Key Takeaways

- Term life insurance offers simple, affordable protection for a set number of years, usually 10, 20, or 30.

- Permanent life insurance lasts a lifetime (if premiums are paid when due) and includes cash value accumulation may take years and is dependent on premium payments and policy type.

- Term policies are better for short-term needs like income replacement or mortgage coverage.

- Permanent policies are better suited for long-term needs like estate planning, wealth transfer or business continuation.

- Choosing the right policy depends on your age, budget, and whether you need temporary or lifelong coverage.

What Is Term Life Insurance?

Term life insurance is commonly chosen for its simplicity and affordability, which makes it ideal for covering family protection during working years or when paying off debt.

Definition and Key Features

Term life insurance covers a specific period. If the insured person dies within this timeframe, the insurance company pays the death benefit to the designated beneficiary. It does not build cash value and is solely for protection, offering a cost-effective way to obtain higher amounts of coverage.

- Typical Coverage Lengths: Term life policies last 10, 20, or 30 years, fitting various needs like short obligations, mortgages, or long-term protection, and expire at term end unless renewed or converted by the insurer.

- Cost and Affordability: Term policies are generally cheaper than permanent life insurance, notably for younger people. Premiums are based on factors like age, health, term length, and coverage, with no cash value involved.

- When Term Life Might Make Sense: Term insurance is suitable for those with specific debts, children, or budget limits.

In summary, term life insurance is best suited for those seeking straightforward, affordable protection over a defined period.

What Is Permanent Life Insurance?

Permanent life insurance policies cover you for life with ongoing premiums and includes additional long-term financial benefits, not just a death benefit.

Definition and Key Features

Permanent life insurance, sometimes called whole life, offers lifelong coverage and builds cash value from premiums. Features include enduring coverage, cash, and consistent payments. Due to its long-term benefits, it's more expensive and complex than term insurance.

- Coverage That Lasts a Lifetime: Permanent insurance provides lifelong coverage, ideal for those with dependents, estate planning needs, long-term obligations, business continuation needs or charitable giving goals. Death benefits are paid out as long as premiums are paid when due.

- Types of Permanent Life Insurance: Permanent life insurance includes several options: Whole Life has stable premiums and guaranteed cash value; Universal Life offers flexible premiums with cash value growth tied to market performance; Variable Universal Life invests your cash value in mutual funds for potential growth. Each type offers unique flexibility, cost, and investment strategies.

- When Permanent Life Might Be a Better Fit: Permanent policies are often used for estate planning and wealth transfer, covering long-term care or final expenses, supporting dependents with special needs, and offering tax-advantaged solutions for high-net-worth individuals.

In closing, permanent insurance provides more than just protection; it's a long-term financial tool that aligns with broader economic goals.

Pros & Cons of Term Life Insurance Policies

Term life insurance is one of the most common types of life insurance. It offers several advantages for people seeking straightforward, affordable coverage, but it also has limitations. Let's take a closer look.

Advantages

- Affordability: Term policies are ideal for tight budgets, and they usually offer level premiums for the duration of the coverage period.

- Simplicity: Easy to understand, manage, and compare with other policies.

- High coverage amounts: Can provide a significant death benefit at a relatively low cost.

- Flexible term lengths: Choose a coverage period (e.g., 10, 20, or 30 years) that aligns with specific financial obligations, such as a mortgage or raising children.

Drawbacks

- No cash value component: The only value term policies offer is their death benefit.

- Temporary coverage: Protection ends after the chosen term unless renewed.

- Premium payments increase if you renew later in life.

- Limited long-term planning benefits: Generally not suitable for estate planning or lifetime death benefit needs.

Ultimately, the pros of term insurance lie in its cost-effectiveness and simplicity, but it may not be the best choice for long-term financial goals.

Pros & Cons of Permanent Life Insurance

Permanent life insurance, including whole life, universal life insurance, and variable universal life insurance policies, can be powerful financial tools that provide lifelong coverage and additional economic benefits.

Advantages

- Lifelong protection: Guarantees a lifetime death benefit as long as premium payments are made.

- Cash value growth: These policies build a cash value component that accumulates tax-deferred over time.

- Policy loans: Access the cash value through tax-advantaged loans (when appropriately structured). Note: Unrepaid loans will reduce the death benefit and may eventually cause the policy to lapse.

- Estate planning benefits: Help manage wealth transfer and cover estate taxes.

Drawbacks

- Higher premiums: Generally more expensive than term coverage, especially early on.

- Complexity: Includes features like investment vehicles in variable life insurance policies, which may require professional guidance.

- Slower early cash growth: The minimum rate of cash value accumulation is often modest in the initial years.

- Potential surrender charges: Fees may apply if the policy is canceled early.

In summary, permanent life insurance policies offer comprehensive, long-term coverage but demand a larger financial commitment and management over time.

Key Differences Between Term & Permanent Life Insurance

Choosing between these types of policies (term and permanent life insurance) involves understanding how each fits your financial situation, life stage, and goals.

Duration of Coverage

- Term Life Insurance: Fixed coverage period, typically 10–30 years.

- Permanent Life Insurance: Covers your entire life as long as premiums are paid.

Cost Over Time

- Term Life: Start with lower premiums, but can rise significantly upon renewal.

- Permanent Life: Have higher initial premium payments, but may remain level and the policy builds value.

