Table of Contents

Table of Contents

Key Takeaways

- Annuities and life insurance can accomplish similar financial goals, like building retirement income and leaving an inheritance.

- Life insurance aims to create a death benefit for your heirs and build cash value that you can withdraw while alive.

- Annuities prioritize growing your money and generating retirement income. While annuities offer death benefits, they are smaller than life insurance.

- Life insurance offers early access to funds and tax-free income via loans, but with lower returns than annuities. Health underwriting is required for purchase.

- Consider combining life insurance, ideal for younger individuals, with annuities, better suited for nearing retirement, in your financial plan.

Annuities and life insurance are insurance contracts that can help advance your financial goals. Both put money to work with tax advantages for someday generating retirement income or creating assets for loved ones — or both. However, their designs, advantages and limitations differ.

Learn how annuities and life insurance compare. That way you can better determine whether either makes sense for your needs.

Annuity vs. Life Insurance: An Overview

Life insurance's primary purpose is to provide a death benefit after you pass away. You choose how much coverage you want. The insurer agrees to pay out this amount if you pass away while covered. There are different types of life insurance policies:

- Basic term life insurance policies only provide the death benefit. Term policies also have an expiration date. For example, a five-year term policy lasts five years.

- Permanent life insurance policies last your entire life1 as long as you keep paying the insurance premiums. These policies also offer cash value. This is money available to you while alive. Cash value policies provide a way to build savings on top of insurance protection.

An annuity's primary purpose is to turn your savings into future income payments. You pick how long you want the annuity payments to last — for example, a set number of years or your entire life, like a personal pension plan. If you aren't ready to start collecting income, you can invest through a deferred annuity to grow your savings. Finally, you could set up an annuity with a death benefit for your loved ones.

Head-to-Head Comparison: Life Insurance vs. Annuity

Now that you've got a basic idea of how annuities and life insurance work, read on to discover the key details about how they compare.

Qualifying with Medical Exams

You are not guaranteed to be able to buy most life insurance policies. Insurers often require that you satisfy health underwriting first. The insurer could pull your medical records and ask you to take a physical as part of the application, for example. The insurer would then decide whether you qualify for life insurance and, based on your health, at what cost.

Annuities don't require medical exams to qualify. You can buy a contract in the amount you can afford.

