Table of Contents

Table of Contents

Key Takeaways

- Review your cash flow and identify income sources for retirement.

- Prepare for unexpected expenses and risks such as health care costs and market fluctuations.

- Plan your income floor with pensions and annuities for guaranteed income.

- Maximize Social Security benefits by choosing the right retirement age and claiming strategy.

You deserve to enjoy a retirement lifestyle of your choosing. Whether you want steady retirement income to last your lifetime or seek confidence to meet whatever the future holds, establishing a plan is an important step toward guiding your retirement in the right direction.

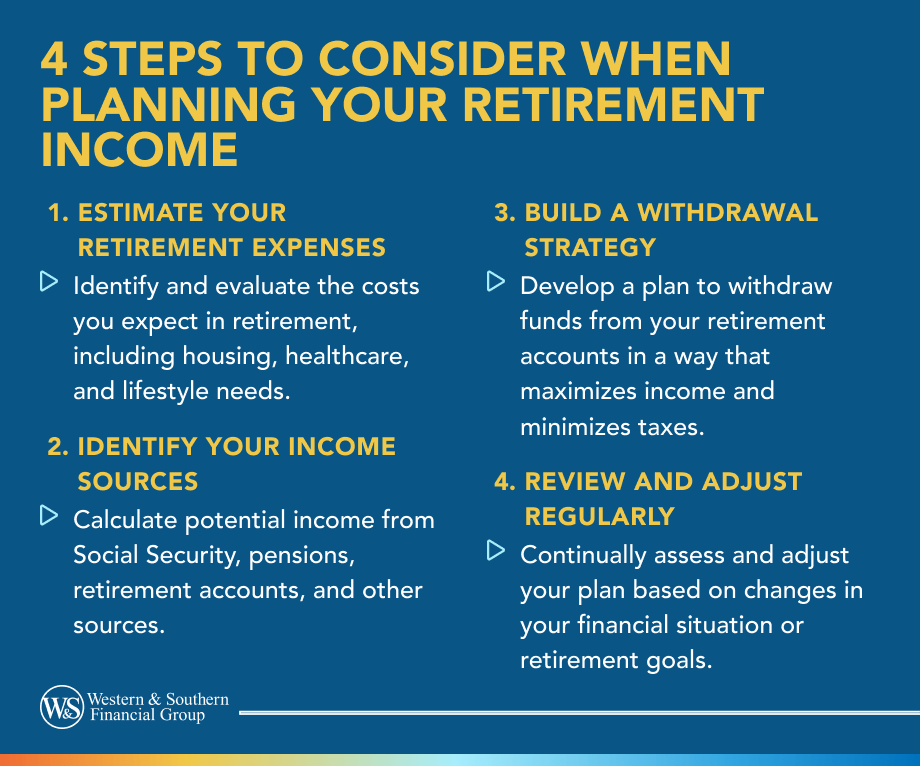

Understanding your sources of income, estimating expenses and managing your assets is at the center of a successful retirement income plan.

1. Review Your Cash Flow

Identify your income sources to set plans in place to maximize the income you need for your retirement future. Your incoming cash flow may include a steady income stream from Social Security, pensions and annuities, as well as other resources such as withdrawals of assets, interest and dividends from IRAs, 401(k)s, life insurance and investments.

Next, assess your outgoing cash flow, which is primarily expenses and taxes. Expenses can be essential or discretionary, but unexpected expenses like medical bills and long-term care are also a vital part of the planning equation.

Keep in mind the variable nature of income taxes and inflation when planning for sufficient income to match your expenses. While you can’t control tax laws, you can help make your retirement assets less sensitive to taxes. Roth IRAs and life insurance are good options for addressing the tax effects on your income during retirement.

Once you’ve mapped out a strategy to deliver sustainable income for your foreseeable future, your financial representative can help you determine the best path for taking income in the most tax efficient way —so that you can work toward a goal of sustaining your income in retirement and providing a legacy for your heirs.

2. Prepare for the Unexpected

As part of the planning process, it is important to explore the common risks that can adversely affect how much you have to live on in retirement. Being aware of the risks can help you define strategies to accommodate costs associated with them.

Common risk factors retirees may face during retirement include longevity (how long you will spend in retirement), the cost of health care, market fluctuations and inflation, and the loss of a spouse.

Making Your Savings Last

We all want to live as long as possible, but the longer you live, the more retirement savings you will need. An important consideration in developing your retirement income strategy is your life expectancy, and for married couples, their joint life expectancy.

Living longer could translate to higher medical expenses, long-term care expenses and a greater need for support from care givers. The current life expectancy for the U.S is 79.25, increasing by 0.18% since 2023.1 These numbers are a clear indicator that taking life expectancy into consideration in your retirement income planning is very important.

Minimizing the impact longevity has on your retirement future includes basing your plans on living beyond your life expectancy, optimizing your Social Security benefits, and considering annuities as a viable lifetime income option.

Understanding the Cost of Health Care

Aging and health-related problems along with the rising cost of care will impact your retirement savings. In fact, medical costs have been increasing since for decades.2 Approximately 70 percent of people age 65 and over will also need some level of long-term care and the average annual cost of long-term care in the United States is $107,146.3,4

Maintaining a healthy lifestyle may help to reduce the likelihood of health problems as you age. Consider buying Medicare supplemental insurance to cover the gaps from Medicare. Securing a long-term care policy or adding life insurance may help with those expenses.

Alleviate the Ups & Downs of Financial Markets

Investments like stocks and bonds will rise and fall as markets fluctuate. Some risk may be necessary to achieve a desired outcome. However, investments such as bonds or CDs are also subject to a risk that changes in interest rates may result in lower returns or undesirable options for reinvesting at maturity.