Policy Flexibility and Customization

- Term Life: Straightforward coverage with optional riders like accelerated benefits. Payment of Accelerated Death Benefits, if not repaid, will reduce the Death Benefit and may affect other policy values.

- Permanent Life: Long-term coverage with similar riders; some types allow flexible premiums and benefits.

Access to Cash Value

- Term Life: No cash value or savings component.

- Permanent Life: Offers a cash value account that can be used for retirement planning or emergencies.

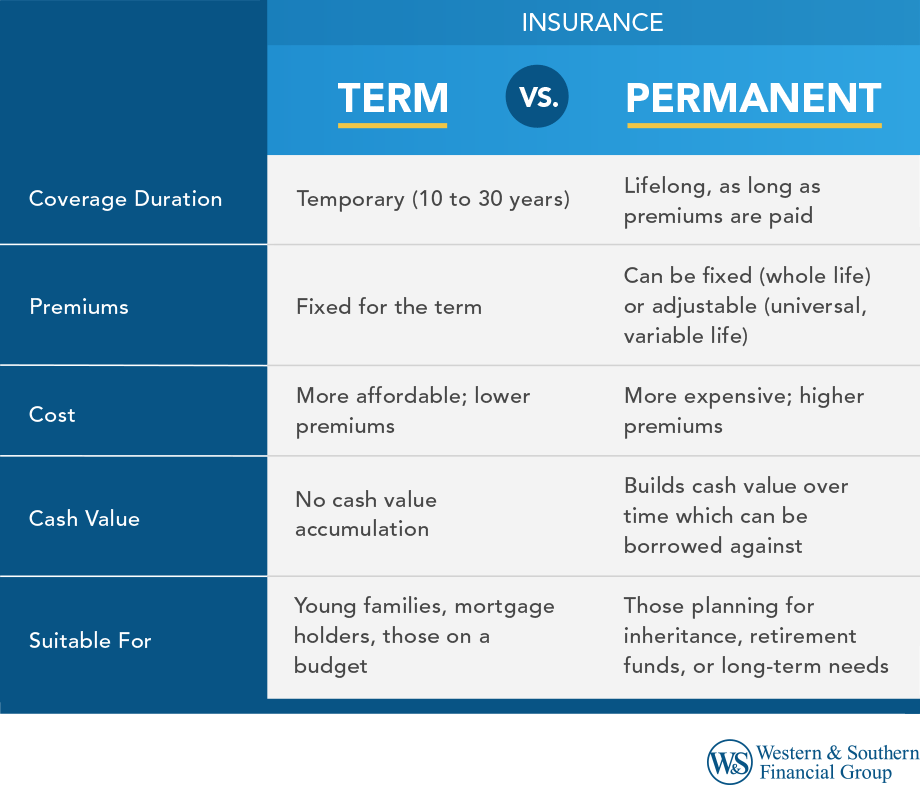

Here's a side-by-side comparison:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Coverage Duration | Fixed (10–30 years) | Entire life |

| Cost | Lower initial premiums | Higher premiums with cash value |

| Cash Value | Not included | Included, potentially builds over time |

| Flexibility | Limited | High (especially in universal policies) |

| Use Case | Short-term obligations such as Income replacement, debt coverage | Long-term goals like estate planning and lifelong needs |

How to Choose Between Term and Permanent Life Insurance

The right policy depends on your financial needs, budget, age, and how life insurance fits into your broader financial strategy.

Assessing Your Budget and Financial Goals

- Choose the term if:

- You want higher coverage for a specific period (e.g., while raising children).

- You're on a tight budget and need low-cost life insurance.

- You want a simple way to protect your income or cover debts like a mortgage.

- Choose permanent if:

- You want to build cash value.

- You need lifetime death benefit coverage.

- You're planning for legacy goals, charitable giving, business needs or estate taxes.

Life Stage Considerations

- Young adults: Term policies often make the most sense due to affordability.

- Mid-career professionals: A mix of term and permanent policies can offer balance.

- Retirees: Permanent insurance can help cover final expenses or transfer wealth, however with age comes generally higher costs, making term more affordable.

Long-Term Needs vs. Short-Term Obligations

Ask yourself:

- Do I only need coverage during my working years?

- Am I looking to leave a tax-free inheritance?

- Do I own a business with key employees, or that needs to support a buy-sell agreement?

Choosing between term and permanent options involves evaluating your time horizon, premium affordability, and insurance's role in your financial strategy.

Final Thoughts on Choosing the Right Life Insurance

Choosing between term and permanent life insurance depends on your goals, timeline, and budget. Term insurance is excellent for young families or short-term needs; permanent insurance fits those seeking lifelong coverage, legacy opportunities, or cash value. Understanding your needs is crucial for an informed decision. Contact a financial representative for guidance.

Explore your life insurance options today for your family’s future! Get a Free Life Insurance Quote

Frequently Asked Questions

Which is better, permanent life insurance or term life insurance?

It depends on your goals. Term life insurance can offer a higher death benefit at a low rate, making it ideal for temporary needs like income replacement. Permanent life insurance provides lifetime coverage, builds cash value, and offers access to funds, making it better suited for long-term financial strategy, business needs, wealth transfer and retirement goals.

Is it worth converting a term to permanent life insurance?

Converting a term policy to permanent life insurance can be worth it if you want lifelong coverage, a guaranteed death benefit, or the ability to build funds over a period of time. It may be a smart move for people whose financial needs have changed, especially if you want to lock in a rate without undergoing a medical exam.