Key Takeaways

- Converting term life to whole life gives you lifelong coverage instead of coverage that ends after a set number of years.

- Whole life insurance builds cash value over time, which you may be able to borrow against or use for future needs.

- You can usually convert without a medical exam, making it easier to qualify even if your health has changed.

- Premiums for whole life are higher than term life, but they stay the same for life and include extra benefits.

- Converting may make sense if your financial goals, dependents, or estate planning needs have changed since you first bought coverage.

Navigating life insurance is a key part of your financial future. Term life insurance helps provide a financial safety net for a specified period, such as 10 or 30 years. If you pass away during the term, your beneficiaries receive the death benefit, as long as you pay the premiums. However, what happens if you want to continue protection for longer than the specified term?

Converting term life to whole life insurance may be an option. A conversion allows you to shift from temporary to permanent coverage, ensuring lifelong protection while maintaining some financial security for your loved ones.

Whether you're evaluating your financial strategy or just curious about the options, here are some basics about the process.

What Is Converting Term Life to Whole Life Insurance?

There are two primary types of life insurance: term and whole. Each has specific advantages and benefits depending on your needs.

Term life insurance protects the policyholder for a set time, often 10, 20 or 30 years. If you pass during the term, your beneficiaries receive the death benefit. However, if you outlive the term, your policy ends. After that point you won't have coverage. There will be no death benefit helping protect your loved ones.

If you're nearing the end of your term policy, consider reevaluating your insurance needs. You can get a new term policy, go without life insurance or convert your term coverage, among other options.

Whole life insurance offers permanent coverage without an expiration date1, ensuring protection for your beneficiaries during your life. Beyond the death benefit, whole life policies often have a cash value component, which can grow over time.

Converting term life to whole life insurance moves you from the temporary coverage of a term policy to lifelong protection. A policyholder can confidently extend coverage while perhaps gains access to some common whole life insurance benefits, such as building cash value. And it may be done without undergoing a medical exam (a common purchase requirement).

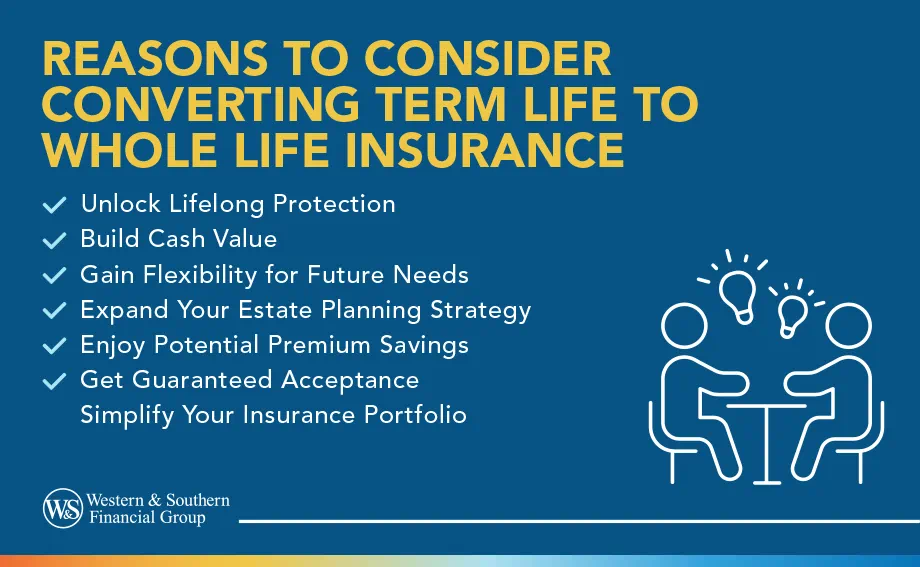

Reasons to Consider Converting Term Life to Whole Life Insurance

Your financial situation and needs likely will change over time. So while term insurance might once have been a good fit, permanent whole life insurance may later become a more appealing option. Here are some reasons why a life insurance conversion may make sense:

Unlock Lifelong Protection

Converting term life to a permanent policy ensures you're covered for the rest of your life1, not just a set period. It also means your loved ones are guaranteed a death benefit, regardless of when you pass during the life of your policy. Knowing beneficiaries will have a measure of financial protection can help add stability to long-term financial strategy.

Build Cash Value

Whole life insurance policies have a cash value component that can grow over time. This is another financial resource you can tap into for a variety of needs. Examples of cash value uses include borrowing against it for major expenses (though doing so may lower your death benefit's value), simply serving as a "in case of emergency" financial safety net or even supplementing retirement savings.

Gain Flexibility for Future Needs

Life is unpredictable. Financial can and do sometimes change. You may substantially grow your income, have outstanding debt or still need to provide for dependents. In those cases, having whole life insurance may offer more flexibility to address future financial obligations, especially if you were to pass unexpectedly.

Expand Your Estate Planning Strategy

Whole life insurance can be part of your estate planning strategy. Knowing you have a guaranteed death benefit may help ensure your loved ones receive some funds without worrying about owing income or estate taxes on the death benefit or be saddled with debts. This coverage can provide a straightforward way to pass wealth to the next generation or a charitable organization close to your heart.

Enjoy Potential Premium Savings

One of the advantages of term life vs. whole life is that the premiums tend to be more affordable. In terms of the cost, converting to whole life earlier in your term may offer long-term savings. Since premiums lock in at your current age and health status, it can help avoid higher costs as you age or your health changes.

Get Guaranteed Acceptance

Term policies often include the option to convert to whole life insurance coverage. That allows you to switch to a permanent policy without undergoing a medical exam again as part of the underwriting process, guaranteeing coverage acceptance regardless of changes to your age and health since your original term policy was issued.

