Key Takeaways

- Primary beneficiaries are the first people or entities who receive your death benefit proceeds, while contingent beneficiaries are the backups if something happens to the primary before you die.

- Naming both types of beneficiaries helps avoid death benefit payment delays and legal issues for your loved ones.

- Many people forget to name a contingent beneficiary, which can leave their assets stuck in the court system.

- Major life events like marriage, divorce, death of a spouse or the birth of a child are good times to review and update your beneficiary choices.

- If you don’t name any beneficiaries, a judge may decide who gets your assets, which might not match your wishes.

Many believe their assets will go automatically to the right person upon their death, but that's not guaranteed. Selecting beneficiaries is an important legal decision affecting your legacy. Knowing the difference between primary and contingent beneficiaries can help prevent family disputes, probate delays, and unintended issues.

What Is a Beneficiary?

A beneficiary is the person or entity you choose to receive assets, such as life insurance payouts or retirement benefits, after your death. You're welcome to name multiple beneficiaries based on how you'd like them to share your assets.

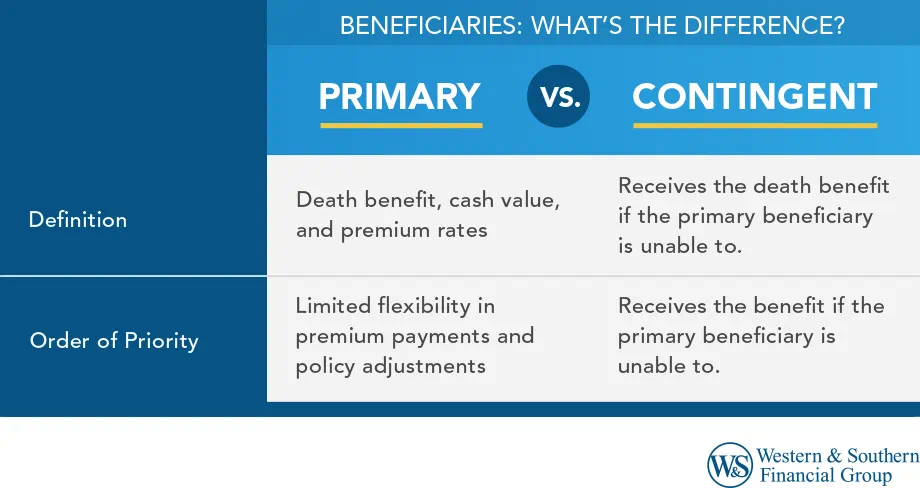

There are two main types of beneficiaries:

- Primary beneficiaries: The first in line to receive assets such as death benefit proceeds.

- Contingent beneficiaries: The backup, in case the primary has pre-deceased you or is unable or unwilling to receive the asset or death benefit proceeds.

These designations are common (but not limited) to in:

- Life insurance policies and annuities

- Retirement accounts (like IRAs and 401(k)s)

- Living trusts

- Brokerage and bank accounts

- Legal documents related to estate planning

Naming primary and contingent beneficiaries clarifies asset distribution, minimizing legal disputes or delays. This may allow your loved ones to focus on healing instead of legal or financial complexities. When it comes to life insurance or retirement accounts, choosing your beneficiaries wisely is crucial for a smooth estate planning process.

Who or What Can Be a Life Insurance Beneficiary?

Life insurance policyholders typically have a significant amount of flexibility when choosing beneficiaries. Here are some examples of who or what can be a primary or contingent life insurance beneficiary:

- Spouses. Married couples commonly name each other to be their primary beneficiary.

- Children. Kids are often named as contingent beneficiaries with the insured's spouse as the primary, but children can also be primary beneficiaries.

- Other relatives. An insured may decide to choose family members other than their spouse or children to be beneficiaries.

- Nonrelatives. There is no requirement to name a family member as a life insurance beneficiary; anyone can be designated.

- Trusts. In some cases, it makes sense to name a legal entity called a trust as a beneficiary. For example, if you want minor children to receive the death benefit, you can make a trust the beneficiary, and a trustee will manage the proceeds on their behalf.

- Organizations. Similar to naming a trust as beneficiary, you can choose an organization, such as a charity, nonprofit or even a business, as either a primary or contingent beneficiary.

- Employers. If you are a key contributor at your place of employment, your employer may establish a life insurance policy to help protect them in the event of your death. In this case, your employer is the beneficiary of the policy.

You have many options for beneficiaries. Accordingly, it can be beneficial to seek out the guidance of a financial professional with expertise on insurance products before buying a life insurance policy.

Why Do Both Designations Matter?

