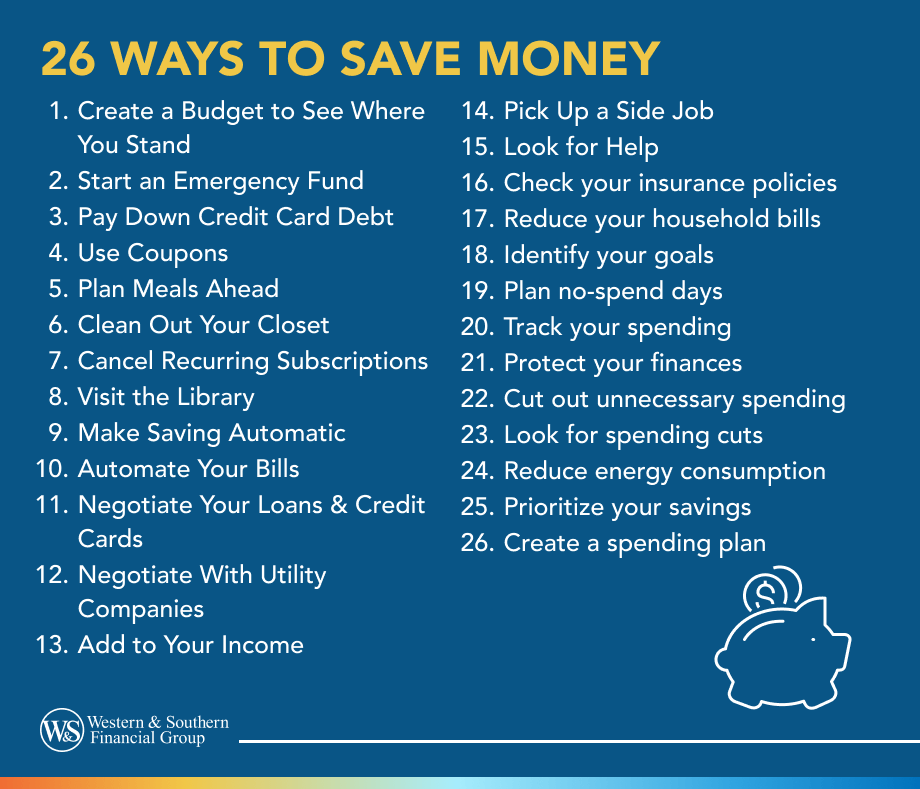

Key Takeaways

- Start by creating a budget to see where your money goes and where you can cut back.

- Build an emergency fund to avoid dipping into your savings when unexpected expenses arise.

- Reduce debt and monthly bills by automating payments, negotiating rates, and canceling unused subscriptions.

- Make small changes like meal planning, using coupons, and having no-spend days to lower everyday costs.

- Treat savings like regular expenses by automating transfers and using extra income or tax refunds to grow them faster.

It can be challenging to start saving money if your monthly income is less than your monthly expenses.

If you're wondering how to save money, the key is having a plan and following through. These strategies can help you get on the path toward saving more.

Understand Your Financial Situation

1. Create a Budget to See Where You Stand

It's hard to know where you stand financially if you don't see what you're making and spending each month. Creating a budget offers a complete view of your finances, helping you cut costs and increase savings. Consider the envelope budget: a cash-based system that allocates money to spending categories using physical envelopes.

Tip

Use a budget spreadsheet or free app to prioritize expenses. List housing, utilities, food (consider a dining budget), and debt first.

2. Track Your Spending

Expense tracking helps control finances by revealing spending patterns in bank statements. Use spreadsheets or apps to categorize and identify areas to reduce costs. Monitoring daily expenses like utilities and entertainment ensures living within your means, aiding quicker achievement of financial goals.

Tip

Review your spending weekly to spot trends early and adjust your budget before it goes off track.

3. Identify Your Goals

Clear financial goals simplify saving. Aim for a vacation, home, or debt repayment, focusing on long- and short-term goals. Write them down into steps. Use budget apps to track progress and prioritize spending, cutting unnecessary costs.

Tip

Break big goals into smaller milestones so you can track progress and stay motivated along the way.