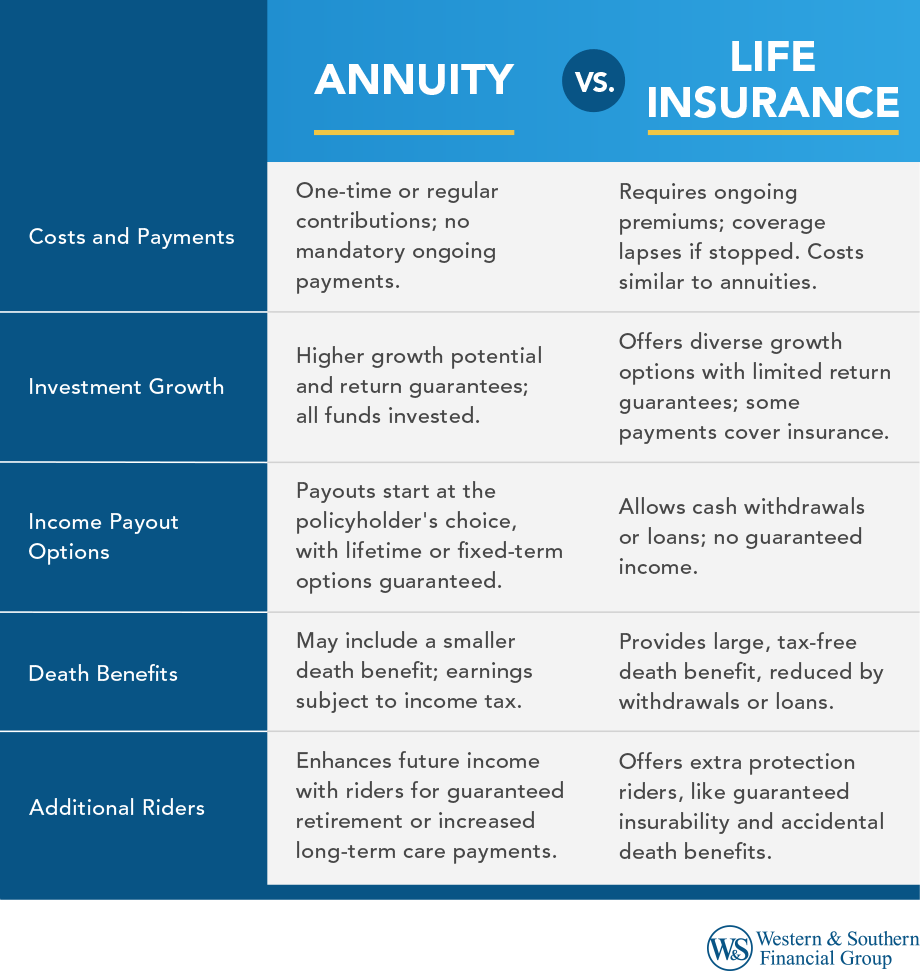

Costs, Fees & Expenses

Life insurance policies charge ongoing premiums. You need to keep paying the insurance premiums to keep your coverage. If you stop paying, your policy lapses.

You can buy annuities with a single large payment, like a transfer from your investment or retirement accounts. You can also make ongoing smaller payments to build up your account gradually. Annuities don't require you to keep making payments. The more you pay, the more you build your wealth, but you won't lose the contract if you temporarily stop payments.

Both annuities and life insurance have annual expenses. In some cases those costs may be built-in and in others they may be added and itemized. They cover the costs associated with investing your money, administrative fees and policy benefits. The costs depend on your policy and insurer. They can be similar for both.

One notable difference is that you pay for the insurance coverage with life insurance. As a result, less money goes toward your investments and future savings than with an annuity.

Investment Growth & Options

Both life insurance and annuities offer various options to grow your money. They range from very conservative with guaranteed returns to higher-risk, higher-return options. A fixed annuity vs. whole life insurance is similar because both pay a guaranteed return on your money. A variable annuity lets you invest your money in accounts whose performance is tied in part to variable investments and your return depends in part on their performance. It is possible to lose money. The same is true for a variable life insurance policy. You decide on the investment style when picking the type of annuity or life insurance policy.

Annuities typically have greater growth potential than life insurance. First, you aren't paying for life insurance protection with an annuity, so all your money goes toward investing. Second, annuities may offer more performance and return guarantees for future retirement income. For example, an annuity might promise a minimum guaranteed retirement income even if your investments underperform and your contract runs out of money.

Life insurance policies have fewer return guarantees because they focus on insurance protection rather than investment performance.

Income Payout Options

You decide when you're ready to start collecting income from an annuity, and you choose how these payments pay out over time. Some options include:

- For a set number of years

- For your entire life

- For your life and someone else's, such as your spouse

Your insurer will tell you how much income you'd receive under each option. The insurer then guarantees you'll receive these scheduled payments.

Life insurance shows how much money is in your cash value. You could take this money out with a withdrawal. You could also borrow from the cash value with a loan, with the option to pay it back into your policy. The insurer charges interest on your outstanding loan. Taking money from your life insurance policy reduces the future death benefit for your loved ones.

Life insurance doesn't give you guaranteed ongoing income. You manage and budget the cash value yourself to make it last. You could exchange your life insurance policy for an annuity if you want the income guarantees. In doing so, you'd give up your life insurance protection but turn your cash value into guaranteed annuity income.

Taxes

Both annuities and life insurance delay taxes on your contract growth. You avoid taxes as long as the money remains in your contract. This can help your return versus a taxable brokerage account where you might owe taxes every year.

