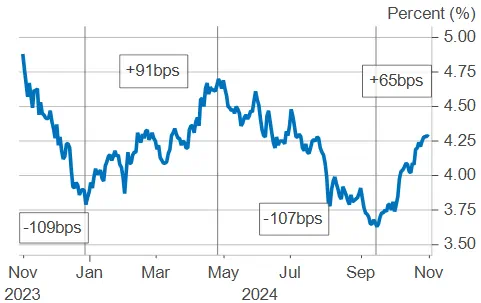

Rate Rise Stalls Stocks

In October, U.S. interest rates rose significantly (see nearby chart and this month's Spotlight on the following page for more detail), driven by a reduced likelihood of recession and growing odds of a Republican sweep in the upcoming election – the latter viewed as a scenario that could lead to higher deficits as well as higher inflation resulting from protectionist trade policies. Following five months of gains, U.S. stocks posted a small decline in October. While small-cap and cyclical stocks outperformed during the third quarter on the back of reduced inflation expectations and the Fed’s 50-basis-point rate cut, October saw balanced returns across style and size.

The recent rise in rates has mixed implications for stocks. On the one hand, it suggests stronger economic growth and potential increases in corporate profits. On the other, it introduces a higher discount rate for future cash flows, which historically correlates with lower valuations. We currently anticipate that the improved outlook for economic growth will remain the market’s primary focus, creating a reasonably supportive environment for risk assets such as equities.

Economic signals continue to support the prospect of a soft landing. Despite third quarter GDP coming in slightly below expectations, consumer expenditures showed notable strength, and labor market conditions have been more resilient than anticipated in recent months. The October jobs report showed a stable unemployment rate, although job creation was lower than expected.

As we enter November, attention turns to the U.S. Presidential election. The recent outperformance of "red stocks" (companies expected to benefit from Republican policies) over "blue stocks," along with betting market trends and recent poll momentum, suggests that Wall Street is increasingly pricing in a potential Republican win. However, polling reliability has been inconsistent in recent years, and most results remain within the margin of error, adding to the uncertainty. Observers largely expect the Senate to flip to Republican control regardless of the Presidential outcome, which would likely limit the risk of tax policy changes significantly impacting corporate profits (beyond the expiration of parts of the 2018 tax cuts next year).

While macroeconomic factors continue to shape the broader market, we anticipate that investors will increasingly turn their attention to corporate profits and company-specific fundamentals. Although elevated valuations may limit absolute gains in equities, many areas of the market, such as value and small-cap, appear more reasonably priced.

Rates Reset Higher

Treasury yield curve with Month over Month change.

Yield Curve (MoM Change)

Source: Fort Washington, US Treasury, and Macrobond.

What to Watch

Labor market data will continue to be a focus over the month ahead as investors assess the strength of U.S. consumers. In addition, markets will be impacted by the U.S. election outcome and FOMC decision.

- The next FOMC meeting is on November 7. Markets currently expect a 25-basis point cut and will be listening for any indicators of future rate cut expectations.

- Inflation figures will be dissected with CPI on November 13 and PCE released on November 27, with the focus on shelter.

- We will be keeping an eye on U.S. consumer spending, which has been driving U.S. economic growth; retail sales (11/15) and consumer confidence (11/8 & 11/26).

Monthly Spotlight

Interest Rate Volatility

Active investors are no strangers to market volatility, but the market’s expectations for interest rate volatility have experienced a sustained move higher since the Federal Reserve began raising rates. As shown below by the MOVE Index, this consistent level of expected volatility hasn’t been seen in over a decade. The volatility of the past few weeks has been especially notable, particularly since it comes on the heels of a 50bp cut by the Fed.

Investors might have expected an initial 50 basis point cut by the Federal Reserve to lead to a rally in Treasury yields. The Fed signaled that they intended to head off further softening in the labor market, thus justifying a larger initial rate move and guidance that more rate cuts were on the horizon. In contrast to expectations for a continued rate rally, Treasury yields have risen sharply since the Fed meeting, with the 10-year Treasury yield rising over 60 basis points.

Several factors have contributed to this move higher in yields. A stronger-than-expected September employment report, released just two weeks after the 50-basis point cut, demonstrated that the labor market remains robust and may not need as much support from the Fed as previously thought. This upside surprise is positive for the overall economy, but it swiftly caused investors to expect fewer Fed rate cuts. Since mid-September, expectations for the fed funds terminal rate (in mid-2026) have jumped from about 2.8% to 3.5%.