Diversification can help limit the effects of market fluctuation. The closer you are to retirement, the more you may want to be protected from market losses. An annual review of your investments with your financial representative provides you the opportunity to shift more investments to income or safety, if appropriate, as you age.

Consider the Purchasing Power of Your Savings

Fixed income assets are often relied upon by retirees, but they typically do not adjust for inflation and can reduce the purchasing power of your hard-earned savings. According to the Bureau of Labor Statistics, the consumer price index has increased at an average rate of 3 percent per year since 1913.5 This means that a couple retiring on $5,000 per month in 1990 will need over $9,000 of monthly income to have the same purchasing power today.

While you can’t control inflation, you can plan your retirement income strategies with the assumption that your needs will increase due to inflation. Work with your financial professional to help you identify assets with less sensitivity to inflation, and review and adjust your expenses annually to account for inflation.

Your Social Security benefits provide for automatic cost-of-living adjustments, and delaying Social Security may result in a larger benefit. Income laddering, a strategy that uses different income streams with various time horizons, may also be an option for lowering the impact of inflation during your retirement years.

Protecting Against the Loss of a Spouse

The loss of a spouse is difficult no matter the situation. Besides losing the partner you’ve walked with hand-in-hand throughout life, the unexpected loss of income and added expenses such as caregiving are now important factors that will impact your retirement income. There may be some solutions to help ease this burden.

Upon the death of either spouse, life insurance transfers the risk to your life insurance company. An annuity with spousal income guarantees and joint and survivor income can reduce the loss of income upon the death of a spouse. Be sure to work through various scenarios with your financial representative to determine the probable loss of income regardless of which spouse passes away first.

Create strategies to handle health care costs and market shifts in retirement. Start Your Free Plan

3. Plan Your Income Floor

Properly planned and carefully managed, your income floor — a foundation of pensions, annuities and Social Security — may have the ability to provide guaranteed income you cannot outlive and be considered a source of income to cover your essential expenses during retirement.

Pensions

While pension plans are not being offered as widely as they once were, these plans are still important retirement income vehicles for those employees who have one. They are funded entirely by employers, which means the employer bears most of the investment risk.

The retirement income you receive from your employer sponsored pension plan relies on a formula that is based on your salary and length of service to the company. When you are ready to retire, your employer purchases an annuity that pays you income based on the formula, in most cases for your lifetime, and if you are married, for your spouse’s lifetime once you pass.

The Value of Annuities

An annuity is one of the only investments that allows you to save as much money as you can without being concerned about paying taxes on the interest you earn until the funds are withdrawn. This can make an annuity a valuable part of your retirement income strategy. They are a popular choice for individuals who want to have access to income payouts in retirement for themselves and their spouse.

When you make a contribution into an annuity, it makes payments to you on a future date or series of dates — monthly, quarterly, annually or even in a lump sum payment – over your lifetime or for a set number of years. The choice is yours. Your financial representative can help you sort through the various options to consider.

Types of Annuities

There are basically two types of annuities: deferred and immediate. With a deferred annuity, your money is invested for a period of time until you are ready to begin taking payments, typically in retirement. Deferred annuities can be converted into an income stream when you want to start collecting payments. By contrast, if you choose an immediate annuity, you begin to receive payments soon after you make your initial investment in the annuity. Taxation of annuity assets depends upon the type of annuity you choose and if you fund it with pre-tax or after-tax dollars.

Fixed deferred annuities are investments issued by an insurance company. They pay guaranteed rates of interest. In retirement, these annuities can be converted into an income stream. Fixed indexed annuities offer long-term tax-deferred savings and provide an opportunity for higher rates than traditional fixed annuities, with interest options tied to positive changes in market indexes.

As long as your money stays in the annuity, you will not be taxed on interest earnings. Once you receive a payout, the annuity interest is taxed as ordinary income.

The guarantees1 annuities deliver may serve as a buffer against potential losses in the other assets in your portfolio and be valuable components of your retirement income plan. They also may provide you access to emergency funds based on their present value.

4. Maximize Your Social Security Benefits

You have been contributing to your Social Security retirement benefits since your first day of work. Social Security is intended to replace a portion of your work income. There are a lot of different factors and circumstances that influence when you may want to claim your Social Security benefits.

While Social Security may not pay all your bills, it is important to plan ahead to help maximize your Social Security benefits. It starts with choosing your retirement age wisely and subsequently the date you want to file for Social Security benefits.

In general, your retirement benefits can be claimed any time between age 62 and 70. Starting benefits at age 62 will result in a permanent reduction of benefits that may adjust for cost of living but will not increase even when you reach full retirement age.

Married couples may have even more Social Security claiming options because one or both spouses have a work record (and thus Social Security benefits of their own), a spousal benefit and survivor’s benefits.

Social Security retirement benefits are an important component of retirement income because they are paid for life and adjusted for inflation. Maximizing this lifetime benefit requires a knowledge of Social Security claiming strategies. Your financial representative is there to help with the answers.

A solid retirement plan helps you maintain financial independence throughout retirement. Start Your Free Plan

Sources

- U.S. Life Expectancy 1950-2024. https://www.macrotrends.net/global-metrics/countries/USA/united-states/life-expectancy.

- How has U.S. spending on healthcare changed over time?.https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/.

- Long-term care statistics 2024. https://www.singlecare.com/blog/news/long-term-care-statistics/.

- Nursing Home Costs in 2024. https://www.seniorliving.org/nursing-homes/costs/.

- Consumer Price Index. https://www.bls.gov/cpi/home.htm.