Typically, life insurance policies are better for taxes when taking your money out. If you take money out as a withdrawal, you owe income tax on your gains. However, you generally don't owe income tax for taking out your gains with a loan. You could plan to tap into your cash value using tax-free loans in retirement and then never pay the money back in your lifetime. When you pass away, the death benefit pays off your outstanding loan, so you avoid those taxes. However, paying off the loan will also reduce the final death benefit. In the event the policy lapses with an outstanding loan this would create a taxable event.

With annuities, you owe income tax once you start receiving income. You get the after-tax money you paid into the annuity back tax-free but owe taxes on the gains. The insurer will tell you how much of your annuity income payments are taxable versus tax-free.

Early Access to the Money

Life insurance is typically better for early access to your money. You can withdraw or borrow your cash value at any age without restrictions, with the exception of modified endowment contracts (MEC), which will incur penalties and taxes if taken before the age of 59½.

Annuities are usually used for retirement. You typically want to keep money in your annuity until you turn at least 59½. If you withdraw or cancel the contract before then, you owe an extra 10% early withdrawal tax penalty, as well as income tax on your gains (if any). The penalty only applies to lump sum withdrawals. If you start ongoing annuity income payments, you can do so at any age without the penalty.

Annuity companies may also charge substantial surrender charges if you cancel the contract early. The penalty typically decreases over time. For example, the penalty might be 7% for canceling in the first year, which decreases by 1% a year before ending in seven years. The annuity company might give you some options for early withdrawals, such as 10% of your balance without penalty. However, early access to your money is more restricted than life insurance.

Death Benefits

Life insurance policies create a larger death benefit and inheritance for your loved ones. When you sign up, you pick a death benefit that could be five figures or larger. Your beneficiaries receive this amount after you pass away, minus any cash value you take out during your lifetime. Life insurance death benefits generally are income tax-free.

Annuities can provide some death benefits. For example, you could set up the income payments to continue to a beneficiary. If you die before starting income payments, your beneficiaries receive the money in your contract: your deposits and investment gains. You could also pay extra for a larger death benefit rider — for example, a 25% increase over your annuity value. Still, the annuity death benefits are much smaller than what you'd receive paying the same amount for life insurance. Your beneficiaries also owe income tax on your annuity earnings. It's not a tax-free death benefit like life insurance.

Riders for Additional Benefits

Both annuities and life insurance allow you to buy additional benefits through riders. Life insurance riders tend to provide extra insurance protection. For example, you could buy a guaranteed insurability rider, which allows you to buy more insurance later in life without a medical exam, or an accidental death benefit rider, which pays more to your beneficiaries if you die in an accident.

Annuity riders focus on your future income payments. For example, you could buy a rider that guarantees a minimum retirement income regardless of your investment performance or a rider where your payments go up if you need long-term care in a nursing home.

Start planning your financial security. Get a Life Insurance Quote

Pros & Cons of Annuities

Pros

- Creates guaranteed lifetime income: An annuity is one of the few ways to create income you cannot outlive. For this reason, annuities are sometimes called longevity insurance — they protect you from outliving your savings.

- Tax-deferred investment growth: Annuities offer tax-deferred investment growth, similar to a traditional Individual Retirement Account or 401(k) plan.

- No income or contribution limits: You can save through an annuity no matter how much you earn. There aren't income limits like there are on retirement plans. You can also contribute as much as you want per year. Annuities could make sense if you've maxed out your other retirement plans.

- No health testing: Your health doesn't matter when applying for an annuity.

Cons

- Restricts early access to your money: Annuities are long-term investments. If you cancel early, you could owe a surrender charge to the insurer. You could also owe the IRS a 10% early withdrawal penalty if you are younger than 59½.

- Starting income payments is usually irreversible: If you begin collecting annuity income, you usually can't change your mind and get your money back. You lose flexible access to your savings.

- Taxes on annuity income: You owe income tax for receiving your annuity gains. It's not tax-free retirement income.

- Ongoing contract fees: Annuities can charge up to 3% annually to cover investments, death benefits, income guarantees and administrative costs. You owe more fees than investing in a brokerage or retirement account.