While economic data has clearly contributed to volatility, the upcoming U.S. election has also been a factor. The two Presidential candidates offer vastly different agendas with implications for economic growth and inflation. Over the past few weeks, markets have begun pricing in a Trump victory with potential effects of tariffs, tax cuts, and a worsening fiscal outlook. As a result, interest rates have risen further amid the impact of these policies.

Despite the recent momentum toward higher rates, we do not expect interest rates to rise materially from current levels. With upcoming employment reports impacted by hurricanes and strikes, it may be difficult to garner much insight into the true state of the labor market for a few more months. However, we expect the larger trends in economic data to support bonds into 2025. Additionally, with markets already pricing in a higher probability of Republican victories in the upcoming election, market reaction likely won’t be significant if this is correct but could see a sharp reversal were Democrats to have a strong showing.

Interest Rate Volatility (MOVE Index) |

10-Year Treasury Yield |

Source: Fort Washington, BofA, Bloomberg, and Macrobond. |

|

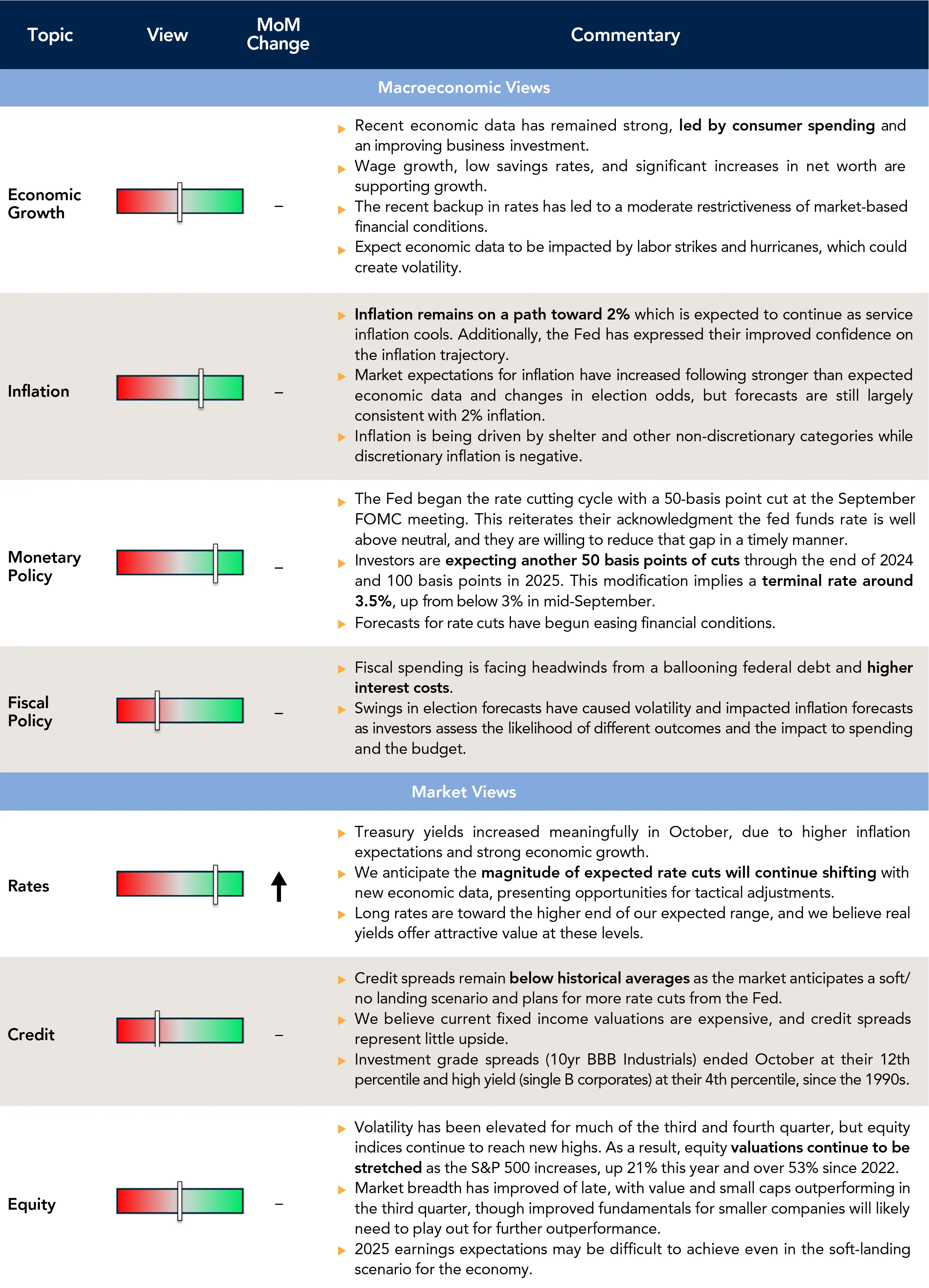

Current Outlook

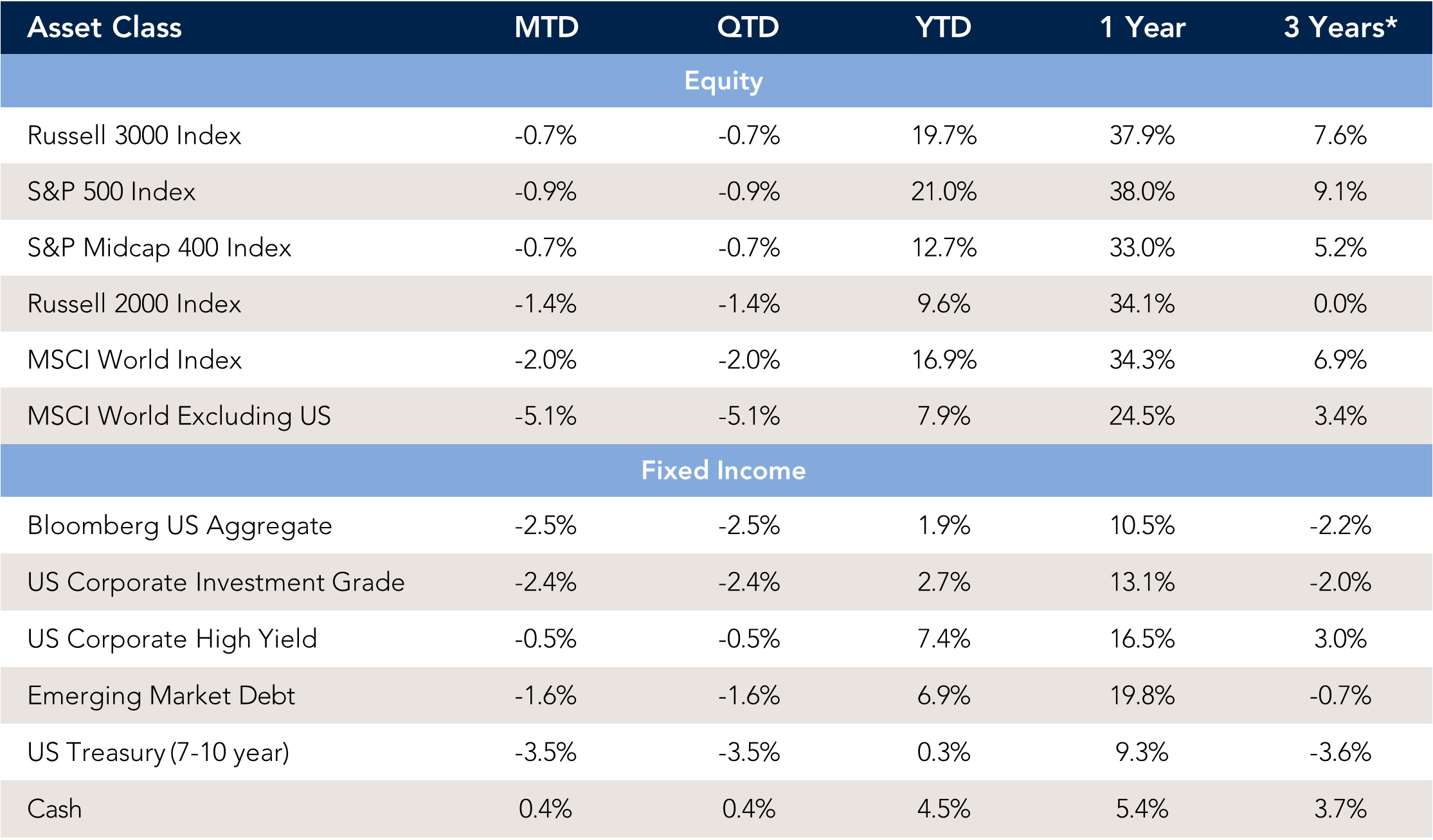

Market Data & Performance

As of 10/31/2024

Source: Fort Washington and Bloomberg. *The 3-year returns are annualized. Past performance is not indicative of future results.

Download Monthly Market Pulse – November 2024

Download Monthly Market Pulse – November 2024