Table of Contents

Table of Contents

Key Takeaways

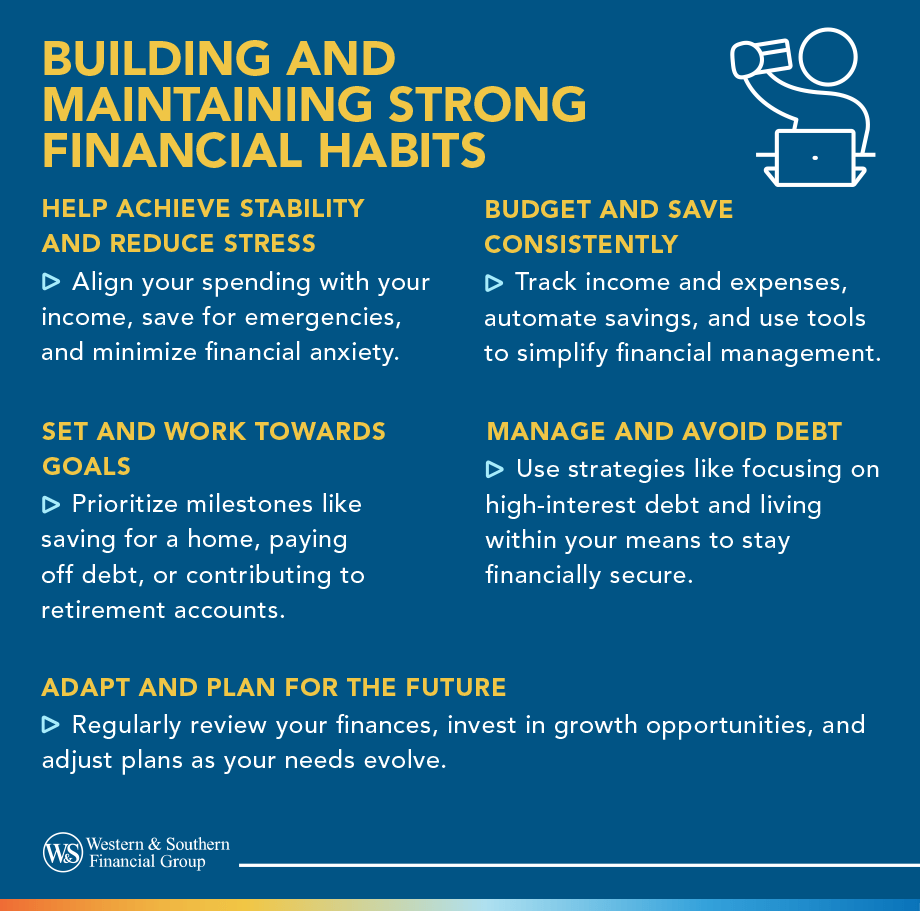

- Good financial habits, like budgeting and saving, lay the foundation for financial stability and help reduce stress.

- Creating a budget helps manage income and expenses, helping ensure funds are directed toward goals and preventing debt over time.

- Building an emergency fund with three to six months of expenses can help protect you against unexpected financial shocks.

- Smart debt management strategies, like the snowball or avalanche method, help reduce financial burdens and regain control.

- Consistently reviewing and adjusting financial plans helps ensure your habits evolve with life changes and stay aligned with your goals.

Why Building Financial Habits Matters

Building good financial habits is important for a stable financial future. Budgeting, saving, and managing debt reduce stress and help achieve key goals like buying a home or retiring. Experts emphasize that strong money habits improve financial health and clarity.

Benefits of Building Financial Habits

- Improved Financial Stability: Prevent overspending and live within your means.

- Preparedness for Emergency Expenses: Build an emergency fund to handle unexpected expenses with at least three to six months of living expenses saved.

- Reduced Financial Stress: Help provide peace of mind by knowing where your money is going.

- Achievement of Goals: Progress toward milestones like buying a house, contributing to retirement funds, or paying off debt.

- Increased Confidence: Feel empowered to make informed financial decisions.

Developing these habits doesn’t require drastic changes. Small, manageable steps can lead to significant results, helping you create a better relationship with money and a brighter financial future.

Budgeting as the Foundation of Good Financial Habits

Budgeting is the cornerstone of financial success because it helps you take control of your monthly income and expenses. With a budget, you can help ensure that your money is allocated toward your goals and avoid falling into an unnecessary debt pile. Experts often recommend aligning your spending habits with your financial objectives to create a budget that works for you.

Steps to Create an Effective Budget

- Track Your Income and Expenses: Understand how much money is coming in and where it’s going by recording all sources of income and monthly expenses.

- Set Financial Priorities: Identify important expenses (needs), discretionary spending (wants), and savings goals, such as retirement funds or emergency savings. Allocate funds accordingly.

- Choose a Budgeting Method: Try popular techniques like the 50/30/20 rule or a zero-based budget to find what works best for you.

- Monitor and Adjust: Review your budget regularly and make adjustments as needed to stay on track.

Budgeting Tools to Simplify the Process

- Apps and Software: Use tools like Mint, YNAB (You Need A Budget), or Excel to track and categorize spending easily.

- Spending Logs: Keep a journal or simple spreadsheet to manually record daily expenses.

- Bank Alerts: Set up alerts for transactions to keep tabs on spending in real-time.

Benefits of Budgeting

- Improved Spending Awareness: Recognize and reduce wasteful habits.

- Savings Growth: Allocate money toward savings goals automatically.

- Debt Prevention: Avoid overspending by staying within your means.

By adopting a simple budgeting routine, you can build the foundation for a lifetime of better financial health.