Pros & Cons of Life Insurance

Pros

- Flexible access to cash value: You can borrow or withdraw your life insurance cash value when you want. There is no early withdrawal penalty from the IRS.

- No taxes on cash value loans: If you borrow your cash value, you can take out your gains without owing income tax. This strategy is a way to get tax-free retirement income.

- Can be converted into an annuity: You can swap your life insurance cash value for an annuity. You don't owe taxes for making the change. However, you can't exchange an annuity for life insurance.

- Creates a sizeable income tax-free death benefit: Life insurance can help you leave a large inheritance on top of building cash value for yourself.

Cons

- Requires health underwriting: You must pass the life insurance company's health standards to buy a policy. Pre-existing medical conditions could increase the premium, or you could even be denied a policy.

- Ongoing insurance costs: With life insurance, you must keep paying the premiums to keep your policy. This is an ongoing cost that lowers your return.

- Takes time to build cash value: It can take several years before you start seeing cash value and over a decade or more to break even on your premiums. Most of your payments first go toward the insurance before the cash value.

- Using cash value lowers the death benefit: If you take out cash value, you reduce how much money is left for your beneficiaries.

Factors to Decide Between Annuities vs. Life Insurance

- Health: Your health determines your options for life insurance. If you have serious pre-existing health conditions, you might not be able to qualify for life insurance, or if you do, the costs might be too high to build significant cash value. In this case, annuities might be your only option. If you are in good health for your age, then both are possibilities.

- Age and retirement timeline: Generally, the younger you are, the more life insurance makes sense. You qualify for lower premiums and have more time to build cash value. You are also more likely to have life insurance needs, such as protecting young children or replacing your work income. Finally, you could tap into the cash value of life insurance more easily at a younger age than with an annuity.

- If you're near retirement, annuities may make more sense. They can give your savings one last push before you reach the retirement finish line. You are also closer, if not past, the 59½ age when the early withdrawal penalty goes away. Finally, at that point, you are closer to needing retirement income, which you can get from the annuity.

- Retirement income goals: Consider what you want for retirement income. Annuities are better for providing a steady monthly income, like a retirement paycheck for life. Life insurance gives you the flexibility to withdraw or borrow what you want. You need to budget the cash value yourself but have more access to all the money.

- Other retirement plans: Do you have a pension from work? If yes, you already have your own annuity and less need to buy your own. If not, you could buy an annuity to create your own personal pension.

- Estate planning goals: How important is leaving money for your loved ones after you pass away? An annuity prioritizes using the money for your retirement income. Life insurance provides more financial protection for your loved ones and legacy planning benefits while still giving you some money you can use while alive.

- Risk tolerance: For investment risk tolerance, it matters more what kind of life insurance or annuity you buy rather than choosing between annuities vs. life insurance in general. There are both safe, guaranteed versions (e.g., fixed annuities, whole life) and higher-risk profile, higher-return potential versions (e.g., variable annuities, variable life) of each.

Preparing to Buy an Annuity vs. Life Insurance

Annuities and life insurance are both long-term decisions that should be researched carefully. As part of your research, contact a financial representative. They can give you a document called an illustration. This predicts how much your money would grow and the death benefits for both options. You can then apply for life insurance to see if you qualify for reasonable premiums based on your health. There's no cost to apply for life insurance.

From there, you can decide whether an annuity or life insurance makes more sense. Remember, it's not an either/or decision. You could also split your money between the two . Your financial representative can help you determine the right combination.

Explore your options and secure your financial future. Get a Life Insurance Quote

Sources

- Policies may be subject to maturity provisions.

- Withdrawals may be subject to charges, withdrawals of taxable amounts are subject to ordinary income tax, and, if taken before age 59½, may be subject to a 10% IRS penalty.

- Interest is charged on loans, they may generate an income tax liability, reduce the Account Value and the Death Benefit, and may cause the policy to lapse.