Highlights

- Stock Correction: The S&P 500 entered correction territory during March as investors navigated volatility amid changes to trade policy.

- Tariffs: Tariffs have caused inflation forecasts to increase; however, investors currently expect the impact to be short-lived. Given the April 2nd tariff announcements, it appears the impact will be larger than previously expected.

- The Economics of Sentiment: Consumer sentiment around the U.S. economic outlook has weakened in recent weeks - but will it impact economic activity? We learn more in this month’s Spotlight below.

Table of Contents

Macro Insights

Tariffs Cloud Economic Skies

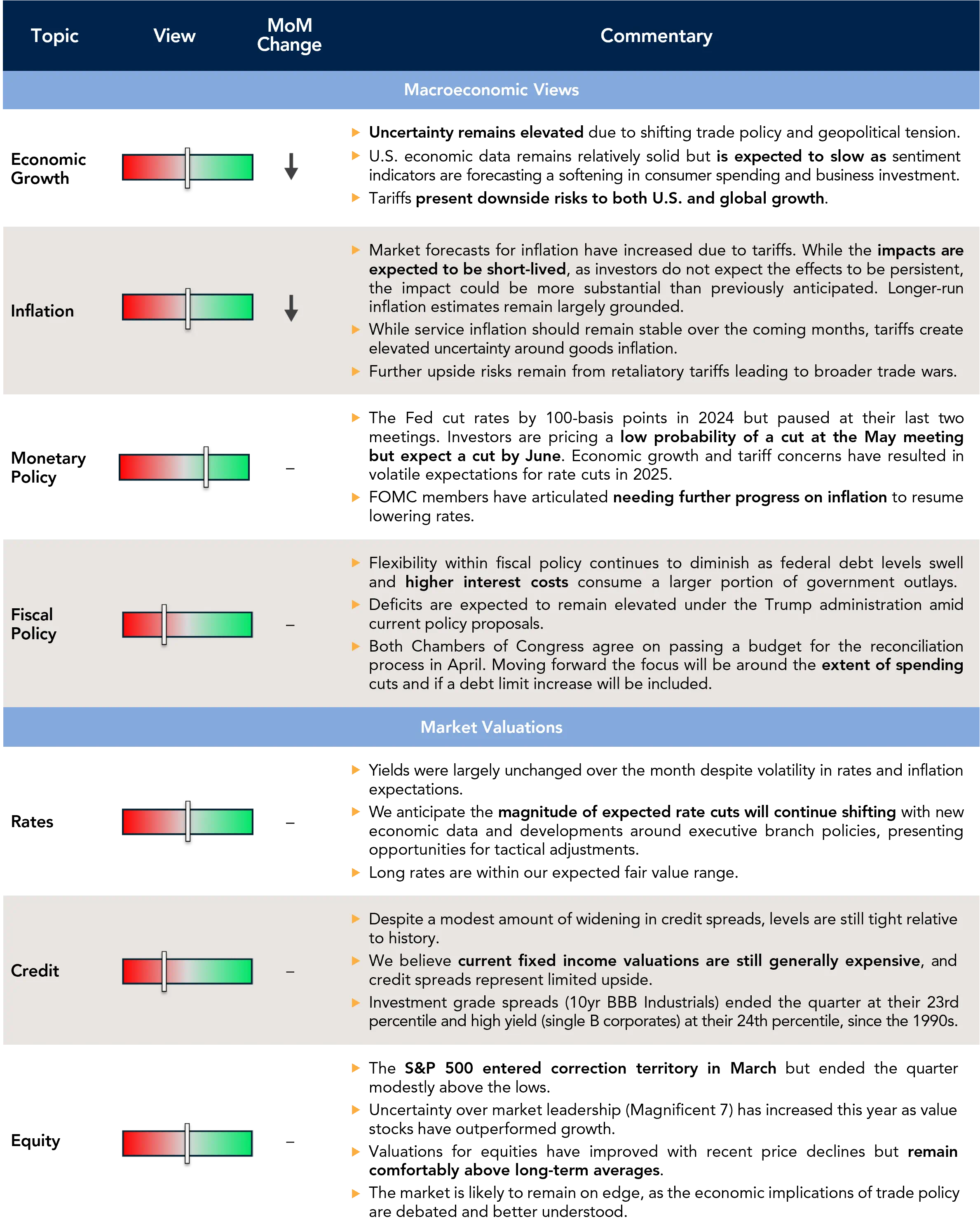

Stocks extended declines in March as renewed economic uncertainty took hold, driven by the threats and implementation of tariffs on imported goods. Growth stocks—particularly the “Magnificent 7”—suffered outsized losses, with the S&P 500 falling 5.6% and the tech-heavy Nasdaq dropping 8.1%. From the market high in mid-February to the low in mid-March, the S&P 500 fell 10.1%, putting it into correction territory before gaining back 1.6% into month-end. Investor sentiment weakened further on concerns that tariffs will dampen demand and weigh on future growth. To date, the softer economic signals have come primarily from soft data—such as sentiment surveys—rather than hard data like employment or consumption figures. However, the balance could shift quickly, and this month’s Spotlight (below) explores the issue in greater depth.