Too often, people only fill out the primary beneficiary information on forms for life insurance or retirement plans. But failing to name a contingent beneficiary can lead to:

- Death benefit payout delays: Without a backup, if no valid beneficiary is designated, proceeds may need to go through probate, depending on state laws.

- Legal complications: Courts may need to decide who gets what—especially if multiple family members are eligible.

- Estate taxes: Assets without direct beneficiaries may be included in your taxable estate.

- Emotional stress: Loved ones are left to untangle complex legal issues during an already difficult time.

How to Choose the Right Beneficiaries

Choosing who will inherit your assets is both an important and thoughtful decision. Here are a few friendly tips to help you make the right choices:

- Relationship: Start by considering close family members, like a spouse, children, or siblings. Don't overlook trusted friends or even charitable organizations that resonate with your values and wishes.

- Age: If you wish to name minors, keep in mind they cannot legally inherit assets directly until they reach the age of majority. In such cases, it's wise to designate a legal guardian or establish a trust to manage the assets on their behalf until they come of age.

- Health: Consider the health and expected longevity of your beneficiaries. If your primary beneficiary has significant health issues, it is important to have a well-defined contingent beneficiary in place to ensure seamless transfer of assets.

- Financial responsibility: Evaluate the financial awareness of your potential beneficiaries. Will they manage the newfound wealth responsibly? Establishing a trust with a responsible trustee might be a beneficial option if you have concerns about a beneficiary's financial management skills.

- Life events: Major life events such as marriages, divorces, births, or deaths should trigger an immediate review of your beneficiary designations. Ensuring your beneficiaries reflect your current family dynamics is essential for maintaining your estate plan's relevance and effectiveness.

Also, make sure:

- Your documentation is accurate: Verify that all names are spelled correctly and precisely. Even minor errors can lead to delays, confusion or disputes..

- Your distribution instructions are clear: Specify the percentages of asset distribution, making sure they collectively total 100%.

- You include detailed identification: Include essential contact information or identifying details, like Social Security numbers, to avoid any ambiguity or misidentification.

Inclusion of these factors helps secure a smoother asset distribution process that aligns with your wishes. Regular updates help ensure your estate plan reflects personal and family changes, keeping your beneficiary designations accurate and effective.

What Happens If No Beneficiary Is Named?

Choosing a beneficiary when you apply for life insurance might appear straightforward, but there are occasions when beneficiaries aren't designated. If no primary or contingent beneficiary is named, or if both have passed away:

- The asset/death benefit proceeds will become part of your estate and will have to go through the probate process.

- A judge will decide how to distribute the asset/death benefit proceeds, generally following the state's intestacy laws.

- The probate process might slow things down a bit, with distributions taking a few extra months.

- Your loved ones may encounter some estate taxes or legal hiccups. Depending on your estate size and structure, there may be estate tax implications. Consult your tax advisor for personalized guidance.

To prevent these issues, it is important to complete your beneficiary forms now, even if you are young and healthy. Clearly designating primary and contingent beneficiaries ensures your assets are shared as you intended, sparing your loved ones the stress and delays of probate.

Tips for Naming Life Insurance Beneficiaries

When naming life insurance beneficiaries, here are important points to keep in mind:

- Read the form carefully. It's important to read your beneficiary form carefully and scrutinize its language before filling in names and percentages, as not all forms are designed the same.

- Always name a beneficiary. Dying without a beneficiary can subject the policy to the probate process, leading to extra costs, delays, and possibly unfavorable taxation.

- Name both primary and contingent beneficiaries. Naming a contingent beneficiary helps ensures your assets/death benefit proceeds go your desired parties, if the primary beneficiary is unable to receive it.

- Consider tax benefits and consequences. Beneficiaries typically don't pay taxes on a life insurance death benefit, but naming an estate instead of an individual could lead to estate tax liabilities for the inheritors.

- Coordinate beneficiaries with your will or trust. When you're naming life insurance beneficiaries, consider tax effects and sync with your estate plan to ensure asset distribution and avoid probate issues.

- Avoid naming your estate as your beneficiary. It's generally best to have assets pass to beneficiaries directly to avoid probate, which could distribute benefits differently than you planned.

- Trusts are generally not ideal as life insurance beneficiaries. Help ensure your life insurance policy coordinates with your estate plan to avoid probate, and consult an expert for tax implications and the appropriateness of naming trusts.

Final Thoughts: Your Legacy in the Details

Choosing between a primary vs. contingent beneficiary isn’t just a formality. It’s a thoughtful decision that can shape how your loved ones remember you, and how quickly they get the support they need after you’re gone.

Align your life insurance beneficiary choices with your long-term objectives. Get a Free Life Insurance Quote