Cut Everyday Expenses

4. Plan No-Spend Days

Try scheduling no-spend days to save money by avoiding unnecessary purchases. Cook at home, enjoy activities, and use items you already have. Skipping small expenses, like dining out or coffee runs, can significantly impact your finances. Gradually increase no-spend days to build better habits, and keep a shopping list for your next shopping trip.

Tip

Track your no-spend days in a journal to stay motivated by noting skipped expenses and savings.

5. Use Coupons

Clipping coupons may seem outdated and unrealistic, but now convenient digital options exist. Take advantage of digital coupons from your grocery store that apply your savings when you check out or a browser plug-in that automatically discounts your online shopping order.

Tip

Set a weekly reminder to check your favorite store apps or coupon sites before your next grocery shopping visit.

6. Plan Meals Ahead

The average American household spends an average of $6,053 on food per year, which includes $3,933 on dining out.1 You might be less tempted to visit the drive-through when you have ingredients and recipes. You could use your free time on the weekends to devise dinner ideas for the week and then make a complete grocery budget.

Tip

Build your meal plan around weekly grocery store sales to help stretch your budget even further.

7. Clean Out Your Closet

Decluttering will not only help you feel more organized but can also boost your income. By having a yard sale or selling clothes or other non-essential items online, you may find that your trash is someone else's treasure.

Tip

Donate unsold items for potential tax deductions.

8. Visit the Library

Libraries aren't just for books. Many local libraries offer free special events and classes, discounted museum admission, and personal development workshops. If you have kids, the library can be a great source of free entertainment.

Tip

Regularly check your library's site for unknown free events and resources.

9. Cut Out Unnecessary Spending

Spending on unnecessary items is tempting, but it accumulates quickly. Unsubscribe from marketing emails to avoid impulse buys. Opt for store brands over premium ones and reduce convenience purchases, such as paper towels and toilet paper.

Tip

Wait 24 hours before buying non-essentials to assess their value.

10. Look for Spending Cuts

To save money, analyze your spending. Review bills to find cuts, like a cheaper phone plan, pooling, or restaurant spending. Small changes, such as canceling an unused gym membership or opting for free entertainment, accumulate. Mindful spending helps you save without deprivation.

Tip

Conduct a monthly financial review to identify opportunities for more cost-effective spending limits.

11. Reduce Energy Consumption

Cut utility costs by adopting easy habits: turn off lights, unplug devices, use energy-efficient appliances, adjust thermostats, and wash with cold water. Seal windows and fix leaks to prevent energy waste.

Tip

Try a smart power strip or programmable thermostat to help reduce energy use automatically.

Simplify & Automate

12. Make Saving Automatic

Automatic savings plans help you save on a tight budget. If offered, set up recurring deposits from a checking account or via direct deposit. Also, consider starting a retirement plan to build funds for retirement. This account is separate from an emergency fund and is crucial for your future.

Tip

Start with just $10 a week; it adds up and builds a savings habit.

13. Automate Your Bills

The next step is to look at automating your monthly bills. Most companies let you automate payments for cell phone plans, auto loans, credit cards, and student loans. This will help simplify your finances so you stay on track, ensure your bills are paid on time, and avoid late fees.

Tip

Enable bill alerts and automation to track and avoid surprises before debits occur.

14. Cancel Recurring Subscriptions

Subscription services, meal delivery services, beauty boxes, entertainment streaming services, or wine clubs can throw off your monthly budget. A monthly cost of $10 or $20 can increase over time.

Tip

Carefully review your subscriptions and cancel anything you don't use.

Manage & Reduce Debt

15. Pay Down Credit Card Debt

Paying the minimum on your credit card might be easier to maintain in the short term, especially when you're short on cash. But tackling credit card debt can help free up money, and you'll likely pay less interest over time.

Tip

Try setting up automatic payments for more than the minimum each month—every little bit helps chip away at your balance faster.

16. Negotiate Your Loans & Credit Cards

If a chunk of your paycheck always goes toward paying down debt from credit cards or other loans, you can approach those companies to negotiate better interest rates. Collect details like your lender's name, owed amount, interest rate, and minimum payment. Call to negotiate better terms.