The implications of the Trump administration’s tariff policies remain uncertain in scale but clear in direction. Tariffs are likely to act as a drag on economic momentum, disrupting supply chains and curbing consumption where businesses pass through higher input costs to consumers. Country-based reciprocal tariffs announced April 2nd exceeded most forecasts and additional product-specific tariffs are still to come (semiconductors, pharmaceuticals, and potentially more). As a result of these new and anticipated developments, we expect elevated market volatility and persistent pressure on consumer and business confidence as policy clarity remains elusive.

Bond markets were relatively stable in contrast. Although credit spreads widened modestly, they remain near historically tight levels. Separately, long-term interest rates held steady, while 2-year Treasury yields declined modestly following remarks by Federal Reserve (Fed) Chair Jerome Powell. His comments were interpreted as leaning more dovish, suggesting the Fed is more concerned about slowing growth than persistent inflation. Despite this shift in tone, market expectations for rate cuts were little changed, with futures pricing in multiple cuts by year-end.

Tariffs continue to dominate investor focus, but concerns about the durability of AI-related demand are also front and center. While near-term enthusiasm remains high, markets are becoming somewhat skeptical about the long-term trajectory of AI infrastructure investment. On trade, the Administration appears committed to a long-term rebalancing of the U.S. role in global commerce. That path is unlikely to be quick or orderly. Volatility is likely to remain a feature of this evolving environment. Fortunately, the economy is entering this period from a position of relative strength, with many consumer spending indicators still showing resilience. As always, we will be closely monitoring incoming data—especially around consumption and business activity—as outlined in our Spotlight.

Investor Sentiment

Bullish sentiment toward equities has softened in recent weeks.

Source: Fort Washington, Investor Intelligence, and Bloomberg.

What to Watch

Sentiment has weakened across consumers and businesses. As a result, investors will monitor incoming sentiment data and indications for potential impacts on economic activity. Inflation data continues to dictate the Fed’s flexibility, and markets will monitor impacts from tariffs.

|

Monthly Spotlight

Soft vs. Hard Economic Data

Much of the U.S. economic momentum in recent years has been driven by consumer spending, particularly higher income earners. However, sentiment has shifted as Americans have become increasingly concerned about inflation, tariffs, and geopolitical tension. The key question for investors now is whether this shift in how consumers feel (reflected in soft economic data like surveys and sentiment trackers) dictates the path of actual economic data or will the economy continue to remain resilient.

Recent economic releases in the United States have exhibited a bifurcation. On the soft data side, indicators, such as consumer sentiment and business surveys, have weakened. Small business optimism, tracked by the NFIB index, pulled back from the recent post-election jump due to declining confidence in the economic outlook. Consumer sentiment declined across the two most closely watched surveys, Conference Board and University of Michigan (U of M). In addition to a souring outlook, the U of M’s latest survey also exhibited a material increase in inflation expectations. While this survey has gotten a lot of media attention, it’s important to put the data in context. These reports have been more volatile given a recent change in methodology (survey responses are now online versus phone responses), and other inflation surveys don’t show the same level of inflation concern.

On the other hand, the hard data appears to suggest the economy is still on solid footing, at least for now. The labor market is a prime example: although it has loosened relative to its tightest levels, jobless claims continue to print near historical lows while job openings and the number of workers quitting their jobs remain stable, suggesting a balanced employment picture. Layoff announcements have increased in some sectors, notably government, but haven’t translated into broad-based job losses.

This divergence in data raises questions about the economy’s underlying trajectory. Soft data, such as sentiment surveys, tends to reflect forward-looking attitudes. If households and businesses become more cautious, the drop in confidence could foreshadow a pullback in hiring, capital expenditures, and consumer spending. However, history shows it is not unprecedented for sentiment to weaken without immediately or materially denting actual economic output.

For now, markets are weighing the possibility that soft data is signaling an actual slowdown, which argues for maintaining discipline in portfolio positioning. While we expect the Fed to remain patient until weakness shows up in the hard data, if sentiment is indeed a leading indicator of a broader economic pullback, we believe fixed income will outperform. The historical inverse relationship between stocks and bonds appeared to break down in recent years; however, it resurfaced during the latest equity sell-off, as yields moved lower alongside falling stock prices. We expect that correlation to hold in a further risk-off environment, particularly because growth concerns will outweigh inflation fears.

Source: Fort Washington, University of Michigan, and Conference Board.

Current Outlook

Market Data & Performance

As of 03/31/2025

Source: Fort Washington and Bloomberg. *Returns longer than 1 year are annualized. Past performance is not indicative of future results.