Simplify Your Insurance Portfolio

To ensure you have enough coverage to meet your needs, it's not uncommon for many to manage multiple life insurance policies, such as employer-provided coverage and a term life policy. Converting to a whole life policy can simplify your portfolio, giving you the coverage you need under one policy. That in turn may make managing your life insurance more straightforward.

How to Convert Your Term Life Insurance Policy

Converting your term life coverage can be relatively simple, but it's important to know how to navigate the transition to ensure it's not only a smooth process but also aligns with your long-term goals.

Step 1: Review Your Current Policy

Look at the terms of your existing policy to ensure conversion is possible. While many policies include a term conversion rider or clause allowing you to switch, the process may require completion within a specific timeframe.

Step 2: Consult with a Financial Professional

A financial professional or insurance agent can review the conversion process with you. They can provide insights on how such a move may fit your needs and overall financial strategy, including costs, benefits and coverage differences.

Step 3: Consider the Financial Implications

Converting to whole life insurance typically means higher premiums, but you'll benefit from lifelong coverage and a cash value component. Compare those costs and benefits to your current coverage and the costs of a new term or permanent policy to judge which is better for you.

Step 4: Submit a Conversion Application

If you decide to move forward, complete and submit a conversion application to your insurer. Generally, you won't have to take a medical exam. That means the application process is often simpler and quicker than applying for a new policy.

Step 5: Adjust Your Financial Strategy

Once the conversion is complete, consider meeting with your insurance agent to review and update your plans to reflect the new coverage. In addition to adjusting your budget for premium payments, consider how to approach the cash value portion of the policy.

Begin your policy conversion. Request a Life Insurance Quote

Pros of Converting Term to Whole Life

When it comes to life insurance, there's no one-size-fits-all approach. So understanding both the advantages and disadvantages of a policy can help you make an informed decision.

Here are some potential benefits of converting your term coverage to a whole life policy:

- Lifelong protection: Conversion from term to whole life insurance ensures coverage for the rest of your life1, as long as you pay your premiums. This means your beneficiaries have a guaranteed payout regardless of when you pass.

- Builds cash value: Whole life policies feature a cash value component, which may grow over time (depending on the policy type). You can use the cash value as a potential financial resource in the future, such as using the funds to cover expenses or supplement retirement income. Bear in mind, doing so may reduce the value of the death benefit.

- Fixed premiums: Once you convert to whole life insurance coverage, premiums remain the same for the rest of your life. So regardless of changes to your age or health, the amount you pay never change. That offers predictability to your payments.

- Income tax-free death benefits: Your beneficiaries will generally still get income tax-free payouts if you convert your coverage. So they won't have to pay income tax on any amount they receive from you. However, discuss potential tax advantages with a tax professional.

Cons of Converting Term to Whole Life

As with any financial product, there may be some disadvantages associated with term life insurance conversion. Here are a few potential considerations to keep in mind before converting:

- Higher premiums than term coverage: Whole life insurance premiums tend to be much higher than term life coverage. The costs are due to the extended coverage and added benefits.

- Smaller death benefit for the premium: Generally, if you compare the premium costs to the death benefit amount of term life vs. whole life coverage, whole life often has a smaller death benefit for the cost of the premium. If maximizing your death benefit for the cost is a priority, that's something to consider.

- Cash value takes time to build: The cash value component of a whole life insurance policy is a long-term asset that can grow over time. It may take several years before the value in the account accumulates, which may delay being able to use it if that's important to you.

Choosing between converting your term policy and buying new coverage depends on many factors, including age, health and financial goals. At the same time, conversion offers guaranteed acceptance and continuing coverage, but that comes with higher costs and other trade-offs. As such, review your options before making a decision.

Is Conversion Right for You? Key Factors to Consider

There are always a lot of factors to consider when deciding which life insurance policy is best for you, including your personal situation, financial goals and long-term protection needs. Here are some considerations to think about when it's time to weigh if conversion is right for you.

Age & Health Status

Your current age and health play a critical role in your life insurance coverage, especially premiums. Those who are younger and in better health tend to have more affordable payments, which could factor in your decision. Since most conversions don't require a medical exam, that's a potential advantage if your health has diminished since the policy was issued.

Financial Goals & Needs

Life insurance plays a role in your broader financial future. Whole life insurance, because it has a cash value component, can act as another financial tool for emergency funds or complement your other long-term saving strategies. Consider how those factors align with your current goals for savings, financial protection and estate planning.

Policy Costs & Cash Value Potential

It's important to understand the costs involved in converting your policy. Whole life insurance premiums are often higher than term coverage. However, you'll have fixed premiums for the rest of your life. Plus, whole policies offer the opportunity to build cash value. Consider if those benefits justify the higher expense.

Length of Life Insurance Coverage

Consider how long you may need coverage. If you have a specific amount of time you want a policy in place, such as until your kids reach adulthood, then conversion may not make sense. However, if you have a longer horizon for your dependents, want to leave a legacy behind or have come into more wealth, conversion may be something to explore.

Letting your term life insurance policy expire without a plan could leave your loved ones vulnerable. This highlights just how important it is to carefully consider your overall life insurance strategy and next steps.

Get the Coverage that Fits Your Needs

When considering any life insurance policy, assess your financial needs and objectives, budget and dependents, along with age and health. Each plays a significant factor in not only how much coverage you may need but also its long-term benefits and costs.

Getting the guidance of a financial professional can help. They can review your current financial situation, goals and budget. They'll work with you to evaluate options that address the needs of you and your family.

Find the life insurance policy that works for you. Request a Life Insurance Quote

Frequently Asked Questions

Is converting term to whole life worth it?

Do you get money back if you cancel whole life insurance?

How much tax will I pay if I cash out my life insurance?

Can you cash out term life insurance?

Footnotes

- Policies are subject to maturity provisions.