Tip

Research competitor rates to leverage in negotiations with your lender.

17. Negotiate With Utility Companies

Cell phone, internet, and cable bills can be reduced. Call providers to negotiate cheaper plans or seek offers and rebates. If unsuccessful, consider switching to competitors to save money and boost your savings.

Tip

Check your bills semi-annually to catch rising costs and discover new discounts.

Boost Your Income & Resources

18. Add to Your Income

You can cut only so many costs when you have a set income. However, another option can help you save — bringing in more money. Consider extra hours or negotiating a pay raise. You can even explore new employment options that make more money.

Tip

Save money by tracking extra income separately and directing part of it to savings.

19. Pick Up a Side Job

Start a side hustle to earn extra money beyond your full-time job. Use this income to save or reduce debt. Options include ride-share driving, sitting, or freelance consulting. Remember to report your earnings to the IRS and maintain good financial records.

Tip

Pick a side hustle that suits your skills and schedule for long-term sustainability.

20. Look for Help

Social support programs, offered through government sites, help those living paycheck to paycheck. Consider refinancing or income-based repayment for college loans, but note that interest might accrue. Debt counseling services can offer further assistance.

Tip

Contact a nonprofit credit counselor for help with your options and making a debt management plan.

21. Check Your Insurance Policies

Review your insurance policies; you may be overpaying. Consider bundling for discounts or raising prices to lower costs, such as your auto insurance policy. Better credit scores can secure lower rates, so check them regularly.

Tip

Annually compare quotes by setting reminders to find discounts for safe driving, good health, etc.

22. Reduce Your Household Bills

Household costs can rise quickly, but you can control them. Audit bills, cancel unused subscriptions, negotiate with providers, and select cost-effective phone or internet plans. Avoid unnecessary purchases and choose store brands.

Tip

Regularly review bank statements to spot unused funds, freeing up cash for financial goals.

23. Start an Emergency Fund

If you're on a tight budget and slowly building your savings, the last thing you want is to have to dip into what you've set aside because of an unexpected expense.

Tip

Create an emergency fund equal to six months' salary to protect your savings against unexpected expenses such as loss, medical bills, or car repairs.

Stay on Track With a Spending Plan

24. Prioritize Your Savings

Treat saving as a must-pay expense with transfers. Use part of your tax refund to enhance savings. Regular saving, even small amounts, speeds up reaching long-term goals.

Tip

Automate a small transfer to savings every payday so it becomes part of your routine, not an afterthought.

25. Create a Spending Plan

A spending plan assigns a purpose to each dollar, aiding effective money management. List income and expenses, allocate funds according to priorities, and use apps for tracking and adjustments. This method ensures you cover necessities and save or invest, reducing financial stress and enhancing goal achievement.

Tip

Try the 50/30/20 rule: 50% to needs, 30% to wants, and 20% to savings or debt repayment.

26. Help Protect Your Finances

Helping ensure financial security involves more than saving. Check your credit scores for better loan and credit cards. Protect accounts with fraud alerts and strong passwords. Use your tax refunds by saving or investing.

Tip

Enable free credit monitoring and fraud alerts to detect unusual activity.

The Bottom Line

These are some of the ways to save money. Cutting costs often yields unexpected savings. Sticking to a budget plan can be motivating. Challenge yourself persistently, and monitoring your savings can significantly improve your financial situation.

Improve your finances by creating a plan to save money effectively. Get My Free Financial Review

Frequently Asked Questions

What is the most challenging part of saving money?

Why is saving money important?

What are the three important benefits of saving?

- Emergency Preparedness: Saving allows you to handle unexpected costs without falling into a financial crisis.

- Goal Achievement: Saving provides the necessary funds for important life milestones like buying a home, furthering education, or starting a business.

- Tranquility: Saving reduces anxiety about the future, enabling you to focus on personal growth rather than constantly worrying about financial survival.

Sources

- Consumer Expenditures--2023. https://www.bls.gov/news.release/cesan.nr0.htm

.jpg?rev=b30888445a984cb9af391aebc08860da&la=en&h=130&w=270&hash=811D9A81F81B2D381CDBDE831D4D12BA)