Key Takeaways

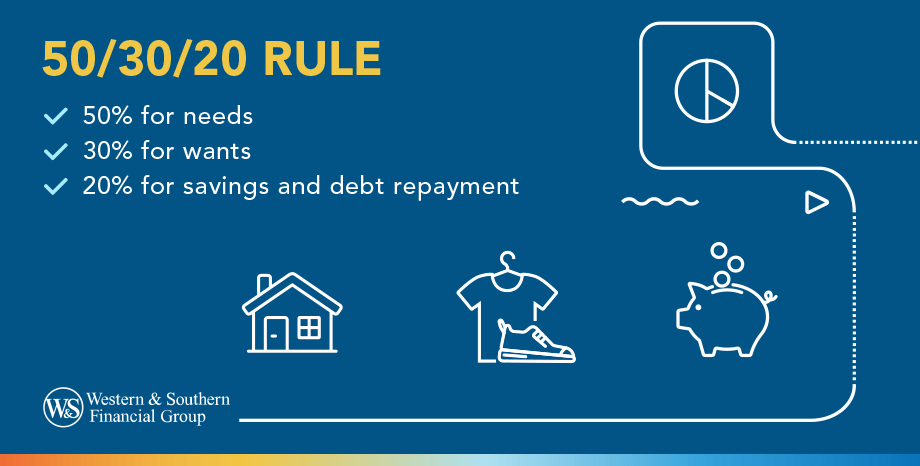

- The 50-30-20 rule divides after-tax income into 50% for needs,30% for wants, and 20% for savings and debt.

- This method encourages financial stability by covering important expenses, growing savings, and balancing discretionary spending.

- Its flexibility allows adjustments based on personal financial goals.

- Automation can simplify budgeting through direct deposits into separate accounts.

- However, this rule may not suit everyone, especially in high-cost areas or for those with irregular incomes, but other budgeting methods may work better.

What Is the 50-30-20 Rule?

The 50-30-20 rule is a simple and widely used budgeting method that helps individuals allocate their household income into three key expense categories:

- 50% for needs (important expenses)

- 30% for wants (discretionary spending)

- 20% for savings and debt repayment

The 50-30-20 budget aids financial planning by offering a structured way to manage monthly. It clarifies budgeting with set percentage allocations, helping identify necessary adjustments. This rule supports building an emergency fund, paying off debt (i.e. student loan debt), or investing, promoting balanced financial stability.

This budget is also flexible and can adapt to individual circumstances. While the traditional split is 50-30-20, some may adjust these percentages to suit their goals, such as raising savings to 30% and lowering discretionary spending to 20%. The key is to maintain a sustainable balance for financial growth without straining daily expenses.

How the 50-30-20 Rule Works

Understanding how the 50-30-20 rule applies to your finances is key to making it work effectively. By breaking your monthly income into structured categories, you can help ensure that your spending aligns with your financial goals.

Breaking Down the Budget

Under this budget rule, your after-tax income is divided into three categories:

- 50% for Needs – Important important expenses such as:

- Rent or mortgage payments

- Utilities (electricity, water, internet)

- Groceries

- Insurance (health, auto, home)

- Transportation (car payments, fuel, public transit)

- Minimum debt repayment (credit cards, student loans, personal loans)

- 30% for Wants – Non-important spending, including:

- Dining out

- Entertainment and subscriptions to streaming services

- Gym memberships

- Travel

- Hobbies and recreational activities

- Designer clothing and luxury items

- 20% for Savings and Debt Repayment – Allocated toward:

- Emergency fund contributions

- Savings accounts for short- and long-term financial goals

- Retirement contributions (401(k), IRA)

- Additional debt repayment beyond the minimum

- Investments

Tip

Set up direct deposit to automatically split your paycheck into accounts for needs, wants, and savings. This promotes consistency and reduces overspending temptation.

Real-Life Examples of the 50-30-20 Rule

Example 1: If your household income after taxes is $5,000 per month, your budget would be:

- $2,500 for needs

- $1,500 for wants

- $1,000 for savings and income to savings contributions

This structure helps maintain financial balance while helping ensure future security.

Example 2: If your household income after taxes is $3,000 per month, a 50-30-20 budget might look like this:

- $1,500 for needs

- $900 for wants

- $600 for savings and debt repayment

This breakdown allows you to stay financially disciplined while still having room for discretionary spending and future planning. Setting up a monthly budget with automated transfers can further streamline the process and prevent financial mismanagement.

Pros & Cons of the 50-30-20 Rule

Like any budgeting system, the 50-30-20 rule has its strengths and weaknesses. Understanding these can help you determine if it aligns with your financial situation and goals.

Below are some key advantages and limitations to consider.

Advantages

- Easy to Follow – A simple budgeting method that requires minimal tracking.

- Encourages Balanced Spending – Prevents overspending on wants while helping ensure savings.

- Flexible and Scalable – Works for different income levels by adjusting percentages.