Saving Strategies That Fit Any Budget

Saving can start small, like $10 or $20 weekly. As your finances improve, increase gradually. Even small contributions add up, and having emergency savings helps manage unexpected expenses without derailing your goals.

Leverage Savings Tools

- Reoccurring Transfers: Set up automatic transfers from your checking account to a savings account to help ensure consistent contributions. This simple strategy helps build your savings effortlessly.

- Round-Up Programs: Use apps or banking features that round up your purchases and deposit the difference into a savings account.

- Savings Challenges: Try fun, short-term challenges like saving $1 more each week to keep things engaging.

Maximize Everyday Savings

- Use Discounts and Coupons: Take advantage of deals, rewards programs, and cashback offers to save money on daily expenses.

- Reduce Unnecessary Subscriptions: Audit your monthly subscriptions and cancel any that you don’t use frequently.

- Cook at Home: Save money by preparing meals at home instead of dining out.

Create Specific Savings Goals

- Emergency Fund: Aim to save three to six months’ worth of basic living expenses to prepare for unexpected costs.

- Short-Term Goals: Save for smaller purchases like a vacation or holiday gifts.

- Long-Term Goals: Contribute regularly to retirement savings accounts or invest in growth opportunities.

By incorporating these strategies into your routine, you can build a savings plan that works within your budget and sets the stage for a more secure future.

Debt Management & Reduction Techniques

Understanding the Impact of Debt

Debt can weigh heavily on your financial well-being, making it harder to save or achieve your goals. Managing and reducing debt is a key step toward financial freedom and stability. Maintaining a strong credit score is an important part of effective debt management and can save you money on loans and interest rates.

Strategies for Managing Debt

- Create a Debt Repayment Plan: List all your debts, including balances, interest rates, and minimum payments. Prioritize them based on your financial goals.

- Focus on High-Interest Debt: Pay off the largest debts with the highest interest rates first to reduce the overall cost of borrowing.

- Consider Debt Consolidation: Combine multiple debts into a single payment with a lower interest rate to simplify management and save money.

Effective Repayment Methods

- Snowball Method: Pay off your smallest debts first for quick wins and motivation.

- Avalanche Method: Tackle debts with the highest interest rates to save the most money over time.

- Biweekly Payments: Split your monthly payment in half and pay every two weeks. This method helps reduce interest and accelerates repayment.

Results may vary based on individual financial circumstances.

Tips to Avoid Future Debt

- Live Within Your Means: Avoid spending more than you earn by sticking to a budget.

- Build an Emergency Fund: Save for unexpected expenses to prevent relying on credit cards or loans.

- Audit Subscription Services: Regularly evaluate your subscription services and cancel any that are unnecessary or underused.

Managing and reducing debt may take time, but with consistent effort and the right strategies, you can regain control of your finances and focus on building a brighter financial future.

Building Long-Term Financial Success

Achieving financial security is a long-term journey that requires strategic planning and consistent effort. By focusing on smart investments, building emergency funds, and diversifying income streams, you can lay the groundwork for lasting success.

Investing for the Future

Building long-term financial success starts with making smart investment choices. Start small with options like index funds, mutual funds, or employer-sponsored retirement plans. These low-risk options allow you to grow your wealth steadily over time. Regular contributions to retirement funds should also be a priority as they help ensure future stability.

Importance of an Emergency Fund

A key component to improve your financial situation is having an emergency fund that covers at least three to six months’ worth of expenses. This helps protect you from unexpected costs like medical expenses or job loss, helping ensure your long-term goals stay on track.

This is not intended as specific investment advice. Consult a licensed financial professional for personal recommendations.

Diversify Your Income Streams

Don’t rely solely on one source of income. Explore side gigs, freelance opportunities, or investments in rental properties to create additional revenue streams. Diversification helps safeguard your finances against uncertainties.

Building long-term financial success is not an overnight process, but with consistent action and forward-thinking decisions, you can help secure a more stable and prosperous future.

How to Maintain Your Financial Habits

Maintaining good financial habits is just as important as building them. To help ensure your efforts lead to sustained success, you need to stay adaptable and proactive in managing your finances.

Regularly Review Your Finances

Make it a habit to review your budget, savings, and investment accounts monthly. Regular reviews help you stay aligned with your financial goals and make necessary adjustments.

Stay Accountable

Share your goals with a trusted friend, family member, or financial advisor who can help you stay accountable. Regular check-ins keep you motivated and on track.

Adapt as Life Changes

Your financial needs will evolve with major life events like marriage, having children, or career changes. Be prepared to revisit and adjust your financial picture as necessary.

Use Reminders and Tools

Set calendar reminders for bill payments or use apps to track spending and savings. These tools help ensure consistency and reduce the likelihood of missed deadlines or oversights.

By staying committed to these maintenance practices, you can preserve your financial progress and continue working toward your long-term goals with confidence.

Final Thoughts on Financial Habits

Developing and maintaining financial habits may feel challenging at first, but small, consistent actions lead to meaningful progress. By implementing these strategies, you can achieve greater stability and work toward your long-term goals. Start today and take control of your financial future—your success is just a step away.

Start building better financial habits today for a stronger tomorrow. Get My Free Financial Review

Frequently Asked Questions

What is financial health?

What are the financial behaviors?

What is the 75-15-10 rule?

The 75-15-10 rule is a budgeting strategy that divides your income into three categories to help manage your finances effectively. Here's how it breaks down:

- 75% for Necessities: Housing, utilities, groceries, transportation, and other essential expenses.

- 15% for Savings and Investments: Retirement accounts, emergency funds, and long-term investments.

- 10% for Discretionary Spending: Entertainment, hobbies, dining out, or paying off extra debt.

This rule helps balance your financial needs, goals, and lifestyle. These methods can help organize finances but may not guarantee specific results.