Key Takeaways

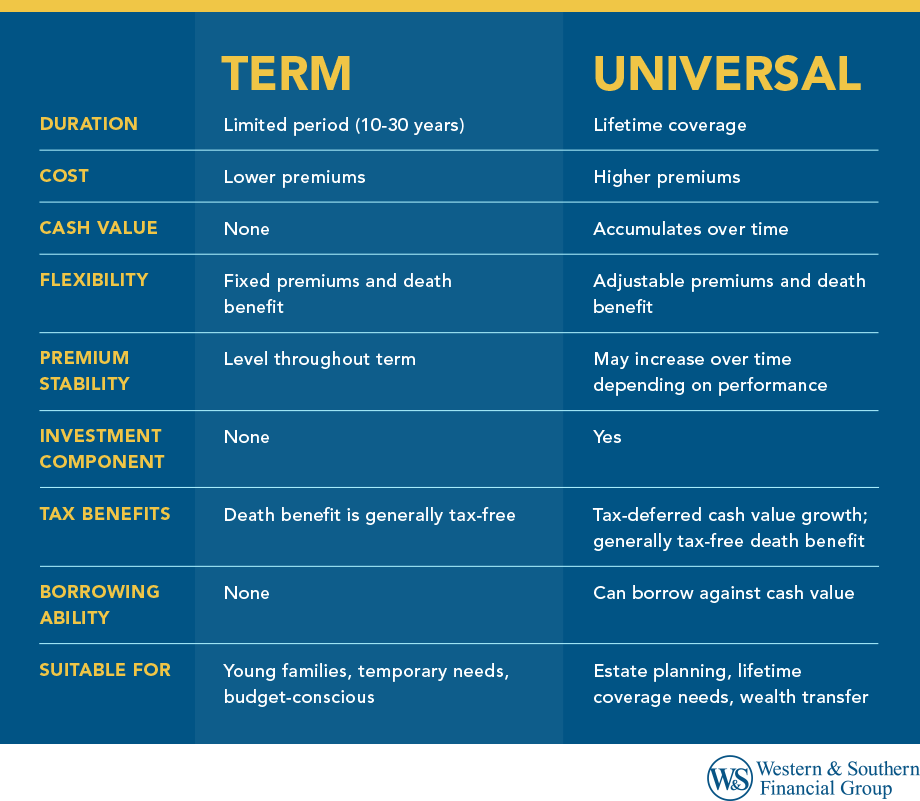

- Term life insurance offers affordable, temporary coverage ideal for young families and specific financial obligations, while universal life provides lifetime protection with flexible premiums.

- Universal life builds cash value you can use, but borrowing from it may reduce your death benefit.

- Premium costs differ significantly—term life is cheaper initially, while universal life requires higher premiums but builds equity over time.

- Universal life offers premium flexibility, allowing adjustments based on your financial situation, while term policies have fixed payment schedules.

- Choose based on age, goals, income, estate planning, and complexity preference.

Making decisions about life insurance protection can feel overwhelming, especially when comparing fundamentally different products like term life insurance vs universal life insurance. These two popular options serve the same core purpose, providing a death benefit to your loved ones, but they function in different ways.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years. Think of it as renting protection rather than owning it. If you pass away during the coverage period, your beneficiaries receive the death benefit. If you outlive the policy term, the coverage ends, and there's no payout.

Key Features of Term Life Insurance

- Temporary Coverage: Protects for a predetermined period (the "term").

- Lower Premiums: More affordable than permanent insurance options.

- No Cash Value: Functions purely as insurance without investment components.

- Simplicity: Straightforward policies that are easy to understand.

- Convertibility: Many policies can be converted to permanent insurance without a new medical exam.

Term life insurance shines in its simplicity, affordability, and level premium rates. It offers substantial coverage for young families with tight budgets at a fraction of the cost of permanent options. A healthy 18-year-old might pay just $15 monthly for a $250,000 policy with a 20-year term.1

Types of Term Life Insurance

Term life insurance consistently provides coverage for a specific period, but variations exist. Here's a breakdown of the common types:

- Level Term Life Insurance: The most common type, this permanent policy offers a constant death benefit and generally stable premiums, ensuring predictable payments. It is often favored for its simplicity and affordability.

- Decreasing Term Life Insurance: The death benefit decreases over the policy term, while premiums usually remain constant. This type is often used to cover debts, like mortgages, that diminish over time.

- Increasing Term Life Insurance: The death benefit increases over the policy term to potentially offset inflation, though this type is less common.

- Renewable Term Life Insurance: This type enables the policyholder to renew the policy at the end of the term without proof of insurability, such as a medical exam. Premiums generally rise with each renewal as the policyholder ages.

- Convertible Term Life Insurance: This option allows you to convert a term life policy into a permanent one, such as whole or universal life, within a set period, which is beneficial if your needs change and you require lifelong coverage.

What Is Universal Life Insurance?

Universal life insurance is a type of life insurance that provides permanent coverage for your entire lifetime. Unlike term insurance, universal policies combine a life insurance death benefit with a cash value component that can grow over time.

Key Features of Universal Life Insurance

- Lifetime Coverage: Protects you for your entire life (as long as premiums are paid).

- Cash Value Growth: Portion of premiums build tax-deferred savings.

- Flexible Premiums: Ability to adjust premium payments and death benefits.

- Borrowing Potential: Option to borrow against the policy’s cash value, but it may lower your death benefit.

- Complex Structure: More moving parts than term insurance.

The hallmark of universal life insurance is coverage flexibility. Unlike other permanent life insurance policies with rigid structures, universal life lets you adjust premiums and death benefits as your financial situation changes.

