Table of Contents

Table of Contents

Key Takeaways

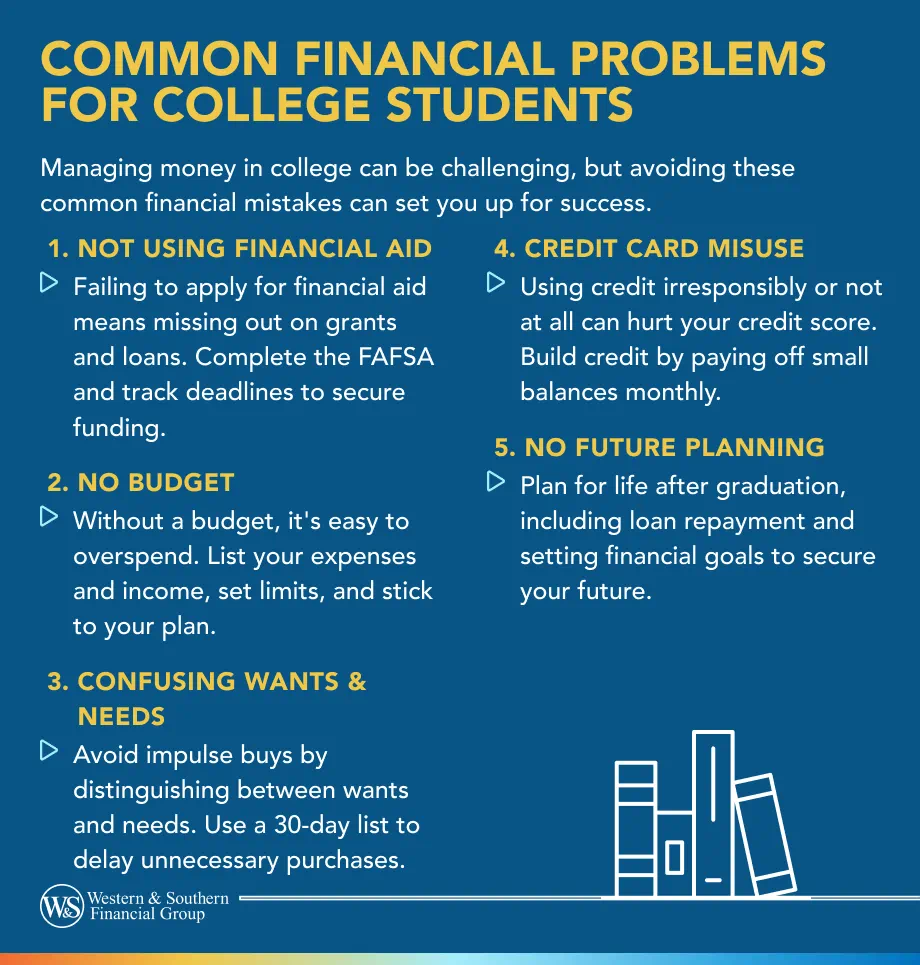

- Apply for financial aid by filing FAFSA and seeking scholarships to get help paying for college.

- Create a budget to track income and expenses and avoid overspending.

- Differentiate between wants and needs when making purchasing decisions.

- Use credit cards responsibly to build good credit history.

- Make plans for paying off student loans and achieving future financial goals after graduation.

College can be an exciting place for self-discovery and growth, but it's also where some young adults develop poor money management habits. If not addressed, these bad habits can often stick with students long after they've left school.

Learn about some of the most common financial problems for college students and find out how you could manage your money wisely.

1. Not Taking Advantage of Financial Aid

By not applying for financial aid, which comes in the form of grants, federal loans and work-study programs, you may be missing out. Take time to fill out a Free Application for Federal Student Aid (FAFSA), which could help you get additional funding for your college expenses.1

Keep track of the deadlines for filing this application and begin your hunt for scholarships well in advance. A checklist of the documents you need to apply for financial aid, such as federal income tax returns and bank statements, could help you stay on track. While it may feel overwhelming, getting your documents in good order could help prevent any snags.

2. Not Creating a Basic Budget

One of the most common financial problems for college students is not having a budget. Without a budget, you may have a hard time keeping your money in good order. Start with a basic budget by listing your expenses — such as tuition, books, room and board, food, school supplies, computer equipment, clothing and entertainment — and income. Don't forget to include one-time expenses, which can consist of things like travel costs for spring break and the holidays and bedding for your dorm room.

Set limits to how much you will spend on specific categories, such as dining out or entertainment, which could help you develop financial self-control. If it's your first time creating a budget, ask your parents or an older sibling who has gone through the ropes to assist you. Also, if you receive financial aid and get a refund check, which can happen if there's more money than what's needed to cover your student account balance, develop a plan for how you'll spend that money. Remember: If it's coming from student loans, it's money you'll need to pay back eventually.

3. Not Knowing the Difference Between Wants & Needs

Are you often flooded with slews of images for alluring products with convenient "buy now" buttons? In the digital age, many people are more inclined to buy stuff they don't need.

But before you give in to the impulse to buy something, take a step back and ask yourself:

- Will this product make my life easier?

- How will this product add value to my life?

- How many times will I actually use this product?

Of course, you will occasionally buy a "want," but making a 30-day list could help you curb your spending. Make a list of non-essential items that you want, and if you still have that nagging desire for something after 30 days, consider making the purchase. Then, look into ways you can get a deal, such as using an online coupon or purchasing the item during a sale.

4. Credit Card Misuse — or Disuse

Your college years are a great time to start building credit. As you may know, having a stellar credit history — and, in turn, an excellent credit score — could help you save money as a consumer. Without good credit, you may not qualify for the best rates and terms on a future car loan, mortgage or personal loan.

To build solid credit, consider being added as an authorized user to one of your parents' credit cards. You'll want to discuss it with them beforehand, including your credit limits and how you'll handle payment. Of course, you'll want to use the card responsibly. Another option is a secured credit card. These work like a hybrid credit-debit card. You'll be required to put down a cash deposit up front, and you can only spend up to the amount you've deposited — so if you deposited $500, your credit limit would also be $500.

Not using your credit card responsibly can really put you in a debt grave — and hurt your credit score. If you do decide to sign up for a credit card, it could be beneficial to avoid using it for unnecessary expenses. That means weekend road trips or spring break vacations you can't afford — or splurging on clothing, fancy gadgets or a music festival. While the fear of missing out can certainly give you the urge to put things on credit, resist the temptation. Stick to your budget instead. Your financial well-being depends on it.

To avoid treating your credit card like it's free money, consider starting with a low balance and committing to only using the credit card for specific purchases and paying off the balance in full each month. If you aren't able to pay it in full each month, devise a game plan to crush that credit card debt in a set amount of time.

5. Not Planning for the Future

You'll spend most of your time in college studying for exams, doing coursework, sitting through lectures — and making the most of what college has to offer. College life is so busy, so it may seem like a tall order to drum up a plan for the future. But it could help to ensure you have a parachute before you jump into the "real world."

Think about coming up with a game plan for paying off any student debt and taking steps to transition as smoothly as possible from graduation to your first job. You may even consider significant life goals, such as buying your first home, getting married, starting a family and retirement. While you don't need to have all the answers now, it may help to start with a road map.

Consider taking steps now to avoid some of the most common financial problems. Making these mistakes could cost you dearly in the long run, but an ounce of prevention is worth a pound of cure. Will that ring true for you?

Plan your college budget and contribute to a 529 plan for future school expenses. Invest Today

Sources

- Complete the FAFSA® Form. https://studentaid.gov/h/apply-for-aid/fafsa.