Table of Contents

Table of Contents

Key Takeaways

- Many retirees work to enhance financial freedom and enjoy experiences beyond basic expenses.

- Extra income from work can fund travel and hobbies for a more enriched retirement.

- Staying productive through work supports mental and physical well-being in retirement.

- Working in roles that match personal interests provides a sense of purpose and community.

- Retirees can diversify income through encore careers, part-time work, the gig economy, or renting assets.

As the costs of health care and general living expenses continue to rise, you might find yourself wondering how to make money in retirement. Life expectancies are also continuously increasing, so it might be more likely for some retirees to outlive their savings.

Besides helping you earn extra cash, picking up some part-time work or even starting your own business in retirement could lead to a number of benefits — and not just financial ones. However, if you do decide to make money in retirement, you should consider the impact it may have on your Social Security and taxes.1

Why Make Money in Retirement?

Some retirees continue to work in order to enjoy more financial freedom by supplementing their retirement savings. For example, you may have enough saved to pay for your normal living costs by the time you retire, but still want additional cash to help fund extended travel or expensive hobbies.

To others, the appeal of continuing to work and earn money after retirement is the satisfaction they get out of being productive. Staying engaged with work you enjoy within your community might be an even more important reason to consider working in retirement, as having something to do and places to be may be good for both your mental and physical health as you age.

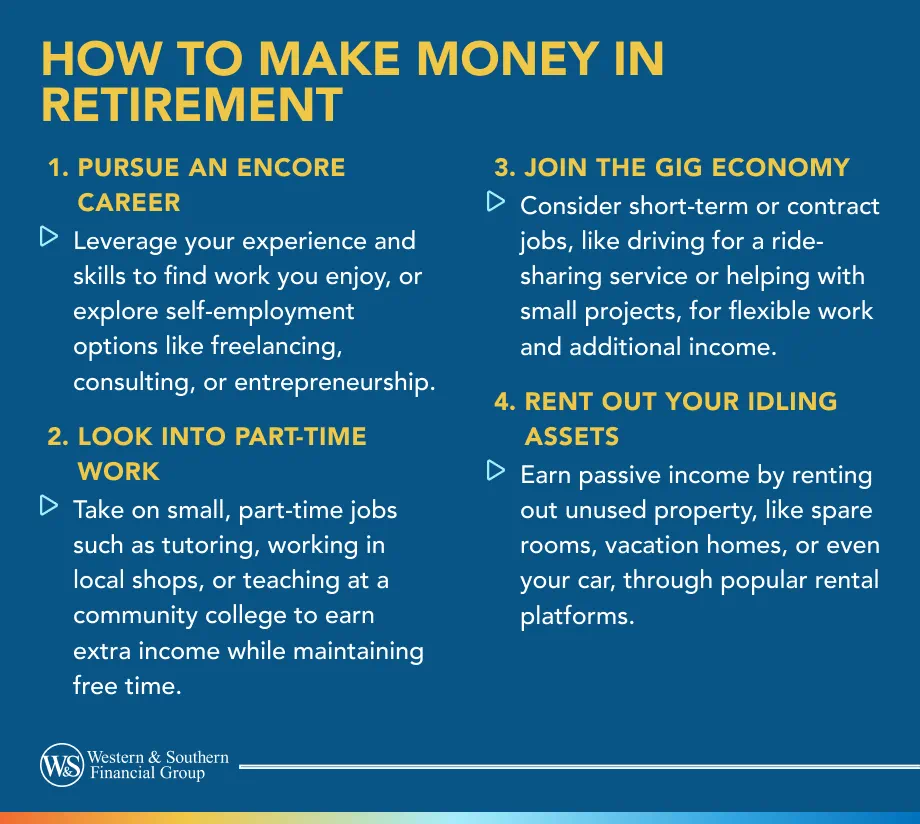

4 Ways to Help Increase Your Retirement Income

There are a number of ways to make extra money in retirement. Here are some ideas to consider:

1. Pursue an Encore Career

You have a lot to offer from the depth of your experience and all the knowledge and skills you acquired over your career. One option to help increase your retirement income is to put all that to use through an encore career, in which you can prioritize doing work you enjoy over the need to earn a particular amount on your paycheck.

Now might also be a good time to explore self-employment if you were ever interested in freelancing, consulting or entrepreneurship, but never wanted to take the leap in previous years. Your expertise and perspective could be highly valued in companies that need advising or guidance.

2. Look into Part-Time Work

You don't have to set up a full-time shop if your goal is to strike a balance between earning extra money and leaving ample time to relax and enjoy your retirement years. Consider some small, part-time jobs that allow you to earn a little bit of money on the side with only a few hours a week. Some ideas could include:

- Tutoring or providing childcare for neighbors or family members as needed.

- Working in one of your favorite local shops.

- Teaching at a local organization or community college, or leading workshops on a particular topic.

3. Join the Gig Economy

The "gig economy" is a way of describing short-term, temporary or contract-type jobs, which are now more popular than ever. These gigs offer a lot of flexibility and control over when and how much you work. The potential downside of these kinds of jobs is that it can be tough to make a full-time income from them, and they don't usually come with benefits like health insurance or a retirement plan — but if you're simply looking to earn a little spending money in retirement, these arrangements might be ideal.

You could drive as much as you want for a ride sharing service, for example. There are also websites available that connect hourly workers with customers who need help with various small projects or errands.

4. Rent Out Your "Idling Assets"

Looking for more passive ways to earn extra cash? Many platforms allow you to monetize assets you own but don't use frequently or full time.

If you have spare rooms in your home or a vacation property, for example, you may be able to list the space as a weekend or seasonal rental. Or, since you likely no longer have a regular commute in retirement, you could consider renting out your car. However, if you decide to rent out your home or car, consider reviewing your home and car insurance policies to help make sure you're protected.

How to Get Started

You may want to start with your existing network. Could a previous employer or manager bring you on as a part-time consultant? Do you know any local business owners who need some help a few days a week? Does anyone in your family have a business that you could support with a few hours of your time? Keeping your working situation within a familiar space may make it easier to find the flexibility you want. On the other hand, if you're interested in starting an entirely new business or freelancing career, there are countless online resources accessible via a quick online search.

The Bottom Line

There are a number of flexible ways to learn to make extra income and help avoid outliving your savings. Consider picking something that interests you and give it a try. The beauty of retirement is you have a lot of freedom to enjoy, and that includes freedom to decide for yourself how to make money in retirement so you can have fun and feel fulfilled.

Build a retirement plan that includes flexible income options to support your goals. Start Your Free Plan

Sources

- Receiving Benefits While Working. https://www.ssa.gov/benefits/retirement/planner/whileworking.html.