- Helps Prioritize Savings – Helps ensure that at least 20% of monthly income is directed toward future financial security.

- Supports Debt Reduction – Allocating funds for debt repayment helps reduce financial stress and interest costs over time.

- Automates Financial Management – Using direct deposit to allocate funds directly into different accounts helps enforce financial discipline.

Limitations

- May Not Suit High-Cost Areas – In cities with expensive housing, 50% for needs may not be realistic.

- Doesn’t Fit All Financial Goals – People who save for retirement contributions or pay off debt faster may prefer a different ratio.

- Lacks Detail for Some – Unlike zero-based budgeting, it doesn’t track every dollar.

- Not Ideal for Variable Incomes – Freelancers or gig workers with fluctuating earnings may struggle with strict percentage allocations.

- May Overestimate or Underestimate Needs vs. Wants – Some expenses, like healthcare or childcare, may not neatly fit into a single category, requiring adjustments.

How to Implement the 50-30-20 Rule

Implementing the 50-30-20 rule requires a strategic approach to managing your finances effectively. Following these steps, you can create a structured budget that helps ensure stability while accommodating your financial goals.

Step 1: Calculate Your After-Tax Income

Start with your monthly income after deductions.

- If you receive a paycheck with taxes withheld, use the net amount.

- If you’re self-employed, subtract estimated taxes.

Consider additional income sources like bonuses, freelance work, or rental income to help ensure an accurate calculation of your available funds.

Step 2: Categorize Your Expenses

Track your spending habits to determine how much goes toward needs, wants, and savings. Reviewing past monthly expenses can provide insights into where your money is going. Categorizing each expense accurately helps maintain a realistic budget and identify areas for improvement.

Step 3: Adjust Spending to Fit the Rule

- If needs exceed 50%, look for ways to reduce fixed costs by refinancing loans, negotiating bills, or cutting unnecessary subscriptions.

- If savings fall short of 20%, automate direct deposits into your savings accounts or retirement funds to prioritize financial security.

Adjust discretionary spending, such as dining out or impulse purchases, to stay within the recommended limits.

Step 4: Automate Savings and Debt Payments

Set up automatic transfers to retirement contributions, emergency funds, and savings accounts to help help ensure consistency. Many banks allow you to allocate direct deposit payments into multiple accounts, making it easier to stick to your budget without manually managing transfers each month.

Automation also helps reduce the temptation to overspend and keeps your financial goals on track. Download a budget app to help you keep track of your spending.

Alternatives to the 50-30-20 Rule

While the 50-30-20 rule is a popular budgeting framework, it may not suit everyone’s financial situation. Exploring alternative budgeting strategies can help individuals find a method that aligns better with their income, spending habits, and financial goals.

- The 80/20 Rule – Prioritizes income to savings, with 80% for spending and 20% for saving/investing.

- Zero-Based Budgeting – Every dollar is assigned a specific purpose, helping ensure precise control.

- Envelope System – Uses cash-based budgeting for different expense categories to prevent overspending.

- Reverse Budgeting – Focuses on prioritizing savings first, setting aside a predetermined amount before allocating funds to needs and wants.

- The 60/20/20 Budget – Allocates 60% to necessities, 20% to savings and debt repayment, and % to discretionary spending; helpful for those in high-cost areas where 50% for needs may be unrealistic.

- The 70/20/10 Rule – This wealth-building method allocates 70% for living expenses, 20% for savings/investments, and 10% for charity or debt repayment.

- The 40/40/20 Rule - Another budgeting strategy that allocates 40% of income to needs, 40% to wants, and 20% to savings and debt repayment.

Each of these budgeting systems provides different levels of structure and flexibility, allowing individuals to choose the approach that best fits their financial situation and long-term goals. Consult with a financial advisor to discover the best budgeting plan for you.

Is the 50-30-20 Rule Right for You?

This budgeting method suits those seeking a structured yet flexible money management approach. It offers clear spending guidelines while allowing for adjustments based on financial goals. However, individuals with high debt may need aggressive repayment plans like the debt snowball or avalanche methods.

Freelancers or gig workers may prefer a variable percentage-based budget. Those focused on long-term savings and early retirement might benefit from a savings-first approach like reverse budgeting. Assessing personal circumstances and financial priorities helps identify the best budgeting system for stability and growth.

Final Thoughts

The 50-30-20 budget is a simple way to manage household income, balance spending, and prioritize savings. Whether you’re just starting or refining your financial habits, this budget rule can help create a solid foundation for long-term financial stability.

By utilizing savings accounts, controlling monthly expenses, setting up a monthly budget, and making consistent retirement contributions, individuals can achieve financial security and flexibility over time.

Calculate your budget with the 50/30/20 rule. Get My Free Financial Review

.jpg?rev=b30888445a984cb9af391aebc08860da&la=en&h=130&w=270&hash=811D9A81F81B2D381CDBDE831D4D12BA)