Table of Contents

Table of Contents

Key Takeaways

- Identify needs and goals before choosing investments.

- Evaluate risk tolerance and balance growth with risk avoidance.

- Plan retirement income sources, considering annuities and strategies.

- Regularly review and adjust your asset allocation based on changing circumstances.

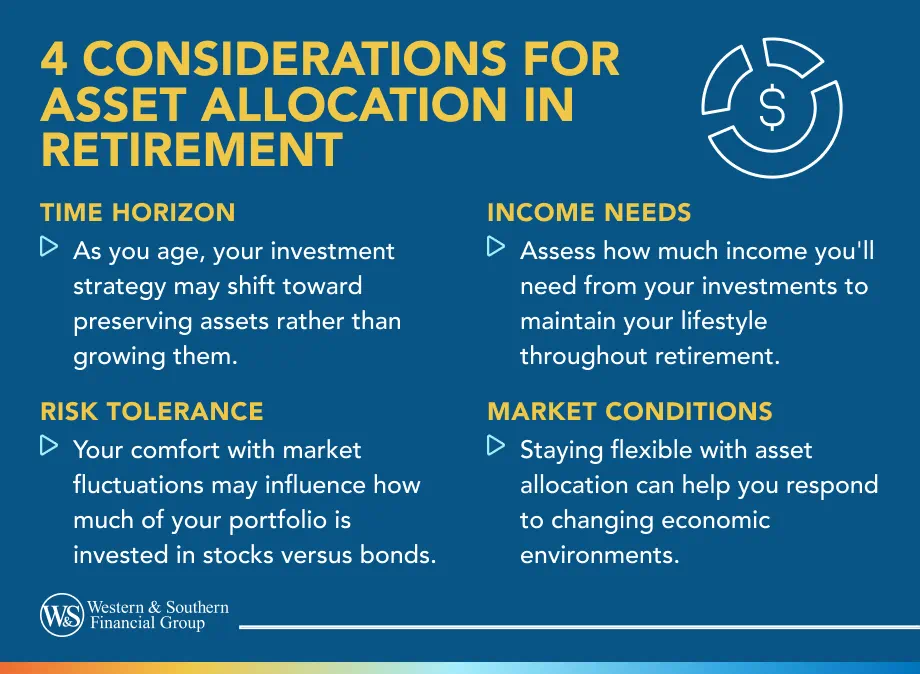

Your asset allocation in retirement is an important consideration. The income you have available, either from investments, savings or phased retirement work, will likely need to last for a lifetime and can also affect your retirement lifestyle.

Other factors, such as market movements and economic conditions, can also impact your finances, but you have some control over how you allocate your money. Here are several considerations to keep in mind during retirement planning.

Start With a Plan

Before you pick an asset allocation model or choose specific investments, you'll likely want to identify your needs and goals. With that information in mind, you can start to build a portfolio that better matches your financial road map. Of course, that won't guarantee a positive performance of any investment assets, which can always build or lose value, but it can help you piece together the bigger picture. Such considerations may include your lifestyle preference, interest in travel and expected health needs.

Consider estimating how much you need to spend in retirement and then figure out what resources are available to you. For example, you might have retirement savings in a 401(k) plan, and you might expect to receive Social Security retirement benefits. It may be helpful to plug that information into a retirement calculator to get an estimate of where you stand, and then consider discussing your findings with a financial representative.

Consider Evaluating Risk Tolerance

Your risk tolerance is one important part of investing. Depending on your needs, goals and preferences, you might choose to invest in stocks, bonds, cash or a combination of investments. You can select individual stocks and bonds or employ tools like mutual funds to help you diversify your investments.

The traditional view says that the more stock you hold, the more risk you're taking. Aggressive investors with exposure to stocks might hope for high returns over long periods of time — but they risk losing money when markets fall. Conservative investors might keep more money in bonds and cash, but those investments might not fare well in the face of rising interest rates or high inflation.

As you consider risk, remember that there are multiple types of risk. Market risk, or the risk of losing money, is one common consideration. But you may also face longevity risk, or the risk of living a long life (and needing to pay yourself during all those years). As a result, you may find yourself balancing seemingly contradictory goals. For example, you might be interested in pursuing long-term growth while avoiding short-term losses.

Consider exploring a variety of risks and prioritizing what's most important to you. This may require difficult choices, but discussions with the right financial professionals can help you through the process.

Plan Where Your Income Will Come From

If you plan to draw money from your retirement savings, you'll want to know where you'll get that income. You might build a portfolio of investments that could provide regular income through dividends, interest or other types of payments. Alternatively, you might set aside enough cash to cover upcoming needs.

There are several ways to help plan for retirement income. You can withdraw a certain percentage of your savings each year, you can try a "bucketing" strategy, or you can choose another strategy. You can also use annuities that guarantee lifetime income payments, which could potentially help eliminate the need to select and monitor investments on your own.

Whatever approach you choose, consider evaluating the potential risks and tax consequences. For example, if you plan to sell assets when you need money, the strategy might not work well if you sell in weak markets. You may also owe capital gains taxes on investments you sell at a gain or distributions you take from certain accounts, so try to plan ahead.1

Keep in Mind That Things Can Change

Consider reviewing your finances regularly, and even adjusting your asset allocation in retirement. It's OK to make changes — it's impossible to predict the future perfectly. Just do the best you can with the information you have today and revisit your plan periodically. You should also make sure you speak with your financial representative.

Your asset allocation mix is a big part of retirement planning, so it's worth taking the time to consider your options. Outlining your needs and goals can help you decide how much risk is appropriate. Consider different types of risk, and evaluate how your asset allocation may stand up to different economic conditions. You can't predict the future with 100% accuracy, but you can make informed decisions and review your finances periodically.

Prepare your income sources to support your lifestyle throughout retirement. Start Your Free Plan

Sources

- Topic No. 409, Capital Gains and Losses. https://www.irs.gov/taxtopics/tc409.