Types of Universal Life Insurance

Universal life insurance, while offering a base of flexible premiums and a cash value component, branches into a few distinct types. Here's a breakdown of the common types:

- Fixed Universal Life Insurance: This is the more traditional form. It offers more stability and predictability, with interest credited at a rate the life insurance company declares.

- Indexed Universal Life Insurance (IUL): Growth is tied to the performance of a stock market index, like the S&P 500. You don't directly participate in the market—returns are based on the index's performance, often with a cap and a floor to limit potential losses. This offers potential for higher returns than fixed universal life, but with some market-linked risk.

- Variable Universal Life Insurance (VUL): This type allows you to invest in various sub-accounts, similar to mutual funds. It offers the potential for the highest returns but carries the most investment risk, as performance depends on your investment choices. This type is the most complex of the universal life offerings.

- Guaranteed Universal Life Insurance (GUL): This type of universal life insurance provides a death benefit guarantee. It prioritizes the policy remaining in force for the policyholder's entire life, with less focus on investment features.

Notable Considerations

Cash Feature

The most significant difference between these policy types is universal life's cash value component. This account within your policy grows tax-deferred at interest rates based on market performance (with guaranteed minimums).

This cash value becomes a living benefit you can access during your lifetime through policy loans, partial withdrawals, full surrender, or by using it to buy paid-up insurance.

This flexibility can be valuable in retirement planning or emergency situations. Accessing cash value via loans or withdrawals may lower your death benefit and lead to policy lapse if not managed carefully.

Premium Flexibility

One of universal life's most attractive features is premium flexibility. Unlike term insurance with fixed payment schedules, universal life allows you to:

- Pay minimum premiums to keep the policy in force.

- Pay additional premiums to build faster.

- Skip premiums (if sufficient exist to cover costs).

- Adjust your death benefit up or down as needs change.

This flexibility can be invaluable during financial hardships or when insurance needs change. However, many policyholders encounter problems with this. Paying only minimum premiums, especially when interest rates are lower than projected, can deplete cash value and potentially cause the policy to lapse.

Risk Factors

Both policy types carry risks, but in different ways:

Term Life Risks:

- Outliving your coverage period.

- Facing significantly higher premiums if you need to renew after the term.

- Not having coverage for end-of-life expenses if the policy expires.

Universal Life Risks:

- Cash value growing more slowly than illustrated if interest rates underperform.

- Increasing insurance costs as you age, depleting cash value faster than expected.

- Policy lapses if it becomes insufficient to cover costs.

- Surrender charges if you cancel the policy early.

Additional Considerations

When comparing term life insurance vs universal life insurance, several other factors deserve consideration:

Medical Requirements: Both policy types typically require medical underwriting, but universal life often involves more extensive examination due to the insurer's lifetime commitment.

Riders and Add-ons: Both can be customized, for an additional cost, with coverages like:

- Accelerated death benefits for terminal illness

- Waiver of premium for disability

- Child or spouse coverage

- Accidental death benefits

Financial Strength of Insurer: Particularly important for universal life, where you're counting on the company to remain solvent for decades.

Tax Implications: Universal life offers tax-deferred growth and potentially tax-free access to cash value—though tapping into it may reduce your death benefit or cause the policy to lapse if not managed carefully.

Who Should Choose Term Life Insurance?

Term life makes the most sense for:

- Young families with significant protection needs but limited budgets.

- Parents wanting coverage until children are financially independent.

- Homeowners looking to cover a mortgage balance.

- People with temporary financial obligations that will decrease over time.

Term life insurance excels at providing maximum coverage for minimum cost during the years you need it most. If your primary concern is protecting your family from financial hardship should you die prematurely, term insurance offers the most efficient solution.

Who Should Choose Universal Life Insurance?

Universal life insurance generally works best for:

- Individuals with estate planning needs seeking to transfer wealth tax-efficiently.

- Business owners using life insurance for succession planning or key person protection.

- Those who have maxed out other tax-advantaged investment options.

- People seeking lifelong coverage with cash value accumulation.

- Those with complex financial portfolios who benefit from its tax advantages.

Universal life shines as a multi-purpose financial tool beyond just providing a death benefit. For those with complex financial needs who can afford the higher premiums, it offers valuable flexibility and potential tax advantages that term insurance can't match.

Making Your Decision

Rather than viewing this as a binary choice, consider your life insurance needs in layers:

- Foundation Layer: A term life insurance policy to cover essential income replacement and debt protection.

- Permanent Layer: Universal life for estate planning, cash accumulation, and lifelong protection.

- Specialized Layer: Riders and supplemental policies for specific concerns.

Many financial advisors recommend securing sufficient term coverage to protect your family's immediate needs before considering universal life for its additional benefits.

Final Thoughts

Choosing between term and universal life insurance requires careful consideration of your unique financial needs and goals. While term life offers affordable, temporary coverage, universal life provides lifelong protection and a cash value component. Understanding these differences empowers you to make informed decisions.

Before making any decision, consult a qualified financial advisor who can analyze your situation and help you create a comprehensive plan that incorporates the right insurance products for your unique needs.

Still torn between term vs universal life? Let a licensed expert guide you. Contact Us

Frequently Asked Questions

Can I have both term and universal life insurance policies?

What happens if I outlive my term policy?

How does universal life insurance differ from whole life insurance?

Is the cash value of a universal life policy protected from creditors?

Can I lose money in a universal life policy?

Is term life insurance worth it if you don't die during the term?

Source

- Family Plan Term Life Insurance - Gerber Life Insurance Company. https://www.gerberlife.com/adult-life-insurance/term-life-insurance